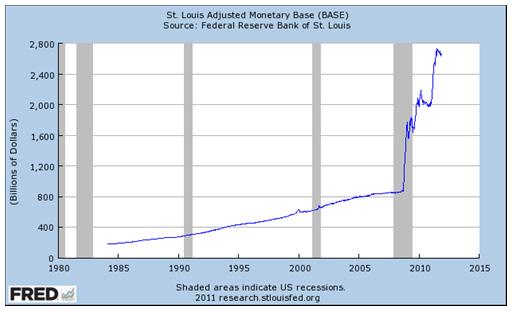

As shoppers in the U.S. celebrate the official start of the holiday shopping season with Black Friday and seek out the bargain basement prices, our own central bank is seeking to lift prices and deter deflation. The central bank's view is that even modest bouts of deflation must be dealt with swiftly, as the combination of heavy debt loads and declining prices is a recipe for recession and rising unemployment. Our response to the threat of deflation has been to expand the Federal Reserve’s balance sheet.

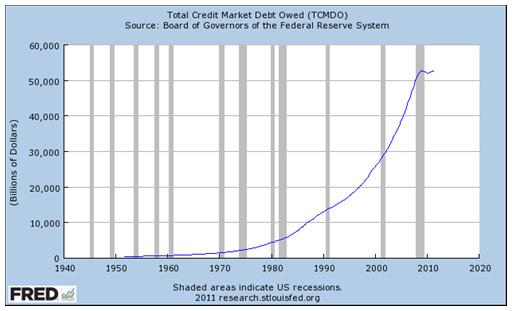

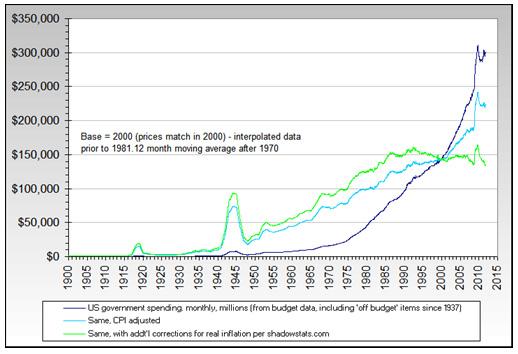

In the early 1970s, Nixon closed the gold window, and ever since, debt and government spending has increased rapidly.

We fear that tinkering with the price of money (e.g. interest rates) does not always bring the desired effect. Economies are large, complex and have a way of bring about unintended consequences. Our view is that quantitative easing programs will eventually bring the desired amount of inflation, but only to be followed by a undesired amount of inflation. We believe that policy makers are simply being too cavalier with the threat of inflation. Inflation can come about quickly and can have abrupt and severe social consequences. Whereas modest bouts of deflation can increase bankruptcies and unemployment rates, a cleansing of debt typically leads the way to recovery as prices fall and buyers come back to the market. Inflation, on the other hand, can be extraordinarily damaging for savers and consumers, and shortages arise. Imagine if the purchasing power of your savings deteriorated by 20% in a single year. Deflation causes people to deter purchases, as tomorrow will bring cheaper prices, whereas inflation causes people to hoard goods, causing shortages, which only drives up the price of goods. The people of Venezuela are seeing the impact of inflation on their economy. From a recent Bloomberg article:

Venezuelan President Hugo Chavez’s move to expand price controls this week sparked panic purchases by consumers, leading to shortages of everything from coffee to toilet paper. Under regulations that took effect on Nov. 22, the government can fix the price of 15,000 goods in an attempt to slow inflation that reached 26.9 percent in October, the highest in the Western Hemisphere. Chavez immediately ordered a freeze on the price of 18 personal care items ranging from toothpaste to deodorant until mid-January to prevent monopolies from “ransacking the people.” While fixing prices, Chavez’s government is printing money and raising spending. The central bank has more than doubled the amount of money circulating in the Venezuelan economy since November 2007, according to data compiled by Bloomberg. Fiscal spending leaped 22 percent this year after accounting for inflation, according to an e-mailed report by Bank of America Corp. economist Francisco Rodriguez.

People of the emerging world know all to well about currency debasement and inflation. We think it is wise for U.S. investors to educate themselves on the risk of inflation.

Tactical Strategy:

We own gold and silver in physical and ETF forms: GLD (GLD) and SLV (SLV). We follow a policy of not timing the market, but slowly accumulating these metals, as they are our insurance policy against inflation. Investors interested in vehicles that retain physical metal should look into Sprott Asset Management’s Sprott Physical Gold Trust (PHYS) and Sprott Physical Silver Trust (PSLV).