Just about a year and a half ago, the most appealing risk/reward ratios could be found in the retail space. Companies like JC Penney (JCP), Best Buy (NYSE:BBY), and RadioShack (RSH) were all struggling at the time and facing serious roadblocks. JC Penney pulled off a successful equity raise at the end of 2013 that stabilized the company. Unfortunately, RadioShack didn't make it and was forced to file for chapter 11 bankruptcy in February. Yet other retailers, like Best Buy, self-engineered a turnaround with a rigorous cost restructuring program and new partnerships.

Best Buy long thesis intact?

Best Buy really came first to my attention in January 2014 when the consumer electronics retailer disappointed investors with weaker-than-expected holiday sales numbers and the stock plummeted as a result.

Since then, Best Buy has improved its operations, pushed for $1.02 billion in annualized cost reductions at the end of the fourth quarter 2014, and returned to positive sales growth. Best Buy's fourth quarter and full-year results were encouraging, which in my book lends a lot of support to the bullish thesis.

Best Buy even demonstrated confidence in its future earnings by announcing a major capital return plan in early March that included a 21% increase in its quarterly dividend, a $180 million special dividend, or $0.51 per share, and $1.0 billion of stock buybacks over the next 36 months.

Both Best Buy's fourth quarter results and the shareholder pay package were extremely good news for investors. In addition, consumer spending is set to kick into gear, a theme I have repeatedly picked up when it came to the earnings and comp surprise potential of U.S. retailers. As long as the U.S. economy grows at or above trend, U.S. retailers across the board are set to benefit from increases in consumer spending, lower gas prices and job gains, which in turn bodes well for capital growth.

Should you worry about the sell-off?

Best Buy's recovery rally recently stalled when concerns over Best Buy's valuation caused investors to move out of their investment.

The resulting pullback in price, however, appears to be a good opportunity to enter into a long position in Best Buy for two particular reasons:

1. The sell-off in Best Buy's shares has driven the retailer's valuation down from 15.5x to 12.3x forward earnings. This multiple can hardly be considered as overpaying for Best Buy, especially when considering that the U.S. economy is an cyclical upswing, which generally supports consumer spending.

2. Best Buy's capital return program does not only mean that shareholders will have more cash in their hands at the end of the day. It also implies that management is confident in the success of its cost restructuring and investment plans. Rarely will a company go full in on buybacks and dividend hikes, when it fears its earnings base will erode.

Share performance

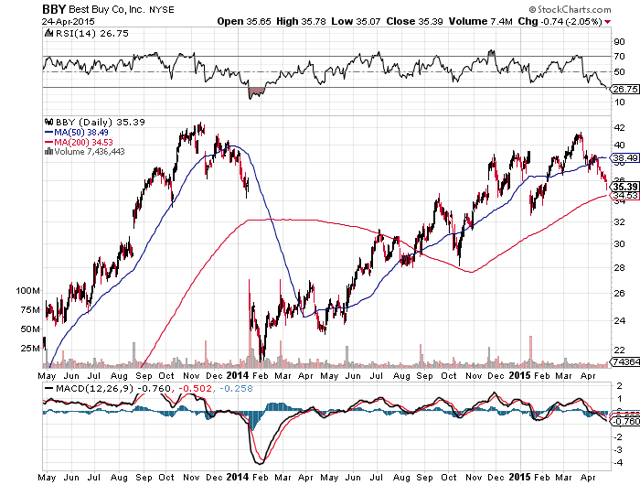

Over the last twelve months, shares of Best Buy have gained 39% in value even though shares have come increasingly under pressure over the last four weeks. Year-to-date, Best Buy is down 10%.

Source: StockCharts.com

Your Takeaway

In the fourth quarter of fiscal 2015, Best Buy reported comparable sales growth of 2.8% for its domestic segment. Since consumer spending will almost certainly grow as long as the U.S. employment situation improves and workers gain in income, retailers as a group are promising investments, with great potential for comp and earnings surprises in 2015 and beyond. Best Buy's sell-off in light of valuation concerns is a good opportunity to buy a repositioning consumer electronics retailer at just about 12x forward earnings.