Equity markets started off the New Year in bright green territory as indexes across the board soared higher, bolstered by returning bulls from holiday break. The Nasdaq led the way higher, clinching gains of 1.67% on the day, while the Dow Jones Industrial Average lagged behind, gaining 1.47%. Basic materials stocks surged ahead alongside financials on Wall Street, while gains in the utilities sector were few and sparse as investors saw their appetite for risk increase.

Confidence in the domestic economic recovery improved considerably after a string of positive economic data releases. The ISM Manufacturing Index came in better-than-expected at 53.9%, trumping analyst forecasts and cruising past last month’s reading of 52.7%. The U.S. housing market also saw glimmers of hope after construction spending data topped estimates, showing an increase of 1.2%, versus the previous reading of -0.2%. Overseas, the euro gained ground after better-than-expected German jobless claims data helped restore investors’ confidence in the debt burdened currency bloc.

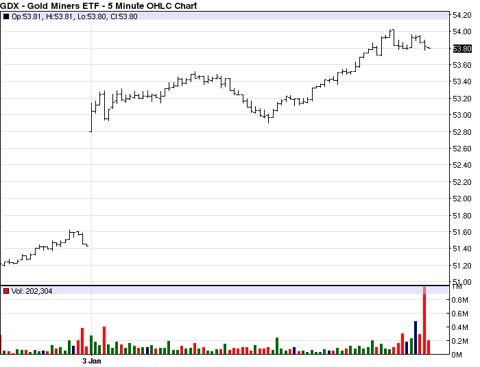

The Van Eck Market Vectors Gold Miners ETF (GDX) was one of the best performers on the day, gaining 4.61%, thanks to equity market euphoria coupled with a rally in the gold futures market. The precious yellow metal soared back up to $1,600 an ounce after news hit the street that Iran had produced its first nuclear-fuel rod. Gold took on safe haven appeal amidst the uncertainty, paving the way higher for GDX, which suffered losses of around 15% in 2011.

Click to enlarge

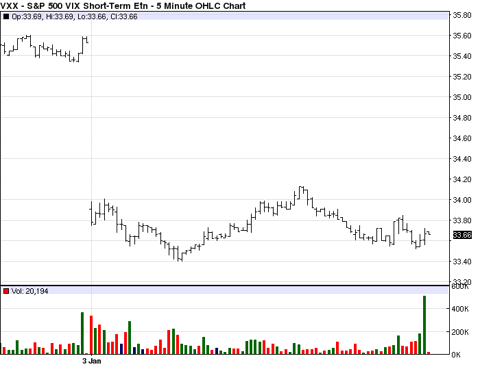

The Barclays iPath S&P 500 VIX Short-Term Futures ETN (VXX) was one of the worst performers, shedding 5.24% on the day. Ongoing geopolitical tensions in Iran created major headwinds for the U.S. dollar, which effectively boosted equity markets higher. Volatility plunged as uncertainty evaporated from the markets after investors digested a better-than-expected ISM and construction spending report on the home front. Positive German employment data further helped to restore confidence amidst the largely uncertain economic landscape.

The Barclays iPath S&P 500 VIX Short-Term Futures ETN (VXX) was one of the worst performers, shedding 5.24% on the day. Ongoing geopolitical tensions in Iran created major headwinds for the U.S. dollar, which effectively boosted equity markets higher. Volatility plunged as uncertainty evaporated from the markets after investors digested a better-than-expected ISM and construction spending report on the home front. Positive German employment data further helped to restore confidence amidst the largely uncertain economic landscape.

Click to enlarge

Disclosure: No positions at time of writing.

Disclosure: No positions at time of writing.

Disclaimer: ETF Database is not an investment advisor, and any content published by ETF Database does not constitute individual investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. From time to time, issuers of exchange-traded products mentioned herein may place paid advertisements with ETF Database. All content on ETF Database is produced independently of any advertising relationships.