The silver market continues to struggle and keeps shares of Silver Wheaton (SLW) from showing a recovery. The recent earnings report showed, as expected, a drop in revenue and earnings. The company's EPS reached $0.13, which wasn't far off the consensus among analysts. But the company continues to sell less gold and silver and could show even lower revenue; its profitability could also take another hit in the coming quarters. Let's see why.

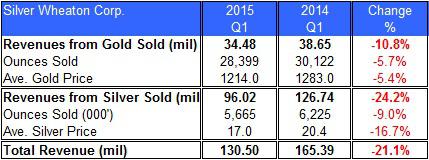

Falling gold and silver sales

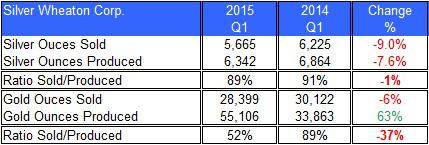

According to Silver Wheaton's account the attributed annual production of gold and silver will reach 43.5 million ounces of silver equivalent - this includes 230 thousand ounces of gold. In the past quarter, the company's partners were able to increase their output by 15% to 10,371 thousand ounces of silver equivalent. A closer look reveals that most of this gain came from gold - output grew by 63% mostly related to the new the relatively new contract the company reached with Vale (VALE) for an additional 25% of the gold stream in the Salobo mine.

The company reported of a drop of only 5% in silver equivalent sold, but the amount of silver volume sold actually fell by 9% and gold by 6%. This discrepancy is because of the change in the gold to silver ratio - it was around 63 in Q1 2014 and is now roughly 72.

Data source: silverwheaton.com.

This decline in sales is partly due to rise in the amount of silver equivalent produced but not yet delivered - this figure rose by 1.6 million ounces to reach 6.5 million ounces of silver equivalent.

Data source: silverwheaton.com.

As you can see, most of the drop from production to sales was in gold, which is, again related to the new contract over the Salobo mine. If the amount of gold and silver not yet delivered keeps rising, this could bring further down the revenue, on top of the adverse impact of low precious metals prices.

More gold less silver

Another thing to consider is that the composition of gold to silver in this company's portfolio has also changed in the past few quarters and is likely to further change in the future. This means that the impact of gold prices will have a higher weight on the company's revenue than before.

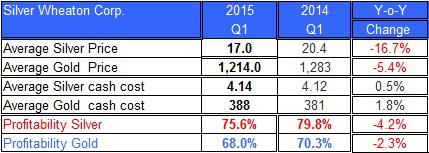

Data source: silverwheaton.com.

In the past quarter the profitability of silver and gold has fallen. The price of silver has declined by a higher pace than gold. But profit margin of silver is still higher than gold's, as presented in the table above.

In the meantime, the company still has the available resources to jump into another streaming deal if one does present itself. After all, the company increased its credit facility from $1 billion to $2 billion, which was mostly allocated to pay a discontinued non-revolving term loan. The streaming company still has $800 million under its revolving term loan.

Silver Wheaton is likely to show lower revenue and narrower margins in the coming quarters. The recent earnings report showed that the company is perhaps adjusting to current precious metals environment by selling less gold and silver and shifting to gold. For more, see "Silver Wheaton Is Not Solely Impacted By Silver."