This article is part of a series that provides an ongoing analysis of the changes made to David Einhorn's Greenlight Capital US long stock portfolio on a quarterly basis. It is based on Einhorn's regulatory 13F Form filed on 05/15/2015. Please visit our Tracking David Einhorn's Greenlight Capital Holdings article series for an idea on his investment philosophy and our previous update highlighting the fund's moves during Q4 2014.

Greenlight Capital's US long portfolio stood at $7.65B this quarter. It is up marginally compared to $7.52B as of last quarter. The long/short ratio shifted significantly to the short side this quarter: 102% long and 88% short as of Q4 2014 compared to 96% long and 66% short as of Q4 2014 - net exposure at 14% compared to 30% last quarter. The top five holdings represent around 44% of the US long portfolio. The number of 13F stakes increased from 41 to 43.

Einhorn's Q1 2015 letter reported that the fund lost 1.7% in the quarter - although the longs performed well, substantial losses were realized in several short positions: Safeway (SWY), Freescale Semiconductor (FSL), and Lorillard (LO). Greenlight is known to be short athenahealth (ATHN), Reynolds American (RAI) and Pioneer Natural Resources (PXD).

To learn about David Einhorn and the perils of shorting, check-out his "Fooling Some of the People All of the Time, A Long Short (and Now Complete) Story".

New Stakes:

General Motors (GM): GM is a large (top-five) 4.64% of the US long portfolio position established this quarter at a cost-basis of $34.62. The stock currently trades at $34.91.GM was Greenlight's third-largest position at 9.55% of the US long portfolio in Q4 2013. That stake was disposed of the following quarter at an average exit price of $35.76 compared to an average entry price of $23.87. Greenlight expected 2014 to be a break-out earnings year but the guidance disappointed and that resulted in the exit decision. The current thesis boils down to the expectation that GM will likely beat the 2015 earnings projection of $4.63 per share.

Macy's Inc. (M): M is a small 1.42% of the US long portfolio stake established this quarter at prices between $62.10 and $67.81. The stock currently trades at $66.53.

Sunedison Semiconductor (SEMI): SEMI is a small 0.91% of the US long portfolio stake established this quarter at prices between $15.19 and $27.14. The stock currently trades at $22.14. Einhorn controls ~6.5% of the business. Seth Klarman also has a large ~19% stake in the business.

Santander Consumer USA Holdings (SC): SC is a very small 0.66% of the US long portfolio position established this quarter at prices between $17.85 and $23.34. The stock currently trades just outside that range at $24.81.

Bank of New York Mellon (BK), Ingram Micro (IM), & Scientific Games Corp. (SGMS): These are minutely small positions (less than 0.5% of the portfolio each) established this quarter. Greenlight controls ~2.3% of SGMS.

Stake Disposals:

Aetna Inc. (AET): AET was a top-five position as of Q3 2013. Q4 2013 & Q1 2014 together saw a ~50% stake reduction at prices between $60.75 and $76. In Q3 2014, the pattern continued with a ~7% decrease at prices between $75 and $85 and last quarter saw a further ~56% reduction at prices between $73.43 and $90.84. The remaining 1.59% stake was disposed of this quarter at prices between $88 and $110. The original position was established in Q2 2012 at prices between $38.50 and $50. The stock currently trades at $113. Einhorn realized 44% IRR on this holding.

Amdocs (DOX): The very small 0.81% DOX position was established in Q2 2013 at prices between $34 and $37. It was increased by just over 50% in Q4 2013 at prices between $40 and $45. Last quarter saw a ~43% reduction at prices between $44.43 and $48.75 and the remaining stake was disposed of this quarter at prices between $46.03 and $54.78. The stock currently trades near the top-end of those ranges at $54.57. Einhorn realized 24% IRR on this holding.

Covidien PLC (COV): COV was a 1.16% of the US long portfolio position established last quarter and eliminated this quarter. Einhorn established this merger-arbitrage stake when the Medtronic (MDT) deal-spread was at $8.79 - the deal closed on January 26, 2015.

Kennametal Inc. (KMT): KMT was a minutely small 0.35% position as of Q3 2014. Last quarter, the position was increased by ~280% to a 1.05% portfolio stake at prices between $33.60 and $41.68. This quarter saw the position eliminated at prices between $30.99 and $35.90. The stock currently trades at $38.06.

California Resources Corp. (CRC) & Green Dot Corp. (GDOT): These are minutely small (less than 0.5% of the portfolio each) stakes that were eliminated this quarter.

Stake Increases:

AerCap Holdings N.V. (AER): AER is a 3.18% position established in Q2 2014 at prices between $38.91 and $48.14. It was increased by ~68% last quarter at prices between $36.68 and $45.22 and another ~50% this quarter at prices between $37.84 and $45.94. The stock currently trades at $48.96. The aggressive stake build-up indicates a clear bullish bias.

Chicago Bridge & Iron (CBI): CBI is a 4.35% of the US long portfolio position established last quarter at prices between $37.78 and $57.85 and increased by ~130% this quarter at prices between $34.51 and $49.48. The stock currently trades at $55.01. For investors attempting to follow Einhorn, CBI is a good option to consider for further research.

Citizens Financial Group (CFG): CFG is a 3.98% position established at an average-cost-basis of $22.01 in Q3 2014. Last two quarters have seen a ~50% stake increase at prices between $21.80 and $25.60. The stock currently trades at $25.93. It is a carve-out from Royal Bank of Scotland (RBS) that debut on 9/23/2014.

Consol Energy (CNX): CNX is a large 7.50% stake (top-five) purchased in Q3 2014 at prices between $36.53 and $46.07. Last quarter, the position was increased by over 170% at prices between $32.13 and $41.61 and this quarter saw a further ~55% increase at prices between $26.56 and $34.34. The stock currently trades at $32.05. The substantial stake build-up indicates a clear bullish bias. Einhorn controls ~9% of the business.

Micron Technology (MU): MU is Einhorn's second-largest 13F position at 11.89% of the US long portfolio. The original stake was purchased in Q4 2013 at an average cost-basis of $16.49. Q1 2014 saw an 8% trimming at prices between $20.67 and $25.49 and the following quarter saw an additional 8% trimming at prices between $21 and $32.50. In Q3 2014, almost 25% of the position was sold at prices between $29.68 and $34.64. Last two quarters have seen minor buying. The stock currently trades at $26.33.

Tri Pointe Homes (TPH): TPH is a very small 0.96% of the US long portfolio stake established last quarter at prices between $12.73 and $15.34 and increased by ~9% this quarter at prices between $13.59 and $16.03. The stock currently trades at $14.51. The homebuilder with a significant exposure to the California market is a spin-off from Weyerhaeuser Company (WY). It started trading in February 2013. The stock is still below the IPO price of $19.

Voya Financial (VOYA) previously ING US: The 3.33% VOYA position was established in Q2 2013 at an average cost-basis of $20.29. Last quarter saw a 37% increase at prices between $35.23 and $43.07 and this quarter saw a minor increase. The stock currently trades at $44.81.

Kapstone Paper & Packaging (KS): KS is a very small 0.61% of the US long portfolio stake that was increased by ~60% this quarter at prices between $28.82 and $35.43. The stock currently trades below that range at $27.41.

Stake Decreases:

Apple Inc. (AAPL): AAPL is Einhorn's largest position at 12.09% of the US long portfolio. The stake was first purchased in the low-40s price-range in 2010. It was reduced by 25% in Q3 2012 at prices between $82 and $100 but upped by 45% in Q4 2012 at prices between $72 and $96. In Q1 2013, the position was again increased by around 50% at prices between $60 and $78. Last five quarters have seen a combined ~55% reduction at prices between $72 and $130. The stock currently trades at $129. Einhorn is realizing large long-term gains from this position.

EMC Corporation (EMC): The original position in EMC was established in Q4 2013 at around $24 per share. It was doubled in Q1 2014 at prices between $23.66 and $28.18. Last quarter saw a ~39% increase at prices between $26.89 and $30.89 but this quarter the pattern reversed: ~48% reduction at prices between $25.17 and $29.83. The remaining stake is at 1.41% of the US long portfolio. The stock currently trades at $26.88.

Halyard Health (HYH): HYH is a very small 0.46% of the US long portfolio position established last quarter at prices between $35.82 and $48.30 and reduced by ~70% this quarter at prices between $43.07 and $49,62. The stock currently trades at $42.35. HYH, a surgical infection prevention products business is a spin-off from Kimberly Clark (KMB). It started trading in November 2014.

IAC Interactive (IACI): IACI was a minutely small 0.30% of the US long portfolio position established in Q1 2013. In Q2 2013, the stake was substantially increased at prices between $43.50 and $51.50. Q1 2014 saw an about-turn as the position was reduced by 28% at prices between $65 and $80. In Q2 2014, the pattern reversed again: 36% stake increase at prices between $62 and $72.59. In Q3 2014, the position was increased by 60% at prices between $63.80 and $72.96. This quarter saw a ~15% reduction at prices between $59.95 and $69.78. The stock currently trades at $74.17 and the stake is at 2.24% of the US long portfolio.

Lam Research (LRCX): LRCX is a 1.52% of the US long portfolio position first purchased in Q1 2014 and more than doubled the following quarter. Greenlight's cost-basis is at $54.07 and the stock currently trades at $78.73. This quarter saw a one-third reduction at prices between $70.24 and $84.48.

Marvell Technology Group (MRVL): MRVL was a top-five position at 4.77% of the US long portfolio as of last quarter. It was reduced by almost two-thirds to a 1.74% portfolio stake this quarter at prices between $14.28 and $16.59. Q3 2014 also saw a one-third reduction at prices between $12.80 and $14.64. The original position is from Q3 2011. Einhorn's average cost-basis in MRVL is at around $11. The stock currently trades at $14.29. The significant selling in a long-term position indicates a clear bearish bias.

Time Inc. (TIME): Time Warner (TWX) spun-off Time Inc. (magazine publisher subsidiary) in June 2014. Greenlight established a 1.13% stake in Q2 2014 at prices between $20.85 and $24.43. Q3 2014 saw an almost one-third increase at prices between $22.59 and $25.62. Last quarter, the pattern reversed as the position was reduced by ~11% at prices between $19.41 and $24.98. This quarter, the remaining stake was almost eliminated at prices between $21.64 and $25.60. The stock currently trades at $22.11.

Time Warner Inc. : TWX is a fairly large 4.17% of the US long portfolio stake established last quarter at an average cost-basis of $72.72. The position was marginally reduced this quarter. The stock currently trades at $85.29.

Aecom Technology (ACM) & ON Semiconductor (ON): These are medium-sized (more than ~2% of the portfolio each) positions established in Q3 2014. They were both substantially increased last quarter but marginally reduced this quarter. ACM is a 2.64% stake purchased at prices between $31.66 and $38.13 and more than doubled last quarter at prices between $28.12 and $33.91. The stock currently trades at $33.58. ON is a 2.77% position established at prices between $8.34 and $9.91 and increased by ~18% last quarter at prices between $6.94 and $10.22. The stock currently trades at $12.61.

Nokia Corporation (NOK) & NorthStar Asset Management (NSAM): These are very small (less than ~1% of the portfolio each) positions established in Q3 2014 and reduced substantially this quarter. The 0.64% NOK position was established at prices between $7.40 and $8.66 and reduced by ~18% this quarter at prices between $7.43 and $8.08. The stock currently trades at $6.90. The 0.97% NSAM position was established as a result of the spin-off of NSAM from NorthStar Realty Finance that was completed in July 2014. NSAM currently trades at $21.67 compared to an IPO price of $18.80. It was reduced by ~30% this quarter at prices between $20.56 and $24.75. The activity indicates a bearish bias toward these businesses.

Keysight Technologies (KEYS) & Life Time Fitness (LTM): These are small (less than ~2% of the portfolio each) positions established last quarter and reduced marginally this quarter. KEYS is a 2.15% position purchased at an average cost-basis of ~$31 and the stock currently trades at $35.33. LTM is a 1.68% stake established at prices between $47.77 and $56.75 and the stock currently trades at $71.83.

FCB Financial Holdings (FCB): FCB is a minutely small 0.20% of the US long portfolio position that was reduced by ~60% this quarter.

Kept Steady:

Civeo Corporation (CVEO): CVEO is a minutely small 0.35% of the US long portfolio position established in Q2 2014 as a result of its spin-off from Oil States International. Einhorn held 2.75M shares of Oil States and per the spin-off terms received 5.5M shares (2:1 ratio). Last quarter, the position was increased by ~73% at prices between $3.92 and $13.25. CVEO started trading in May at $22.80 and the stock is currently at $4.35.

Conn's Inc. (CONN): CONN is a 1.41% of the US long portfolio position established in Q1 2014 at an average purchase price of $35.49. Q2 2014 saw a 6% stake increase at prices between $38.59 and $49.87. The stock currently trades at $39.99. The specialty retailer fell ~50% in February 2014 after announcing increased credit losses. Einhorn purchased the shares on the thesis that the market has over-reacted. He currently controls 9.8% of the business. For investors attempting to follow Einhorn, CONN is a good option to consider for further research.

Green Brick Partners (GRBK): The 1.69% of the US long portfolio GRBK stake was acquired as a result of BioFuel Energy's JGBL Builder Finance acquisition and rename transaction. The deal closed with Greenlight owning 49% of the business. David Einhorn was appointed Chairman of the Board following the transaction.

Liberty Global Class A & Class C (LBTYA) (LBTYK): Liberty Global position accounts for 2.81% of the US long portfolio. Einhorn had a position in Virgin Media (VMED) from Q2 2012 onwards and the Liberty Global position was established as a result of the acquisition of VMED by Liberty Global. The VMED position roughly doubled in around twelve months of ownership.

Market Vectors Gold Miner ETF (GDX): GDX stake is currently at 2.03%. The original position was increased by ~47% in Q2 2013 at prices between $23.42 and $35.06. Q3 2014 saw a 27% reduction at prices between $21.36 and $27.32. Last quarter, the pattern reversed: ~35% increase at prices between $16.59 and $21.94. The stock currently trades at $20.72. Einhorn also has a large holding (top-five) in physical gold.

Oil States International (OIS): OIS was a fairly large stake established in Q1 2013 at an average purchase price of $77.16. Last quarter, the position was almost eliminated at prices between $42.42 and $61.90. The stock currently trades at $43.13. In the Ira Sohn conference in May 2013, Einhorn highlighted this position saying the shares could be worth as high as $155 per share, if the accommodation business it owns is spun-off as an REIT. The business was spun-off as Civeo Corporation in May 2014.

NOTE: The performance implied by the quoted prices above understates the actual performance due to the effect of the spin-off of CVEO from OIS. The spin-off terms called for OIS shareholders to receive two shares of CVEO for every share of OIS held.

Spirit Aerosystems (SPR): SPR is a 1.50% position that had seen consistent buying since the stake establishment in Q1 2013. The position was increased by just over 40% in Q4 2013 at prices between $21.50 and $26 and another 20% in Q1 2014 at prices between $26.51 and $35.89. In Q3 2014, the pattern reversed as the stake was reduced by 29% at prices between $32.57 and $39.73 and last quarter saw minor additional selling. The stock currently trades at $53.33.

Sunedison Inc. (SUNE): The very small 0.23% of the US long portfolio position in SUNE established in Q4 2013 was increased to a fairly large 3.34% position in Q1 2014 at an average entry price of $15.55. In Q2 2014, the stake was increased by another 79% at prices between $16.74 and $22.87. Last quarter saw a further ~18% increase at prices between $14.30 and $22.86. The stock currently trades at $28.96. SUNE completed the IPO of its yield-co TerraForm Power (TERP) in July 2014. SUNE is currently Greenlight's third-largest 13F position at 7.83% of the US long portfolio and they control 9.2% of the business.

Take-Two Interactive (TTWO): TTWO was first purchased in Q4 2013 at prices between $18.81 and $22.38. The position was increased by ~15% in Q1 2014 at prices between $16.88 and $22.26 and the stock currently trades at $24.69. The stake is at 1.56% of the US long portfolio and Einhorn controls 5.6% of the business.

Yahoo Inc. (YHOO): YHOO is a 1.36% position established last quarter at prices between $37.82 and $52.37 and the stock currently trades at $44.75.

Fifth Street Asset Management (FSAM) & Vodafone Group (VOD): These are minutely small (less than 0.5% of the US long portfolio each) stakes that were kept steady this quarter. Greenlight controls 9.98% of FSAM.

Per Greenlight's Q1 2015 letter, the top disclosed long positions in the partnership are Apple, Consol Energy, gold, ISS A/S, Micron Technology and SunEdison. In addition to partner stakes, the fund also invests the float of Greenlight Capital RE (NASDAQ:GLRE).

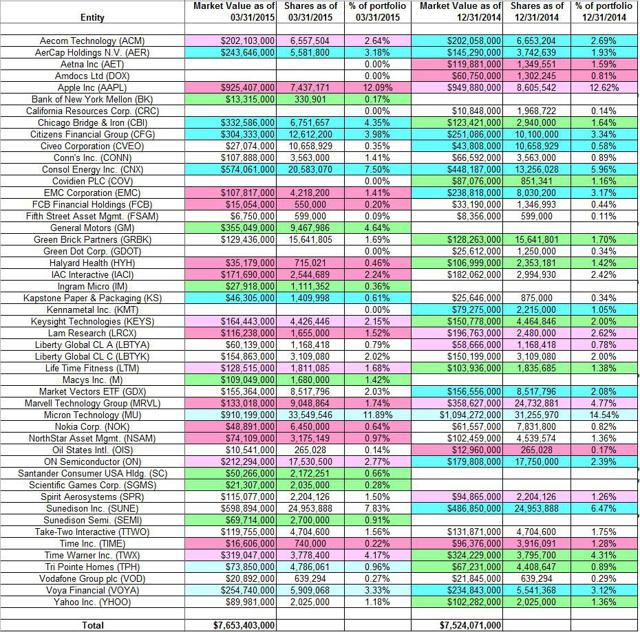

The spreadsheet below highlights changes to Greenlight's US stock holdings in Q1 2015: