By Elliott R. Morss, Ph.D. ©All Rights Reserved.

Introduction

Back in 2013, I explored what would happen when the Fed ended quantitative easing and allowed interest rates to rise. It is now two years later, and they have not risen yet. And further, the IMF is urging the US to hold off increasing rates until 2016. All that said, it is nevertheless true that the disappointingly slow but steady US recovery suggests the Fed will start increasing rates in the next 12 months. Below, I review and update what I said back in 2013 and offer my latest thoughts on the investment implications of higher rates.

An important question I have: Will just stopping the Fed's purchases of Treasuries be enough to cause interest rates to rise? Quite amazingly, with average Treasury rates still around 2%, there is a healthy demand for them. And it is not as if the Treasury has reduced its offerings of Treasuries on the open market. According to the Fed's flow of funds data, the Treasuries supply has increased from $5 trillion in 2007 to $13 trillion today. Admittedly, the Fed bought $2 trillion of them as part of its quantitative easing program. But that still means there was a global market for an additional $6 trillion of them at 2% rates. Will the Fed have to sell at least part of its store of Treasuries to get rates to increase? Probably.

Looking Forward by Looking Backward

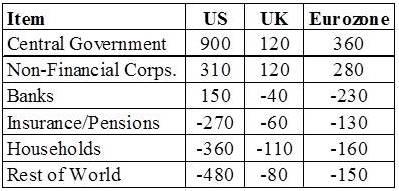

Before getting to investment implications, let's take a look at the impact of lower rates. Back in 2013, The McKinsey Global Institute completed a thorough study on the effects of lower rates on different economic sectors in the UK, the US, and the Euro Region. The findings are summarized in Table 1. Overall, and not surprisingly, borrowers benefited while lenders were hurt.

Table 1: Interest Rate Effects - Cumulative, 2007-2012

Source: McKinsey Global Institute.

The savings on debt interest for central governments has been substantial. McKinsey estimates that in the US interest payments on debt fell from 4.8% in 2007 to 2.4% in 2012; for the UK and the Euro Region, the reductions were 5.1% to 3.2% and 4.5% to 3.3%, respectively. Of course, non-financial corporations also benefited from lower interest rates.

Banks are both lenders and borrowers. In the US, banks were able to take advantage of low interest rates to attract funds while keeping their lending margins nearly the same. Not so for UK or Euro banks where lower rates have reduced their profits.

Insurance companies and pension funds are in a tricky position. On the one hand, their balance sheets look better because the value of their bond and other debt holdings have increased. However, many of these institutions issued annuities before rates went down with high guaranteed returns they now cannot cover with their investments. Adjustments will be needed.

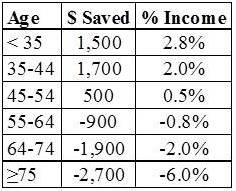

Household have also been hurt by the loss of interest income, but losses depended on whether you are net lenders or borrowers. Younger people are mostly borrowers while older people are mostly lenders. McKinsey estimated the differences by age bracket (Table 2). People under 35 saved $1,500 over what they would have paid without lower rates; people 55 and older lost income because of lower fixed income returns.

Table 2: Impact of Lower Rates on US Households, by Age Bracket

Source: McKinsey Global Institute.

So looking forward, it is pretty likely that higher rates would reverse these effects: Borrowing costs for all would rise, and older people would earn more income from low-risk government securities.

The main reason for lowering rates was to increase aggregate demand and help countries get out of the 2008-2010 depression. Ironically, it is not clear lower rates did much to stimulate demand. In the depths of the depression, neither individuals nor companies wanted to spend more whatever the rate. In addition, even if people wanted to take advantage of lower rates and borrow more, banks had tightened up their borrowing terms.

Investment Effects

Let's start with the theory on what should happen and then look at the numbers. In theory, a fall in US rates should result in investors switching out of debt to equity. And now, an increase in US interest rates should increase the global demand for US debt. The theory goes that to finance these purchases, people would sell equities causing stock markets to fall. And in addition, the dollar would strengthen as the demand for dollars to buy US debt increased. So higher rates should mean moves out of equities into debt and a stronger dollar. But for rates to increase, prices on outstanding debt will have to fall. And then there is presumed economic impact of higher rates on economic activity - it should put a damper on economic growth. And this last concern, often reflected in the media, is that higher US interest rates will weaken the already slow US recovery.

So that's the theory. What are the facts? John Reese runs Validea and is one of the best writers on investments. In his latest newsletter, he looked at findings from the extensive research on linkages between changing interest rates and stock market performance. His conclusion:

So, what did I find? Well, I can tell you with certainty that if rates start rising, stocks will go down. That is, unless they go up.

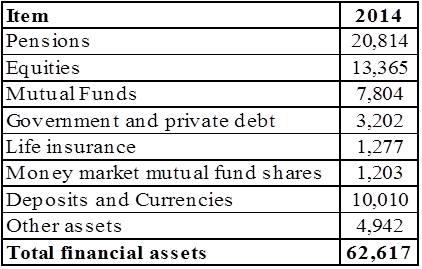

So with nothing definitive there, I decided to take a somewhat different approach. The Flow of Funds data from the Federal Reserve allows one to look at investment holdings of the major investors through time. So in what follows, I look at how their holdings have changed between three dates: 2007 to 2010, 2010 to 2014, and 2007 to 2014. Table 3 provides data on household assets provided by the flow of funds database. Note that households make final investments decisions on only equities, debt, and deposits. Final investments decisions on pensions, mutual funds, and life insurance are made by those entities.

Table 3: US Household Assets ($USD in Billions)

Source: Federal Reserve Flow of Funds.

So in what follows, I look at the direct investment decisions made by households, pensions, mutual funds, exchange-traded funds and the rest of the world between equities and debt for the years 2007, 2010, and 2014.

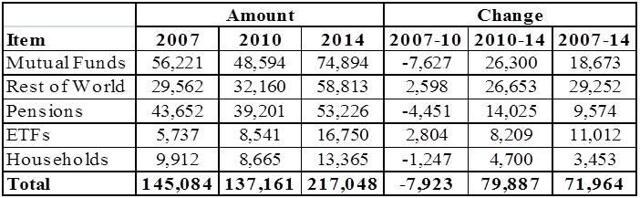

The data appear in Table 4. They allow us to see what investors did going from boom (2007) to bust (2010) - high interest rates to low ones - and back up out of the depression (2010 - 2014) with rates still low. The reduction in equity in the boom to bust period was not surprising. It probably had little to do with interest rates. Rather, in times of panic, investors want their assets to be as liquid as possible.

Table 4: Equity Holdings of Leading Investors ($USD in Billions)

Source: Federal Reserve Flow of Funds.

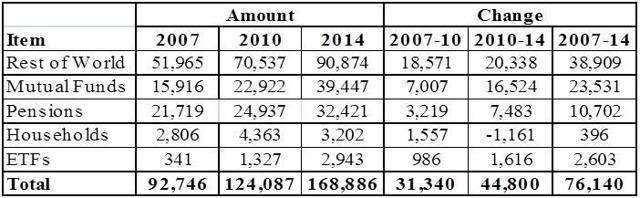

One might think the growth in equity purchases in the recovery period (2010 - 2014) could at least be in part attributable to a switch from debt to equities because of low debt returns. But before drawing that conclusion, it is worth looking at what happened to debt holdings (Table 5).

Table 5: Debt Holdings of Leading Investors ($USD in Billions)

Source: Federal Reserve Flow of Funds.

Source: Federal Reserve Flow of Funds.

It turns out that debt holdings grew rapidly in the 2007 - 2010 period - 10.2% compounded. And rather than there being a sell-off in the 2010 - 2014 period because of lower returns, debt continued to grow at a very healthy rate - 8.0%. Treasuries constituted 55% of the debt covered by Fed. data in 2007. With a compounded annual growth in Treasuries outstanding of 14.3% for the 2007 - 2014 period, the Treasury share of debt its share grew to 77% in 2014. This was a huge supply increase, but the market absorbed it without causing interest rates to rise.

Conclusions

Concerns about higher interest rates are overblown.

- The Federal Reserve Board won't raise rates to gut the recovery. They will only raise them to curb inflation and to limit speculative bubbles.

- An interesting question: given the apparent growing global demand for Treasuries, will the Fed be able to get rates to rise, even if it sells a significant portion of its Treasury holdings?

- It is unlikely, even if the Fed can get rates to rise, that we will see a significant swing from debt into equity - the market for fixed income securities (mostly debt) is huge regardless of the rate.

- Don't buy bonds today unless you are willing to hold them to maturity and the redemption rate will cover your costs. At some point, rates will rise, and when that happens, bond prices will fall.