Analyst ratings are a great start when searching for companies with exciting prospects, but finding companies with bullish ratings from analysts with a history of predicting stock performance is even better.

Using analyst ratings from Reuters that are presented on a linear scale (with 1 = "Strong Buy" and 5 = "Strong Sell"), we sliced the ratings data of stocks from the tech sector into three monthly time periods, and identified the groups of analysts that have shown predictive value over two consecutive time periods.

We further narrowed down the list by only focusing on those stocks that have seen bullish trends in recent analyst opinion.

Although past performance is no guarantee of future results, the recent accuracy of these analyst ratings suggests their opinions may be a helpful starting-off point for your own analysis.

Interactive Chart: Press Play to compare changes in analyst ratings over the last two years for the top six stocks mentioned below. Analyst ratings sourced from Zacks Investment Research.

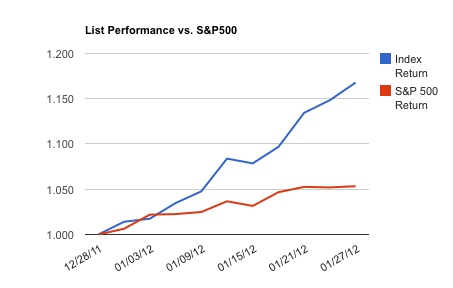

We also created a price-weighted index of the stocks mentioned below, and monitored the performance of the list relative to the S&P 500 index over the last month. To access a complete analysis of this list's recent performance, click here.

Do you think these stocks will outperform like analysts expect? Use this list as a starting point for your own analysis.

List sorted by market cap.

1. Broadcom Corp. (BRCM): Designs and develops semiconductors for wired and wireless communications. Market cap of $19.02B. Mean average rating changed from 2 to 2.02 between 10/28/11 and 11/27/11 (bearish change). Analysts correctly predicted the direction of the stock over the next month, with the stock generating an alpha of -7.8%. Analysts also got it right between 11/27/11 and 12/27/11, with the mean rating changing from 2.02 to 2 (bullish change). Over the following month, the stock generated an alpha of 14.79% relative to the S&P 500 index, as predicted by the analysts. This same group of analysts now expect the stock to outperform in the future, with the mean rating changing from 2 to 1.94 between 12/27/11 and 01/26/12 (i.e. bullish change). The stock has had a good month, gaining 18.54%.

2. Telefonos de Mexico, S.A.B. de C.V. (TMX): Provides telecommunications services primarily in Mexico. Market cap of $14.14B. Mean average rating changed from 3.5 to 3.56 between 10/28/11 and 11/27/11 (bearish change). Analysts correctly predicted the direction of the stock over the next month, with the stock generating an alpha of -6.18%. Analysts also got it right between 11/27/11 and 12/27/11, with the mean rating changing from 3.56 to 3.29 (bullish change). Over the following month, the stock generated an alpha of 3.95% relative to the S&P 500 index, as predicted by the analysts. This same group of analysts now expect the stock to outperform in the future, with the mean rating changing from 3.29 to 3.14 between 12/27/11 and 01/26/12 (i.e. bullish change). The stock has lost 3.98% over the last year.

3. F5 Networks, Inc. (FFIV): Provides technology that optimizes the delivery of network-based applications, and the security, performance, and availability of servers, data storage devices, and other network resources in the Americas, EMEA, Japan, and the Asia Pacific. Market cap of $9.60B. Mean average rating changed from 2.08 to 2.11 between 10/28/11 and 11/27/11 (bearish change). Analysts correctly predicted the direction of the stock over the next month, with the stock generating an alpha of -4.31%. Analysts also got it right between 11/27/11 and 12/27/11, with the mean rating changing from 2.11 to 2.03 (bullish change). Over the following month, the stock generated an alpha of 9.22% relative to the S&P 500 index, as predicted by the analysts. This same group of analysts now expect the stock to outperform in the future, with the mean rating changing from 2.03 to 2 between 12/27/11 and 01/26/12 (i.e. bullish change). The stock has had a good month, gaining 13.56%.

4. Seagate Technology PLC (STX): Designs, manufactures, markets, and sells hard disk drives for the enterprise, client compute, and client non-compute market applications in the United States and internationally. Market cap of $8.31B. Mean average rating changed from 2.29 to 2.48 between 10/28/11 and 11/27/11 (bearish change). Analysts correctly predicted the direction of the stock over the next month, with the stock generating an alpha of -7.17%. Analysts also got it right between 11/27/11 and 12/27/11, with the mean rating changing from 2.48 to 2.38 (bullish change). Over the following month, the stock generated an alpha of 20.97% relative to the S&P 500 index, as predicted by the analysts. This same group of analysts now expect the stock to outperform in the future, with the mean rating changing from 2.38 to 2.29 between 12/27/11 and 01/26/12 (i.e. bullish change). This is a risky stock that is significantly more volatile than the overall market (beta = 2.21). The stock has had a good month, gaining 22.52%.

5. LinkedIn Corporation (LNKD): Operates an online professional network. Market cap of $7.06B. Mean average rating changed from 2.85 to 3.08 between 10/28/11 and 11/27/11 (bearish change). Analysts correctly predicted the direction of the stock over the next month, with the stock generating an alpha of -1.33%. Analysts also got it right between 11/27/11 and 12/27/11, with the mean rating changing from 3.08 to 2.62 (bullish change). Over the following month, the stock generated an alpha of 10.95% relative to the S&P 500 index, as predicted by the analysts. This same group of analysts now expect the stock to outperform in the future, with the mean rating changing from 2.62 to 2.5 between 12/27/11 and 01/26/12 (i.e. bullish change). The stock has had a good month, gaining 13.48%.

6. Sprint Nextel Corp. (S): Offers wireless and wireline communications products. Market cap of $6.50B. Mean average rating changed from 2.59 to 2.65 between 10/28/11 and 11/27/11 (bearish change). Analysts correctly predicted the direction of the stock over the next month, with the stock generating an alpha of -11.42%. Analysts also got it right between 11/27/11 and 12/27/11, with the mean rating changing from 2.65 to 2.67 (bearish change). Over the following month, the stock generated an alpha of -10.65% relative to the S&P 500 index, as predicted by the analysts. This same group of analysts now expect the stock to outperform in the future, with the mean rating changing from 2.67 to 2.62 between 12/27/11 and 01/26/12 (i.e. bullish change). It's been a rough couple of days for the stock, losing 7.26% over the last week.

7. NII Holdings Inc. (NIHD): Provides wireless communication services to businesses and individuals primarily in Mexico, Brazil, Argentina, Peru, and Chile. Market cap of $3.41B. Mean average rating changed from 1.76 to 1.86 between 10/28/11 and 11/27/11 (bearish change). Analysts correctly predicted the direction of the stock over the next month, with the stock generating an alpha of -10.18%. Analysts also got it right between 11/27/11 and 12/27/11, with the mean rating changing from 1.86 to 1.9 (bearish change). Over the following month, the stock generated an alpha of -10.31% relative to the S&P 500 index, as predicted by the analysts. This same group of analysts now expect the stock to outperform in the future, with the mean rating changing from 1.9 to 1.84 between 12/27/11 and 01/26/12 (i.e. bullish change). The stock has lost 54.48% over the last year.

8. Rovi Corporation (ROVI): Provides digital entertainment technology solutions for the discovery and management of entertainment content. Market cap of $3.30B. Mean average rating changed from 1.67 to 2 between 10/28/11 and 11/27/11 (bearish change). Analysts correctly predicted the direction of the stock over the next month, with the stock generating an alpha of -14.61%. Analysts also got it right between 11/27/11 and 12/27/11, with the mean rating changing from 2 to 1.94 (bullish change). Over the following month, the stock generated an alpha of 17.72% relative to the S&P 500 index, as predicted by the analysts. This same group of analysts now expect the stock to outperform in the future, with the mean rating changing from 1.94 to 1.81 between 12/27/11 and 01/26/12 (i.e. bullish change). The stock has had a good month, gaining 21.36%.

9. Cree, Inc. (CREE): Develops and manufactures light emitting diode (LED) products, silicon carbide and gallium nitride material products, and power and radio frequency (RF) products. Market cap of $3.05B. Mean average rating changed from 2.41 to 2.44 between 10/28/11 and 11/27/11 (bearish change). Analysts correctly predicted the direction of the stock over the next month, with the stock generating an alpha of -17.7%. Analysts also got it right between 11/27/11 and 12/27/11, with the mean rating changing from 2.44 to 2.36 (bullish change). Over the following month, the stock generated an alpha of 15.78% relative to the S&P 500 index, as predicted by the analysts. This same group of analysts now expect the stock to outperform in the future, with the mean rating changing from 2.36 to 2.3 between 12/27/11 and 01/26/12 (i.e. bullish change). The stock has had a good month, gaining 21.24%.

10. Qlik Technologies, Inc. (QLIK): Engages in the development, commercialization, and implementation of software products and related services that deliver data analysis and reporting solutions primarily in the Americas, and Europe. Market cap of $2.26B. Mean average rating changed from 2.21 to 2.25 between 10/28/11 and 11/27/11 (bearish change). Analysts correctly predicted the direction of the stock over the next month, with the stock generating an alpha of -12.95%. Analysts also got it right between 11/27/11 and 12/27/11, with the mean rating changing from 2.25 to 2.12 (bullish change). Over the following month, the stock generated an alpha of 6.09% relative to the S&P 500 index, as predicted by the analysts. This same group of analysts now expect the stock to outperform in the future, with the mean rating changing from 2.12 to 2 between 12/27/11 and 01/26/12 (i.e. bullish change). The stock is a short squeeze candidate, with a short float at 6.4% (equivalent to 5.1 days of average volume). The stock has had a good month, gaining 10.33%.

11. CommVault Systems, Inc. (CVLT): Provides data and information management software applications and related services primarily in North America, Europe, Australia, and Asia. Market cap of $2.09B. Mean average rating changed from 2.65 to 2.7 between 10/28/11 and 11/27/11 (bearish change). Analysts correctly predicted the direction of the stock over the next month, with the stock generating an alpha of -15.36%. Analysts also got it right between 11/27/11 and 12/27/11, with the mean rating changing from 2.7 to 2.58 (bullish change). Over the following month, the stock generated an alpha of 7.27% relative to the S&P 500 index, as predicted by the analysts. This same group of analysts now expect the stock to outperform in the future, with the mean rating changing from 2.58 to 2.53 between 12/27/11 and 01/26/12 (i.e. bullish change). The stock has had a good month, gaining 16.43%.

12. Take-Two Interactive Software Inc. (TTWO): Develops, and distributes interactive entertainment software, hardware, and accessories worldwide. Market cap of $1.32B. Mean average rating changed from 2.38 to 2.4 between 10/28/11 and 11/27/11 (bearish change). Analysts correctly predicted the direction of the stock over the next month, with the stock generating an alpha of -7.4%. Analysts also got it right between 11/27/11 and 12/27/11, with the mean rating changing from 2.4 to 2.31 (bullish change). Over the following month, the stock generated an alpha of 6.28% relative to the S&P 500 index, as predicted by the analysts. This same group of analysts now expect the stock to outperform in the future, with the mean rating changing from 2.31 to 2.12 between 12/27/11 and 01/26/12 (i.e. bullish change). The stock is a short squeeze candidate, with a short float at 14.73% (equivalent to 5.33 days of average volume). The stock has had a good month, gaining 10.14%.

13. Synaptics Inc. (SYNA): Develops and supplies custom-designed human interface solutions that enable people to interact with various mobile computing, communications, entertainment, and other electronic devices. Market cap of $1.11B. Mean average rating changed from 2.41 to 2.5 between 10/28/11 and 11/27/11 (bearish change). Analysts correctly predicted the direction of the stock over the next month, with the stock generating an alpha of -9.56%. Analysts also got it right between 11/27/11 and 12/27/11, with the mean rating changing from 2.5 to 2.47 (bullish change). Over the following month, the stock generated an alpha of 9.26% relative to the S&P 500 index, as predicted by the analysts. This same group of analysts now expect the stock to outperform in the future, with the mean rating changing from 2.47 to 2.41 between 12/27/11 and 01/26/12 (i.e. bullish change). The stock is a short squeeze candidate, with a short float at 16.64% (equivalent to 12.13 days of average volume). The stock has had a good month, gaining 13.63%.

14. Blue Coat Systems Inc. (BCSI): Designs, develops, and sells products and services that secure, accelerate, and optimize the delivery of business applications, Web content, and other information to distributed users over a wide area network (WAN) or the public Internet/Web. Market cap of $1.10B. Mean average rating changed from 2.94 to 2.88 between 10/28/11 and 11/27/11 (bullish change). Analysts correctly predicted the direction of the stock over the next month, with the stock generating an alpha of 39.32%. Analysts also got it right between 11/27/11 and 12/27/11, with the mean rating changing from 2.88 to 2.94 (bearish change). Over the following month, the stock generated an alpha of -3.13% relative to the S&P 500 index, as predicted by the analysts. This same group of analysts now expect the stock to outperform in the future, with the mean rating changing from 2.94 to 2.93 between 12/27/11 and 01/26/12 (i.e. bullish change). The stock has lost 9.75% over the last year.

15. ICG Group, Inc. (ICGE): A private equity and venture capital firm specializing in patient capital, growth capital, acquisitions, and mid and late venture investments in public and private companies. Market cap of $344.17M. Mean average rating changed from 1.67 to 2 between 10/28/11 and 11/27/11 (bearish change). Analysts correctly predicted the direction of the stock over the next month, with the stock generating an alpha of -2.88%. Analysts also got it right between 11/27/11 and 12/27/11, with the mean rating changing from 2 to 1.75 (bullish change). Over the following month, the stock generated an alpha of 6.53% relative to the S&P 500 index, as predicted by the analysts. This same group of analysts now expect the stock to outperform in the future, with the mean rating changing from 1.75 to 1.6 between 12/27/11 and 01/26/12 (i.e. bullish change). The stock has lost 25.89% over the last year.

*Ratings sourced from Reuters, price data sourced from Yahoo Finance, all other data sourced from Finviz.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.