After taking a look at a couple of companies that are roughly a little more than a decade away from being dividend aristocrats I decided to look at those with even less dividend growth history. This may at first appear far-fetched, and maybe in a sense it is, but one has to keep in mind that all of the current aristocrats started somewhere. I decided to narrow this list to companies that I believe will be able to continue to increase their dividends for at least roughly the next two decades.

Specifically I looked for names that have exemplified outstanding businesses as well as ones that have raised their dividends over the past few years. Since only raising the dividend a few years does not necessarily exhibit great commitment these names have to be taken with a grain of salt. I felt that these business have proved themselves enough where it is difficult to even imagine big drops in their respective businesses in the foreseeable future.

What makes these names very different than the previous list is that people don't tend to think of these as dividend growth plays. Most of them sport very low yields making them not very attractive currently to dividend growth investors. However, since I see the possibility of these companies being able to raise their dividends over the next two decades I think they are actually solid dividend growth plays. These names will also more than likely see more business growth than the previous list, making them more attractive in terms of share appreciation over the years.

Below I outline the companies I think have the right businesses and performance to make it the next two decades. Most of their businesses speak for themselves and may be fairly obvious choices. They are meant to be fairly obvious as they are examples of the broad range of companies that may make it to dividend aristocrat status one day.

Apple

One company that people are definitely not particularly buying for dividend growth would be Apple (AAPL). With just three years of dividend growth it can hardly be called a perfect dividend growth play right now. Nonetheless it is a dividend growth play currently. In the most recent dividend raise Tim Cook even comments that the company knows dividend growth is important to its shareholders. That latest dividend raise came as the company continues to increase its capital return program. Apple is certainly one company that has done well rewarding shareholders through the years.

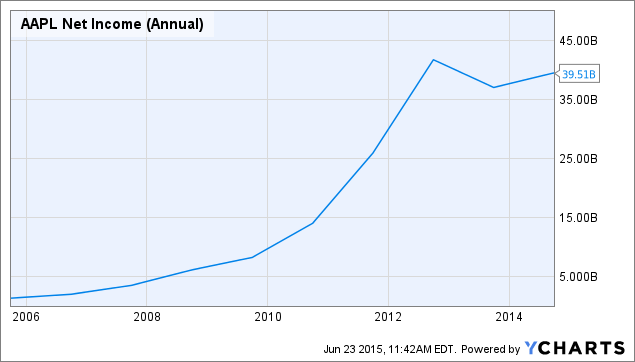

Apple makes the list because in reality it does have a very reliable business. I don't foresee any big drop off in performance for the company in the near future and it has already proven it can innovate well. It's pretty easy to state that the company has built one of the worlds strongest brands that will not be fading anytime soon. The chart below makes a good case for the company being able to perform no matter what.

With the possibility of growth slowing over the next two decades watch for the company to look at dividend growth as a way to reward shareholders. With such a good business and brand behind it this is one company I expect to make it to dividend aristocrat status one day.

Starbucks

Starbucks (SBUX) is another name that people don't typically seek specifically for dividend growth. With five years of dividend raises it has exactly two decades ahead of it before it could earn the title of aristocrat. Starbucks makes the list because it also has built a strong core business. The company actually only began paying a dividend to shareholders in 2010 which has signified that the company means business by raising it every year since.

The driving force behind this dividend growth will of course be the overall growth of the business. This past December the company outlined a five year plan. In the plan the company projects sales growing nearly 100% from FY 2014 to $30B in FY 2019. Earnings are also forecasted to increase handsomely with a 5 year estimated growth rate of 18.5%.

Starbucks, like Apple, has also done an excellent job of innovating. In the five year plan the company expects to have 20-25% of locations offering the Starbucks Evening experience by 2019. This is just one way in which the company is innovating to drive both revenue and earnings growth.

Visa

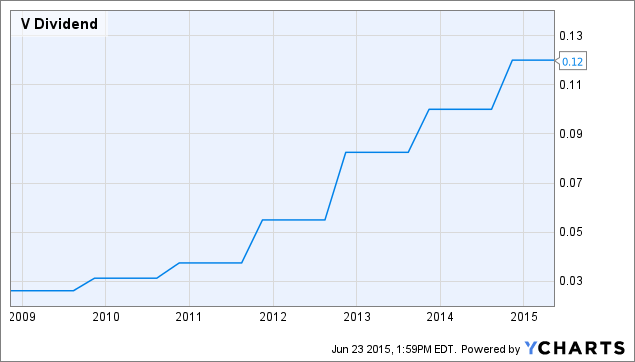

Visa (V) is another name that has only recently really started dividend growth. It began paying a regular quarterly dividend in 2008 and has raised it all 7 years since. The yield for Visa is incredibly low, but so is the payout ratio at just about 19%.

Visa actually may fit better with the other more historically reliable names. However, it also offers better forward growth prospects than many of the companies that have boring reliable businesses. For a number of years now Visa has been the dominate name in terms of market share for both credit cards and debit cards by spending. In fact between 2006 and 2014 it was able to slowly increase its market share of the credit card space.

Although the company continues to have a very low yield its recent dividend growth has shown its true colors. The 3 year DGR is nearly 36%. With a payout ratio of only 19% the company has plenty of cushion to continue with the handsome raises as well.

Valero Energy/ Phillips 66

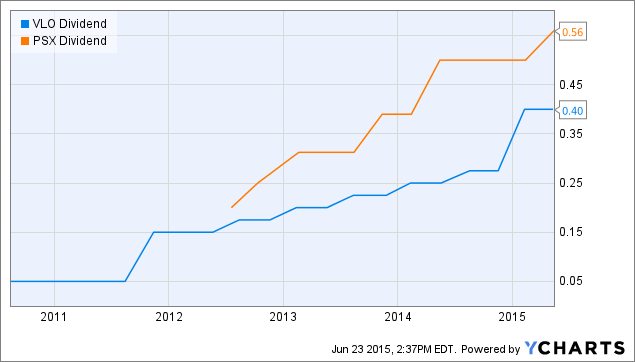

Valero Energy (VLO) and Phillips 66 (PSX) are the most attractive out of this bunch based solely on dividends. Currently shares of the two yield about 2.7%. Previously Valero did have a streak of raises but cut its dividend in 2010. Since then it has more than made up for the cut with a 3 year DGR of 52%.

Phillips 66 only began paying a dividend in 2012, but has raised it every year since. I decided to add these names to the list because both continue to perform well and have shares trading at fairly attractive values. With higher yields they appear more attractive to current dividend growth investors seeking more income right now. Over the past five years both of these names have been able to really show strong performance that they should be able to maintain. Payout ratios for both are below 31% showing that as of right now they are both very sustainable.

Summary

Looking back on previous dividend aristocrats it is important to remember that they all had a starting point. The names above are some higher growth names that are not your typical dividend growth plays but are slowly turning into solid ones. It's interesting to note that out of the names above not a single one sports a payout ratio of over 50% making these dividends highly sustainable. Adding to that these companies are all forecasted to continue to see strong earnings growth which should translate into further dividend growth. Although there is no way to be certain that dividend growth will continue for the next two decades for any of these names I do think each has a good shot of being able to do so. The list above is only a starting point and I believe that dozens of other companies will be able to reach aristocrat status one day.