By Columbia Threadneedle Investments Global Asset Allocation Team

Thank you for your continued interest in research and insights from Columbia Threadneedle Investments. Our Global Asset Allocation team continually monitors global economic and market conditions in order to develop our Investment Strategy Outlook. If you would like to subscribe to this publication, please click here.

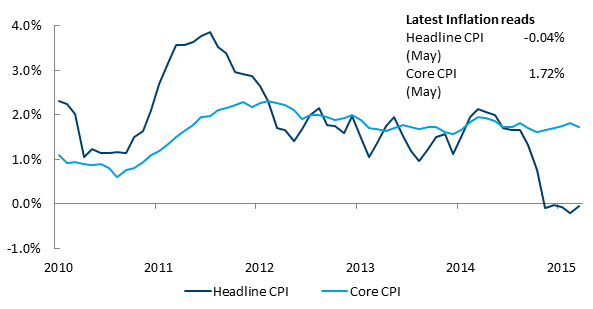

A review of the Global Asset Allocation Team's research continues to point to an environment favorable for stocks over bonds. After the first-quarter economic slowdown - attributable to many factors including bad weather West Coast port disruptions, weaker trade and the strength of the U.S. dollar - there are tentative signs that growth is improving but unlikely to be strong enough to overcome the weakness seen in the first quarter. Our long-run investment clock, which monitors and tracks economic conditions, reflects this slowdown and shows that growth is positive but decelerating. This is generally still supportive of risk assets and the team recommends maintaining a modest overweight to equities and underweight to fixed income.

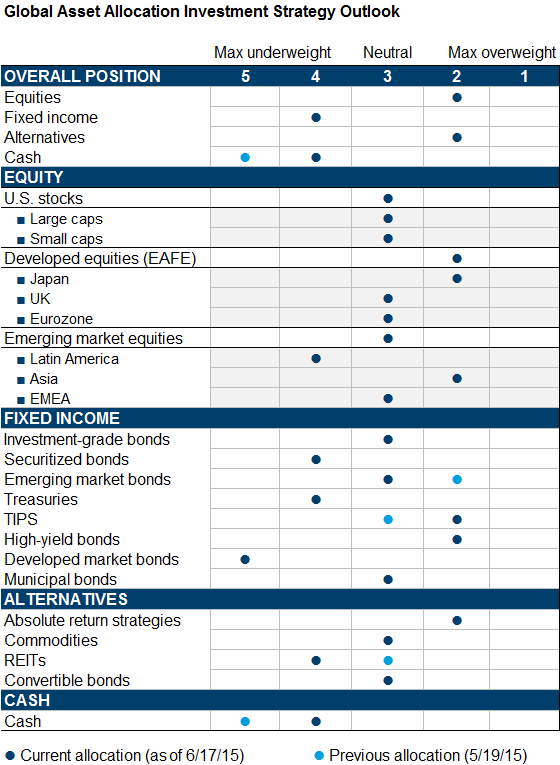

At the same time, we notice an increase in cross-asset correlations, reflecting changes in the market environment. The correlation between bonds and equities globally is on the rise, which is particularly challenging for multi-asset portfolios, as it makes diversification via bonds difficult (Exhibit 1). We outlined the risk management challenge posed by this synchronization of markets back in the January article, "Same song, slightly different arrangement". In the piece, we pointed out a number of volatility episodes when a troublesome commonality caused negative returns across nearly all asset classes. We continue to monitor global markets for similar episodes. While the team continues to recommend underweighting bonds in multi-asset portfolios, we propose raising cash allocations from max to modest underweight. We also continue to recommend portfolio diversifiers that seek to generate sources of return less correlated to traditional markets, such as liquid alternatives and absolute return strategies.

Exhibit 1: Correlation between bonds and equities is on the rise

Source: Columbia Management Investment Advisers, 06/15

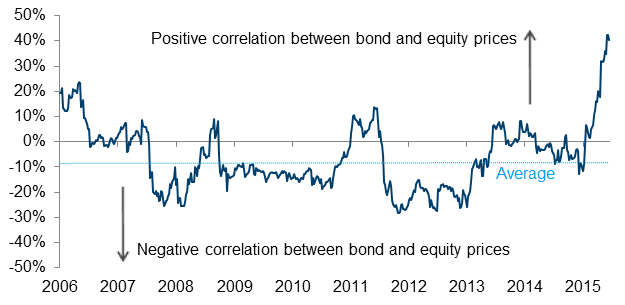

A medium-to-longer-term theme that we observe is the reduction in the deflation fears we saw towards the end of last year. However, as we look into the second half of the year, we see better inflation trends emerging. Recent economic data for the U.S. points to a modest pick-up in core inflation (Exhibit 2). A rebound in inflation expectations should be well sustained, and forecasts for inflation are bottoming, suggesting some normalization ahead. Meanwhile, despite a rapid and sizeable backup in bond yields, duration does not look appealing. The team recommends an upgrade to inflation-linked bonds to a modest overweight from neutral. We also recommend a move from neutral to underweight in REITs. With potential rate hikes looming in the United States, we downgraded emerging market bonds (U.S. dollar denominated) from overweight to neutral. Emerging markets' country fundamentals overall do not appear strong enough to withstand any potential liquidity shocks.

Exhibit 2: A modest pick-up in core inflation

Source: Columbia Management Investment Advisers, 06/15. Headline CPI and Core CPI reflects year-over-year change on a monthly basis from May 2010 through May 2015.

The Global Asset Allocation Team discussed whether to downgrade high-yield bonds, where default risks have begun to rise and expectations are for a pickup in default rates in 2016. However, we decided not to downgrade them at this point. As the U.S. economy rebounds in the second half, we would expect spreads to narrow modestly which, combined with higher carry, should enable outperformance versus Treasuries. We do worry about liquidity risks in the credit markets and continue to watch out for deterioration in market conditions. We maintain our neutral recommendation for investment-grade bonds.

There were no changes to our regional equity allocations. We did not see strong signals for change in our country this month. The team discussed the ongoing Greek crisis at length. Markets are no longer as complacent over Greek-related contagion risks as they were about a month ago, and the consensus belief continues to be that authorities will arrive at a solution that keeps Greece in the euro area. Worst case is Greece defaults and leaves the eurozone, but we believe the fallout for financial assets would be temporary. We remain neutral on European equities after last month's downgrade. We remain neutral on U.S. equities after last month's upgrade. We continue to like Japanese equities, as the country's economy shows some signs of improvement and corporate earnings remain in a strong uptrend. In emerging markets, we recommend maintaining an overall neutral stance and favor Asia over Latin America, where we have an underweight.

As always, we continue to monitor global economic and market conditions and will adjust our outlook accordingly.

Disclaimer: The views expressed in this material are the views of the author through the date of publication and are subject to change without notice at any time based upon market and other factors. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. This information may contain certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those discussed. There is no guarantee that investment objectives will be achieved or that any particular investment will be profitable. Past performance does not guarantee future results. This information is not intended to provide investment advice and does not account for individual investor circumstances. Investment decisions should always be made based on an investor's specific financial needs, objectives, goals, time horizon and risk tolerance. Please see our social media guidelines.