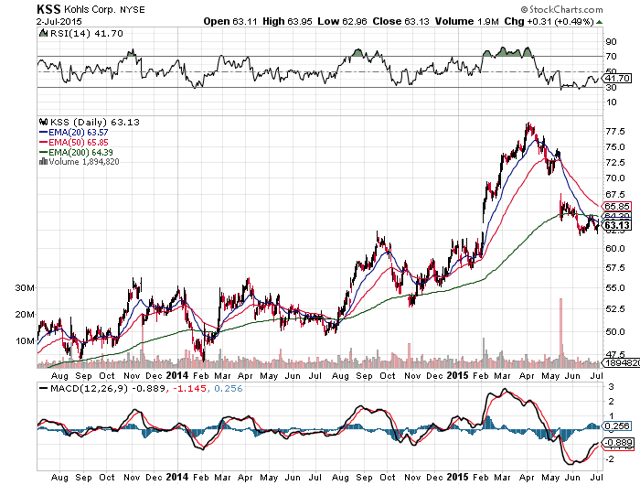

Back in early February, the net payout yields model was starting to flash a warning sign for Kohl's (NYSE:KSS). The struggling retailer saw the stock surge from $58 in January to nearly $75 in February before an eventual surge to nearly $80. Not surprisingly, the stock didn't hold up well when the quarterly results weren't as spectacular as expected with falling oil prices.

The best part now is that a stock with a strong capital return program and solid profits provides a huge safety net. The reduced market value makes it easier for a stock buyback program to do its magic while the dividend yield pays investors to wait.

The question though is whether the stock decline has done enough damage and the company still has the capital to continue returning it to shareholders in order to buy the stock now.

More Capital Returns

For the quarter ending in May, Kohl's bought $147 million worth of stock, compared to $167 million in the prior year. As well, the company spent $90 million on dividends, up from $80 million last year. So while the revenue total for the quarter missed estimates sending the stock cratering, the EPS number easily surpassed estimates. A prime reason being that the outstanding shares declined to 202 million versus 208 million last year before extra support for the EPS.

The key to the investment story is that the company gave guidance of spending $1 billion on stock buybacks during the year. The forecast though was for spending that cash on a share price that averaged $70 versus the current price around $63.

A buyback at that rate and the current market cap of $12.5 billion would repurchase roughly 8.3% of the outstanding shares. Maybe most interesting is the company only spent a fraction of the target during Q1 when the stock prices were elevated.

The company guided to earning $4.40 to $4.60 for the year and the reduced stock price allows the buybacks to fuel the earnings for the year and into next year.

Rebounding Yields

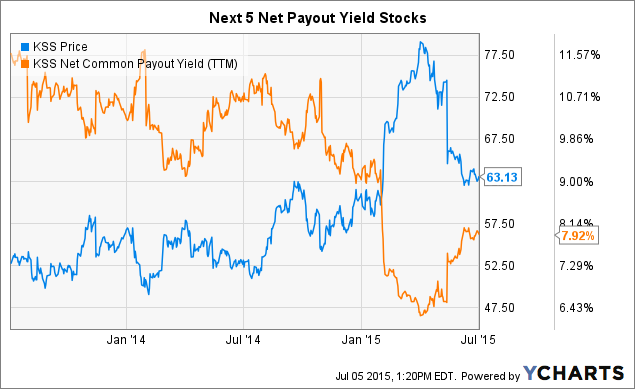

The best part about the net payout yields concept (combination of net stock buyback yield and dividend yield) is that it quickly provides a warning sign that an associated stock is getting over valued. If a company with a strong capital return plan shies away from stock buybacks and doesn't raise the dividend to match stock gains, investors should heed the warning. Remember, as a stock rises it isn't good enough to continue the same level of buybacks. A company must increase the level because we're only interested in the highest yields in the market.

In the case of Kohl's, the company slowly spent less on stock buybacks each quarter over the last couple of years. Combined with the ever higher stock price and the yields finally plunged. As the stock peaked in April, the net payout yields reached relatively low levels.

Now that the stock is down considerably in the last couple of months, the yield is back up to a more attractive level of 8%. Not to mention, the company is forecasting a ramp up in stock buybacks.

Takeaway

Clearly Kohl's over heated when the stock traded up towards $80 at the start of April, but the stock is now attractively priced at $63. The company has a strong buyback in place and investors get paid a 2.9% dividend to wait. Disappointing results or not, Kohl's still produces solid earnings making the stock a solid buy in the low $60s.