The Consumer Discretionary sector ranks fourth out of the 10 sectors as detailed in our Q3'15 Sector Ratings for ETFs and Mutual Funds report. It gets our Neutral rating, which is based on aggregation of ratings of 16 ETFs and 21 mutual funds in the Consumer Discretionary sector. See a recap of our Q2'15 Sector Ratings here.

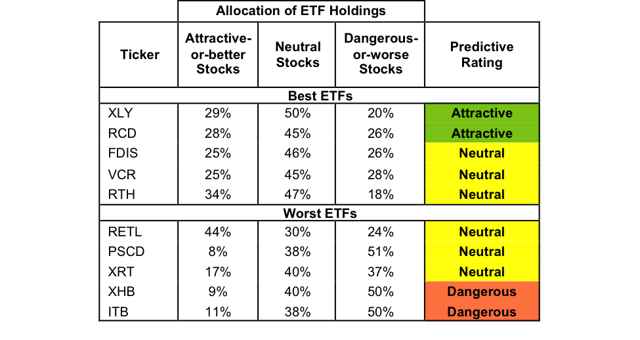

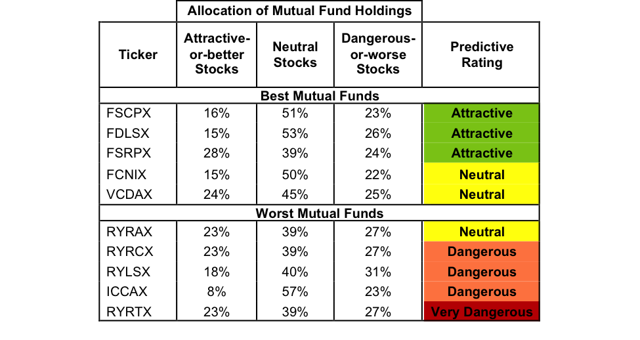

Figure 1 shows the five best and worst rated Consumer Discretionary ETFs and Figure 2 shows the five best and five worst rated Consumer Discretionary mutual funds. Not all Consumer Discretionary sector ETFs and mutual funds are created the same. The number of holdings varies widely (from 25 to 387). This variation creates drastically different investment implications and, therefore, ratings.

Investors seeking exposure to the Consumer Discretionary sector should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2.

Figure 1: ETFs with the Best & Worst Ratings - Top 5

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

The PowerShares Dynamic Retail Portfolio ETF (PMR), is excluded from Figure 1 because its total net assets are below $100 million and do not meet our liquidity minimums.

Figure 2: Mutual Funds with the Best & Worst Ratings - Top 5

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

The Consumer Discretionary Select Sector SPDR ETF (XLY) is our top-rated Consumer Discretionary ETF and the Fidelity Select Consumer Discretionary Portfolio (FSCPX) is our top-rated Consumer Discretionary mutual fund. Both earn our Attractive rating.

The iShares U.S. Home Construction ETF (ITB) is our worst rated Consumer Discretionary ETF and the Rydex Retailing Fund (RYRTX) is our worst rated Consumer Discretionary mutual fund. ITB earns our Dangerous rating and RYRTX earns our Very Dangerous rating.

470 stocks of the 3000+ we cover are classified as Consumer Discretionary stocks.

General Motors (GM) is one of our favorite stocks held by Consumer Discretionary ETFs and mutual funds and earns our Very Attractive rating. Taking advantage of the growth in auto sales, General Motors has grown its after-tax operating profit (NOPAT) by 41% compounded annually since 2012. This increase is accelerating on a trailing twelve-month basis as NOPAT is up 82%. General Motors' return on invested capital (ROIC) has also risen from 6% in 2012 to its current 13%. Despite the rapid improvement of NOPAT and ROIC, GM's stock price has failed to increase. At the current price of $30/share, GM has a price to economic book value (PEBV) ratio of 0.6. This ratio implies that General Motors' NOPAT will permanently decline by 40%. This expectation seems very pessimistic given the growing auto industry and General Motors' recent successes. If General Motors can grow NOPAT by just 2% compounded annually for the next 5 years, the stock is worth $44/share - a 47% upside.

Speedway Motorsports (TRK) is one of our least favorite stocks held by Consumer Discretionary ETFs and mutual funds and earns our Very Dangerous rating. Since 2009, Speedway Motorsport's NOPAT has declined by 13% compounded annually, from $97 million to $57 million. The company's profit issues have continued this year as trailing twelve-month NOPAT is $51 million. Over the same time frame, Speedway's ROIC has fallen from 5% to just 3%. Despite the declining fundamentals of the business, the stock price implies excellent future profit growth. To justify its current price of $23/share, Speedway Motorsports would need to grow NOPAT by 9% compounded annually for the next 14 years. These expectations are very optimistic considering that NOPAT has actually declined for the past 5 years.

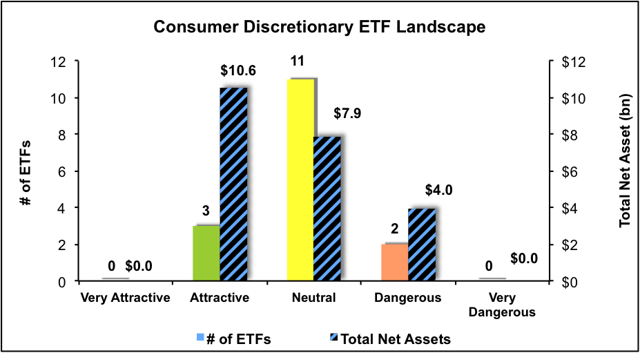

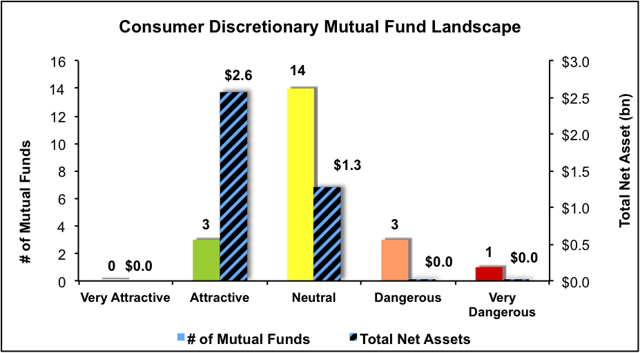

Figures 3 and 4 show the rating landscape of all Consumer Discretionary ETFs and mutual funds.

Figure 3: Separating the Best ETFs From the Worst ETFs

Sources: New Constructs, LLC and company filings

Figure 4: Separating the Best Mutual Funds From the Worst Mutual Funds

Sources: New Constructs, LLC and company filings

Disclosure: David Trainer and Allen Jackson receive no compensation to write about any specific stock, sector or theme.