Cabot Oil & Gas Corp. (COG) is an independent oil and gas company with 7.4 Tcfe of total proved reserves as of December 2014. The company's operations are focused on the Marcellus Shale and Eagle Ford regions, with 200,000 net acres and 89,000 net acres, respectively, in these two locations. This article discusses why Cabot Oil & Gas is one energy stock that's worth considering at current levels.

From a stock price perspective, Cabot Oil & Gas has corrected from 2015 highs of $35.4 to current levels of $26.6. I believe that this correction provides an opportunity for long-term investors to gradually accumulate the stock. I must caution here that oil can see a very sluggish recovery, and a big portfolio allocation to the sector at this point in time is not advisable. However, investors can consider buying some stocks that have sound fundamentals and are value picks. I believe that Cabot Oil & Gas falls into that category.

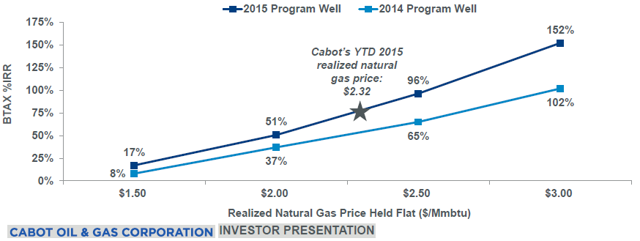

With energy prices trading at lower levels, the most important reason to consider an investment in Cabot Oil & Gas stock is the attractive IRR from the company's assets. The chart below shows the company's best assets in the Marcellus Shale and puts things into perspective:

For YTD 2015, the company's realized natural gas price of $2.32 translates into an IRR of nearly 75%. Even at $2.0/Mmbtu, the IRR is 51%. With the company drilling its most prolific wells in Marcellus, there are strong reasons to consider the stock at this price.

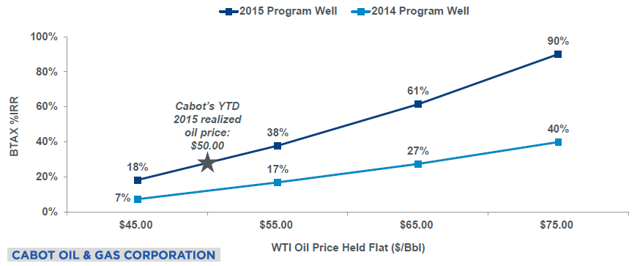

Another reason to consider Cabot Oil & Gas at these levels is the company's liquids production growth and IRR in Eagle Ford. As compared to Q2 2014 production of 10,308 boe/d, the production for Q2 2015 surged to 17,889 boe/d. Importantly, Eagle Ford Shale economics is also attractive with 38% IRR at $55 per barrel oil.

For YTD 2015, the company's realized oil price has been $50 per barrel, implying an IRR of approximately 25%. Even if FY 2016 oil prices averaged $55 per barrel, the IRR will remain robust. I expect strong activity in terms of well completions.

I must also mention here that Eagle Ford has 1,300 net locations and the current rig count in the assets is just one. However, as oil gradually recovers into FY 2016, I expect the rig count to increase. Therefore, strong production growth for liquids is likely to be maintained in FY 2016 and beyond.

Cabot Oil & Gas is also well-placed from a balance sheet and cash flow perspective. The company's current debt to capitalization of 48% provides high financial flexibility, but I expect Cabot Oil & Gas to invest conservatively as long as a sustained oil price recovery is not seen. For the first half of 2015, the company reported operating cash flow of $439 million. This implies an annualized OCF of $850 million (on the conservative side). The operating cash flow is therefore in sync with the company's capital expenditure and plan of $900 million for the year.

A conservative spending plan certainly doesn't imply that Cabot Oil & Gas does not have the liquidity to accelerate spending if there is a sustained recovery in oil price. As of June 2015, the company had $1.4 billion in an undrawn credit facility, and this can be utilized for accelerating investments. With a strong inventory of potential drilling locations, I see long-term growth continuing for Cabot Oil & Gas.

In a recent article, I discussed why I am bullish on natural gas for the long term. In my view, natural gas prices will be meaningfully higher if investors are looking at a time horizon of three to five years. The same time horizon needs to be considered for Cabot Oil & Gas.

Another important point I want to mention is that Cabot Oil & Gas mentioned during its Q2 2015 conference call transcript that it's likely to announce its 2016 investment plan in the third quarter of FY 2015. While I recommend exposure to the stock at current levels, investors can limit their exposure by waiting for an announcement regarding the FY 2016 investment plan. I believe that will set the stage for the next rally, consolidation, or downside for the stock.

In my view, the stock has limited downside from current levels. Even if the company's capital expenditure remains the same as in FY 2015, I believe shares will react positively as internal cash flows will largely suffice for 2016 investment as well. However, the bearish scenario is that oil remains in the $40 to $45 range and the investment guidance for FY 2016 is lower than FY 2015. Overall, amid these concerns, the stock is worth accumulating in small quantities.