Heading into 2015, Plains GP Holdings LP (NASDAQ:PAGP) was one of the best bets among the pure-play midstream General Partners. The company was projecting over 20% dividend growth for the year (technically distributions given that they are a LP), leading to the stock yielding just over 3%, far lower than peers such as Williams (WMB) and Oneok, Inc (OKE). However, due to factors outside of its direct control at Plains All American Pipeline (PAA) (lower crude oil prices, and oil spill), PAGP has had an abysmal time, down nearly 30% YTD.

Q2 2015 Overview

For the quarter, PAGP generated operating income of $208M, net income of $103M and diluted net income per class A share of $0.14. These numbers are more or less inline with the prior period.

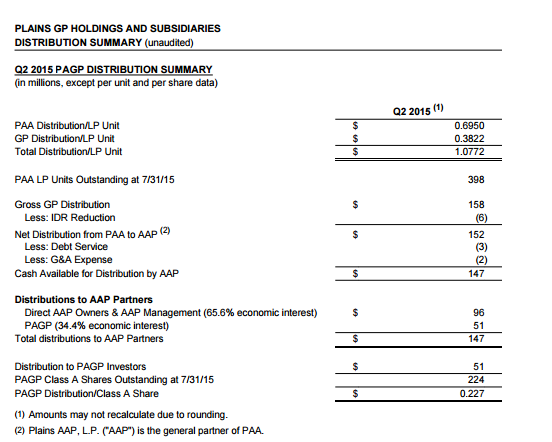

As for distributable cash flow, or DCF, PAGP generated $51M from its 34.4% economic interest in PAA's General Partner Plains AAP, LP, or simply "AAP ". In total, AAP generated $147M in DCF.

PAGP declared a $0.227 per share distribution for Q2 2015, up 23.8% from last year. As for the coverage ratio, AAP paid out the full $147M in distributions, resulting in a 1.00x coverage ratio.

Source: PAGP

Updated guidance at PAA is bearish for PAGP

Given that PAGP's only asset are its ownership interest in PAA's General Partner and the resulting IDR payments, its results are highly tied to the success of the MLP. This means that if growth slows down at PAA, PAGP will suffer a similar fate. Due to this fact, the news out of PAA during the Q2 2015 conference call was extremely bad for PAGP.

Basically, PAA slashed its distribution growth guidance in 2015 to at most 6%. Furthermore, PAA hinted that the 2016 distribution growth rate could be modest to flat as the MLP wants to keep its coverage ratio near or above 1.10x. Keep in mind that PAA has historically used a portion of its excess DCF to fund its capital budget, which reduces the need to issue equity and dilute unitholders.

As for what is hurting PAA, the company has been impacted by lower crude oil prices and a weaker outlook for oil production growth. PAA has also faced unexpected costs due to the California oil spill in May. The company booked a $65M charge in Q2 related to this incident, with more charges likely to come later this year.

In other words, with slower distribution growth coming from PAA, PAGP is also going to see slower dividend growth. The company has been estimated to grow dividends by over 20% this year. Now, with the updated guidance, PAGP would be lucky to see 10% to 12% growth going forward, assuming they grow at double the pace of PAA.

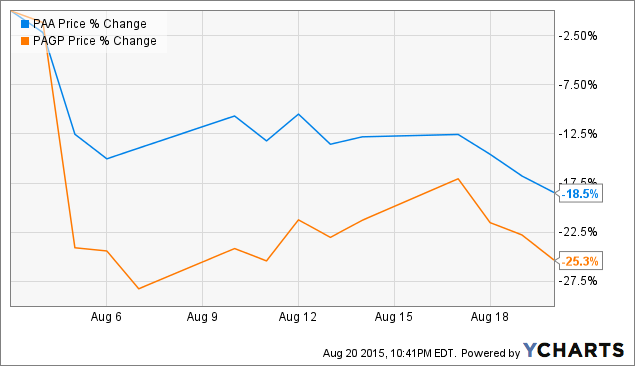

This lowered guidance has had an outsized impact on PAGP compared to PAA. Shares of PAGP fell 25%+ after the Q2 report came out, well underperforming its MLP.

Conclusion

Overall, while the price action in PAGP has been brutal, I think it was justified. This company is heavily tied to the fate of PAA, which is one of the biggest mover of crude oil in the country. With that commodity setting new multi-year lows almost daily, it is going to take a major recovery in oil prices before the sentiment improves.

However, one bright spot is that PAGP now seems fairly valued at the current price and dividend/dividend growth level. Indeed, PAGP has been re-priced to yield 5%, more or less inline with other midstream companies who are also looking at 10% or so growth such as Williams and Kinder Morgan (KMI), or even its MLP PAA which yields 8.3% and has 6% growth going forward.

Disclaimer: The opinions in this article are for informational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned. Please do your own due diligence before making any investment decision.