SanDisk (SNDK) and Micron (NASDAQ:MU) have both fallen almost 50% from their highs of about a year ago and may seem like attractive investments now. In fact, we owned SanDisk for awhile a few years ago. We sold out because we felt that even though the company was operating in the rapidly growing flash storage market the industry was still very cyclical and boy did we turn out to be right.

Right now the NAND flash memory market consists of seven major players. The chart below shows each company and its corresponding market share as of 2015.

Manufacturer | 2015 Market Share |

Samsung (OTCPK:SSNLF) | 27.9% |

Toshiba | 21.9% |

SanDisk | 18.2% |

Micron | 13.7% |

SK Hynix (HXSCF) | 11.4% |

Intel (INTC) | 7% |

With the NAND flash memory market forecast to grow 12% this year and projected to continue growing at double digit rates for years after you would think investing in SanDisk or Micron now at a 50% discount should be a slam dunk.

The problem is the industries extreme cyclicality. With cyclical industries companies tend to flood the market with product when demand is strong, with the market oversupplied prices drop significantly, companies cut back on production, then prices rise due to tight supplies and the whole cycle repeats itself. This cyclicality makes it hard to predict what a company's margins will look like from year to year or even quarter to quarter.

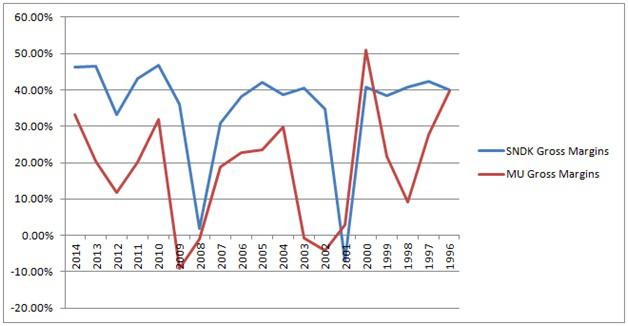

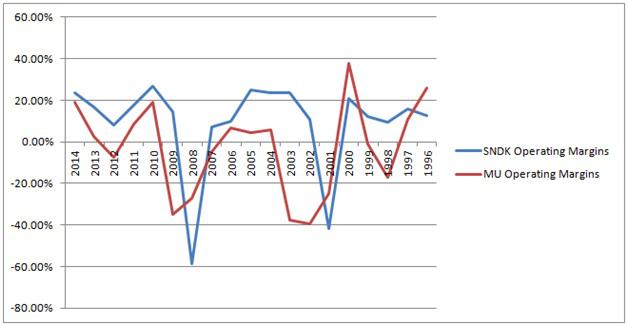

The graphs below show SanDisk and Micron's gross margins and operating margins respectively over almost the past two decades.

As you can see margins are all over the place and fluctuate greatly even during non recessionary periods. With margins varying from losing money in some years to almost doubling in others it is almost impossible to value either company with a high degree of certainty. So what can an investor do?

When to Invest in SanDisk and Micron

The situation with the NAND flash memory companies reminds us of the same environment hard disk manufacturers operated in (in the interest of full disclosure we also owned WDC in the past).

Decades ago the hard drive industry consisted of at least a dozen major players such as NEC, DEC, Maxtor, IBM (IBM), Samsung, Hitachi, Fujitsu, JVC, Memorex, Toshiba, Western Digital (NASDAQ:WDC), and Seagate (STX). After many years of consolidation the industry has been reduced to two major players, Western Digital with 43% of the market and Seagate with 40%, and a distant also ran in Toshiba with 17% of the market.

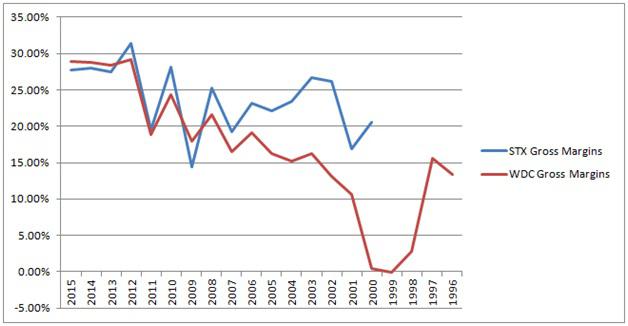

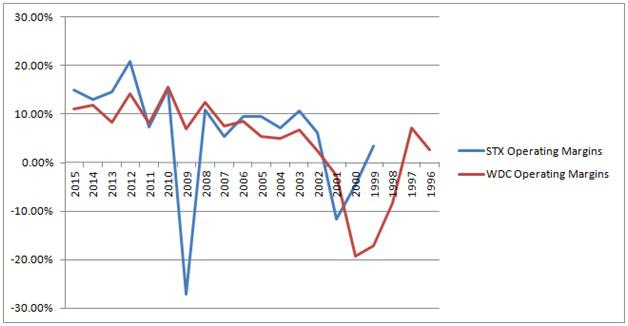

The effect the industry consolidation on margins has been remarkable. The two graphs below show gross margins and operating margins for Seagate and Western Digital respectively.

As you can see as the industry consolidated margins began to stabilize. In 2009 Fujitsu sold its hard drive operations to Toshiba reducing the number of industry players to four. Then in 2011 Western Digital purchased Hitachi's hard drive operations reducing the industry to three companies. It was during this time period that we can see gross margins really begin to show a lot of stability. However, due to the disruption caused by the Thailand floods in 2011 there is still some variability. The trend toward consolidation has culminated in margins remaining fairly steady for WDC and STX over the past four to five years.

Summary

The long term future of storage is definitely NAND flash memory. While traditional magnetic hard drives still have a place today where massive amounts of information need to be stored it would be foolish to bet against progress. Technology, invention, and innovation will bring down the price of NAND flash storage to a point where it eventually supplants traditional magnetic hard drives in most applications. I have no idea when that will be but industry growth for Micron and SanDisk is almost certain. The question then is when do the stocks become attractive investments?

Notice I said investments. Because of the cyclical nature of the flash industry the stocks will likely have wild swings and anyone who can time the flash memory industry cycle properly will probably be able to make a substantial amount of money. What I'm after is when do the stocks become attractive enough to be a buy and hold investment and not just a trading instrument?

Right now there are seven major competitors in the industry. With hard drive manufacturers we only really saw industry cyclicality become a minor factor and margins improve when the industry consolidated to four major players. Once the flash memory industry consolidates to three or four major players SanDisk and Micron may be worth a look as long term investments. For now investors should stay on the sidelines and let the traders try to time the industry's cycles.