Overview

We've been bearish of Primero Mining (NYSE:PPP) since analyzing the company's acquisition of Brigus Gold. We didn't predict the project's specific difficulties, but rather pointed out that its opex was relatively high compared with the gold price, and that the company had to take on Brigus' debt. It turned out that Primero's shareholders were getting less gold production per share at a higher cost per ounce while shouldering a larger debt-load on an absolute and relative basis. While shares rose at first in the beginning of 2014 Brigus' primary asset - Black Fox - was underperforming expectations both on costs and production as Primero faced difficulties in moving towards underground mining. As a result, the stock began to decline from a 2014 peak of ~$9/share.

In January, we revisited the bearish position and decided that the shares had declined sufficiently. Furthermore, while Black Fox continued to have issues, the company's other mine - San Dimas - was performing exceptionally well. We haven't yet turned bullish given valuation concerns, yet we otherwise believed that the company would improve its performance. This was at ~$3/share.

Now we're at $2/share, and while the gold price is lower, we're seeing clear signs that the Black Fox operation is improving as development costs come down dramatically. Furthermore, the company's streaming obligation to Sandstorm Gold (NYSEMKT:SAND) - a liability that we have criticized - has cushioned the blow as Primero only experienced the lower gold price on 92% of its production. As a result, we no longer see Black Fox as a liability.

But the real story is San Dimas, which has successfully been ramped up to the 2,500 tpd. ore throughput level, and is ahead of schedule to grow production to 3,000 tpd. The 20% growth in mill throughput is misleading in the amount of growth we can project from this; we think growth in gold and silver production can exceed this while costs can come down dramatically. This decline comes on the back of the already low operating costs. As a result, operating cash flow from San Dimas is going to rise dramatically.

More importantly, we are comparing this cash-flow - which can easily exceed $100 million per year - to a market capitalization of just $340 million or an NEV of $413 million.

This low valuation is likely a function of three phenomena. The first we've already alluded to and has been the subject of every one of our Primero articles in recent memory, and that is the issues at Black Fox. Black Fox has been losing money, so the company's combined operating cash flow has been negatively impacted. The second is that the gold market has been lousy and miners have fallen substantially and - in most cases - indiscriminately. Third, we've seen a lot of stock come onto the market in the past couple of years. Goldcorp (NYSE:GG) - which was once a 20% shareholder - exited its position last year. Furthermore, Primero Mining was removed from the Market Vectors Gold Miners ETF (NYSEARCA:GDX), and this fund held ~9 million shares at the end of last year (see the 2014 schedule of investments, p. 41). The Market Vectors Junior Gold Miners ETF (NYSEARCA:GDXJ) has lost ~2 million shares this year due to outflows. That amounts to more than a fourth of the shares coming onto the market during a bear market.

Thus, with the decline in shares and likely improvements in operations at San Dimas, we believe the stock is worth buying for that asset alone.

San Dimas

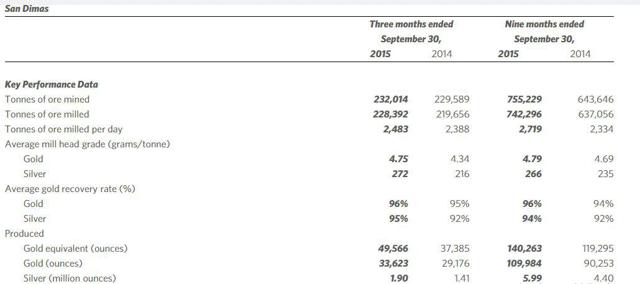

2015 has been a phenomenal year for this mine as production has ramped up on the back of both grade and throughput increases.

As a result, costs are way down.

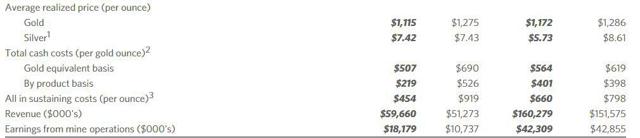

The company's AISC has come down substantially as development costs are down, cash costs are down, and the Mexican peso is down.

Now, we think there are two places in which Silver Wheaton (SLW) will improve its production.

The first is related to the company's silver streaming agreement; the company sells 100% of its silver production - up to 6 million ounces - annually to Silver Wheaton for $4.22/oz., set to rise 1% per year, and 50% of its silver production thereafter.

A couple of notes on this. The "year" in this case is based on the anniversary of the agreement, which is August 6th. Given the company's ~8 million ounces of annualized silver production, in the last "quarter" (May 6-August 5th), Primero is netting ~$9.50/oz. on average, meaning its byproduct credits come way down. This skews the figures, so Q3 numbers will appear more favorable, so keep this in mind when looking at them. Similarly, Q4 numbers will reflect a lower realized silver price since 100% of production is sold at the streaming rate.

As Primero increases production, it will also increase the average price it receives for its silver since it only sells 50% after 6 million ounces at the reduced streaming rate. What this effectively means is that AISC in gold terms on a byproduct basis will decline as production rises, all else being equal.

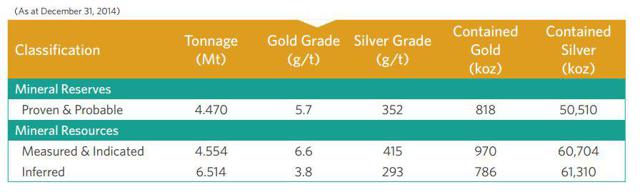

Second, the company's ore grade is expected to rise. Note that the grade being produced (4.75 gpt. gold and 272 gpt. silver in Q3) is still well below the reserve and the M&I resource grade.

The company has simply been mining lower-grade areas first, and it expects ore grades to rise towards the average reserve grade in the near future.

The increase will be tremendous - 20% for gold and 29% for silver. If we assume 3,000 tpd. production and an ore grade of 10% lower than the reserve grade (5.1 gpt. for gold and 317 gpt. for silver), then the company will produce ~170,000 oz. of gold and 10.6 million oz. of silver.

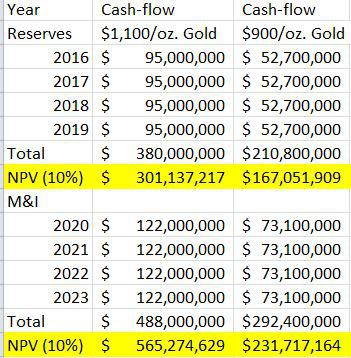

This has positive implications for future cash flows. In the first 9 months of 2015, AISC came in at $660/oz. Ex-silver credits ($34 million), this comes to $972/oz. (we'll round to $1,000/oz.). In our scenario, the company will generate $6.60/oz. vs. $5.73/oz. ($4.26/oz. from Silver Wheaton (1% inflation included) for 8.3 million ounces and $15/oz. for 2.3 million oz.). This leads to revenue of $70 million, or a reduction in production costs on a byproduct basis of $411/oz. down to ~$590/oz. Of course, we're not factoring in the improved gold grade, which should reduce the company's variable costs (~1/2, or ~$500 per gold ounce) by the grade improvement (20%, or 10% in our conservative assessment). This means another $50/oz. reduction in costs, meaning that San Dimas will produce gold with an AISC net of byproducts at $540/oz. At 170,000 oz. of production and a gold price of $1,100/oz., this comes to $95 million in operating cash flow.

Primero has enough mineral reserves to produce at this rate for four years. However, the San Dimas project is hardly one that should be valued based on reserves. Producing mining companies have little incentive to prove out reserves - especially underground reserves - given the cost of doing so and given that they don't need capital. Companies with underground mines such as Lake Shore Gold (NYSEMKT:LSG) and Klondex Mines (OTC:KLDX) operate the same way.

San Dimas has been in production since the 1990s, and management has an excellent understanding of the geology. It has even referenced mining ore that was not classified under reserves. That being said, it makes sense to look at the cash flow potential from the measured and indicated resources, which, as we've seen, have an even higher ore grade - 6.6 gpt. for gold and 415 gpt. for silver. This is a 26% further increase in the gold grade and an 18% further increase in the silver grade compared with reserves. Even with a conservative analysis, we can project that the company can improve its production and costs meaningfully, so that projections exceeding $100 million in operating cash flow per year at today's gold/silver prices make sense.

Assuming just a 15% increase in gold grade production would rise to 195,000 oz. of gold production and 11.7 million ounces of silver assuming just a 10% increase in the silver grade. That would put Primero's realized silver price even higher $7.10/oz. (assumes $0.20/oz. in inflation adjustments). This would shave another $15/oz. off AISC based on silver credits, and the increase in ore grade would generate a 7.5% benefit (rounded down to 5%). This gives us an estimated AISC on a byproduct basis of just $475/oz. At $1,100/oz. gold cash flow comes in at $122 million. The company has ~4 years' worth of measured and indicated resources.

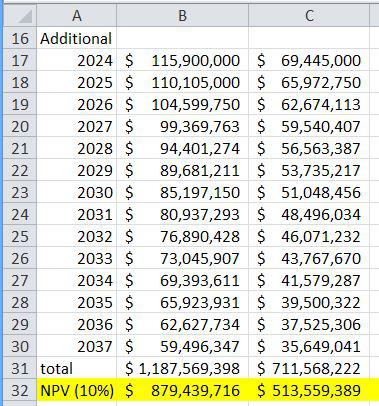

The current resource estimate includes another 6 years' worth of inferred resources. Management likely suspects that the mine can produce for much longer than this, as hinted at by the fact that mine closure costs are discounted out 22 years in the latest technical report. We will assume an annual decline of 5% in cash flow in our long-dated numbers. We are also calculating the NPV in a depressed gold price scenario of $900/oz. Since silver will likely also decline in value, we will assume an added $50/oz. in costs.

Since we don't know the order in which this ore will be mined (or even if other ore will be mined in the next 8 years), we've counted it last, and note that we have been conservative in factoring in grade increases and have consistently rounded down in our calculations.

We note that this project is incredibly resilient in the face of lower gold prices.

In addition to calculating the project's NPV, we wanted to value it against other "1"-project companies with "low cost" underground mines with a few years of reserves. We're looking at Lake Shore Gold, Klondex Mines, and Kirkland Lake Gold (KGILF)

| Company | Production | AISC | Operating Cash-Flow (at $1,100/oz Au) | NEV/OCF |

| Primero (SD only) | 170,000 oz. | $540/oz. | $95 million | 4.3 |

| Lake Shore Gold | 180,000 | $845/oz. | $46 million | 8.4 |

| Klondex Mines | 105,000 | $700/oz. | $42 million | 7.7 |

| Kirkland Lake Gold | 170,000 | $910/oz. | $32 million | 11.5 |

Kirkland Lake has more than 1 million ounces of reserves and deserves to trade at a premium valuation as a result, yet we prefer the safety of San Dimas' exceptionally low costs, the mine's relative maturity, and the relative valuation of Primero.

Black Fox

The company's efforts to turn around Black Fox appear to be successful to the point that the asset isn't losing cash anymore. Last year, costs were regularly above the price of gold as production missed expectations while development and sustaining costs were very high. The latter have continued to be high in 2015 although they have come down considerably, so that AISC in the first nine months of the year had been $1,183/oz. (cash costs at $856/oz). However, Q3 figures were much better at $1,000/oz. with cash costs at $780/oz., and the decline has been sequential throughout the year. High costs are attributable to the transition from open pit to underground mining and an extensive exploration program - these should decline going forward.

Next year, production is expected to rise from ~80,000 oz. to 100,000 oz. as the transition to underground mining plus low-grade stockpiled ore processing begins. While we have not yet seen 2016 guidance, we know that development costs should decline.

This is a young asset for which we're not sure what production costs will be longer term. Since they've been high, we're guessing that the company will cease the operation should the gold price fall, so the value of the project at $900/oz. gold is the discounted cash flow of the project in care and maintenance. At $5 million per year for 10 years at a 10% discount rate, this is $31 million. At $1,100/oz. gold, $1,000/oz. AISC and 100,000 oz. of production, the project makes $5 million per year (remember that Primero's effective realized gold price is $1,052/oz. since it sells production to Sandstorm). Either way, there has to be some major improvement in either the gold market or production costs at Black Fox before we can ascribe it value based on its cash flow.

That being said, Black Fox is no longer a liability, which means the strong performance at San Dimas will be more visible going forward.

The Bottom Line

Primero Mining has put out some bad numbers in the past several quarters as high development costs and inefficiencies at Black Fox skewed costs. However, the company's flagship project - San Dimas - has performed exceptionally well as costs have dropped while production has grown. These trends are highly likely to continue as management targets higher-grade ore and as silver credits increase in value.

On an NPV basis, this project alone makes Primero worth owning so long as we assume at least 6 years of production at the current gold price. We have reason to believe that it will produce for much longer, so that the stock is inexpensive relative to the projected NPV assuming reserves plus measured and indicated resources are produced. It is also very inexpensive on a relative basis, as we saw with the comparison with the other underground junior gold miners.

We have trouble quantifying the value of the company's other assets, particularly Black Fox, which is a high-cost, young mine whose cash flow generation is minimal to nonexistent at the current gold price. Cerro del Gallo and Grey Fox - a satellite deposit to Black Fox - are not yet in production, and the former may not be economic at current gold prices (it isn't based on our 2014 calculations). Management is preparing a scoping study for the latter. Still, these projects provide substantial upside potential to what we believe is an inexpensive stock.

Assuming that all of the company's projects except for San Dimas have no value, we think the stock can trade so that the NEV is worth 65% of San Dimas' operating cash flow over the 22 year mine life (in order to account for taxes, interest, other expenses, offset by depreciation), with far-out cash flow sufficiently discounted to reflect the higher risk of mining ore not included in reserves or measured and indicated resources: $3.13/share. If we were to value the company in line with its least expensive peer on a price to operating cash flow basis - Klondex - it would have an NEV of $739 million, or a market cap of $668 million ($4.10/share).

These figures are substantially higher than the current share price, and are based on conservative cash flow estimates. With that in mind, we think the downside has played out in Primero, and it now makes sense to accumulate shares.