In this article, we're going to look at some documents that we've obtained from the Texas Secretary of State and Texas Comptroller that we believe call into question American Capital's (NASDAQ:ACAS) ownership of its most marked-up investment, Service Experts/SEHAC Holding Corporation. Service Experts is a company that ACAS acquired from Lennox International (LII) in 2013, and since then, it has been carried in ACAS's investment portfolio at about 10 times its cost. Yet, Texas tax filings clearly show Lennox signing off on "Service Experts, LLC" tax forms as late as November 2014 - and Lennox executives are listed as officers and directors of Service Experts' subsidiaries as late as last week, according to the Texas Secretary of State and Comptroller.

In 2013, ACAS used shareholder money to buy Service Experts, a company with declining revenues and a cumulative operating loss of over $60 million for the two years prior to the acquisition. It then appears to just make a nominal $5 million additional investment into this business. Just nine months later, ACAS has marked up this asset by 5X. About a year after that, ACAS has listed the company at 10X what it paid for it.

Why is this a surprise? This newly marked-up entity was considered a dog by its previous owner just a few quarters prior to being bought out.

Additionally, an ACAS subsidiary, ACAM, granted (at zero cost to the employee) an unnamed employee ownership interest in one of its (ACAM) unnamed subsidiaries, and repurchased this interest for $140 million, three years later. One would have to carefully read an exhibit in ACAS's filings to find this tidbit of information, as it is hidden in ACAM's Consolidated Financial Statements, a separate exhibit from ACAS's annual filings. We believe ACAM structured this transaction to look far more like a financing than a compensation expense, and because ACAM was not consolidated through ACAS at the time, ACAS's shareholders may have had little to no idea what the impact of such a financial arrangement would be. ACAS's shareholders deserve an explanation. We believe that both of these examples illustrate just some of the reasons that the company's integrity, including the valuations of its investments, needs to be called into question.

We believe that if ACAS's auditor is forced to scrutinize the company's accounting practices, this may lead to a delay of its 2015 audit and possible restatements. Furthermore, if a final audit supports our belief that ACAS is using questionable accounting, then the value of the company to a potential activist will likely be diminished.

We started looking at ACAS when we noticed that Elliott Management had increased its stake in late November. With the fame that came from "the sovereign debt trial of the century" between Elliot and Argentina, we wanted to make sure that ACAS was a name we had on our radar. It was no surprise to us that shortly after getting involved, ACAS announced that it would be undergoing a strategic review and increasing its buyback in order to maximize shareholder value. The company's valuation looked conservative, and this seemed like a great way to unlock value.

Elliot Management disclosed on November 25 that it owned 9.1% of the company and that it had signed a non-disclosure agreement with the company - generally the type of agreement used when activists take a larger role within management or plan to participate in financings.

As we will show, we have found numerous questions related to compensation and management's integrity at ACAS that we believe need to be explained to investors. Our investigation is ongoing, but we felt that this was a reasonable time to release our findings.

Who owns and operates Service Experts, LLC?

In addition, now that Elliott has called into question management integrity, we wonder how one of ACAS's newest acquisitions, Lennox's Service Experts (listed as "SEHAC Holding"), can be valued at such an extreme multiple of what was paid for it, just a few years after being purchased.

In reviewing American Capital's portfolio, Service Experts, listed as SEHAC Holding Corporation (Service Experts Heating and Air Conditioning), stood out to us because its current fair value is listed at about ten times the cost that is listed for the Convertible Preferred Stock and about seven and a half times the cost listed for the common stock. This is the cost and fair value of SEHAC Holding Corporation as listed in American Capital's last 10-Q report.

SEHAC Holding Corporation seems to encompass both Service Experts, purchased from Lennox in 2013, but also several other acquisitions like 2014's acquisition of Engineering Excellence National Accounts. However, surprisingly, we noticed that the cost of SEHAC in ACAS's financials has not changed since Q3 2013.

Is it possible that SEHAC made acquisitions that justify such a significant increase in valuation? Yes, it's possible - but plausible? Not in our opinion. With only a $5 million increase in capital contributions and no disclosure of any significant debt, which would in theory lower equity value, we find it incredible that these acquisitions alone would have created over $100 million in value. So how is the value of SEHAC Holding Corporation rising so quickly - up almost fifteen-fold in about 12 quarters?

This prompted us to look at the nature of the transaction between Lennox and American Capital. We found the original press releases from both American Capital and Lennox disclosing the sale in early 2013. Neither press release discloses the terms of the agreement, but Lennox's press release does note that this is inclusive of a two-year equipment supply agreement.

American Capital immediately brought in Scott Boxer, pictured below, a former COO of Service Experts under Lennox to take on the role of the new CEO.

But this newly marked-up entity was considered a dog by its previous owner just a few years ago.

Lennox apparently had the goal of divesting of Service Experts because it was an underperforming business. Here is what Lennox said about the business in late September 2012 at a Bank of America conference:

Our final segment is Service Experts. We've seen weakness in this business through second quarter. Our revenue was down 13%. The disconnect between this business and our Residential Equipment business is Service Experts doesn't participate in residential new construction in any meaningful way and so they missed that bump.

It's also the dealers that are part of our Service Experts network have traditionally focused on premium product, the premium segment and that's the segment of the market that is not growing and they haven't been able to pivot as much as we would like to the entry-level products. We're taking cost actions and we're repositioning the business.

In addition, Todd Bluedorn, CEO of Lennox is quoted at the 2015 Wells Fargo Industrial conference as saying:

Yes. I mean, look other than my family, I think I'd sell anything at the right price or sort of walk away from problem, right. So, look, I got lots of confidence in our refrigeration business, but if we end up where it isn't performing. Look, Service Experts wasn't performing, we got rid of it; [Hearth] wasn't performing it, we got rid of it. So we're not married anything, we'll do what's best for the shareholder.

To find that the business is now being valued at seven to ten times cost less than three years later is astonishing. Could it be that just months after American Capital took over the business, it has supposedly swung back to prominence and is now capable of being valued at more than 10 times what was paid for it? We ask the auditors to tell us what the current net income margins and multiples are being used to value the company, that was bleeding money two years ago, today. What were they when Lennox sold the business two years ago? These paper gains seem highly questionable, given Service Experts' disclosed operating history.

Leading to even more confusion for us is that regulatory filings from the Texas Secretary of State show us that Lennox executives are still listed as officers and directors of "Service Experts, LLC" and "Service Experts Heating and Air Conditioning, LLC". Since Boxer is the CEO of Service Experts, we were obviously looking for his name to show up on all legal documents for the company. Here is a copy of results from the Texas Secretary of State for "Service Experts, LLC" for 2014 and "Service Experts Heating and Air Conditioning, LLC" for 2015. They both show Todd Bluedorn (Lennox's CEO) and David Dorsett (Lennox's VP of Tax) as officers and directors of the company.

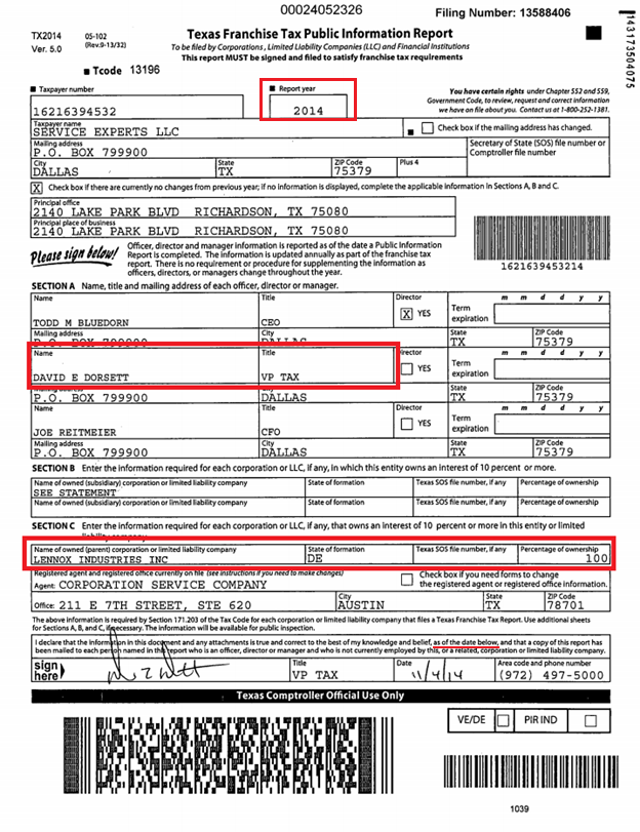

In addition, we were also able to locate the below Texas Franchise Tax Form from 2014 that indicates as of the time signed and submitted that Service Experts, LLC is still 100% owned by Lennox Corporation. Further, the names listed on this tax return are all current officers and directors of Lennox including, once again, none other than Todd Bluedorn, current CEO of Lennox.

Signed in November of 2014, this Texas franchise tax form indicates to us that Lennox is still the beneficial owner of Service Experts. Clearly, continuing to sign tax forms for a divested business seems sloppy on the part of Lennox. For ACAS, however, not ensuring that it has ownership of an asset that it subsequently marked up 10X is, in our opinion, grossly negligent, and if taken at face value of this tax document alone could suggest a fraudulent transaction. We are choosing not to just take this tax document at face value; however, we feel strongly that having this kind of lack of internal control only leaves us with these kinds of choices to consider.

We can figure that someone at Lennox may have made an error, but for there to be no corresponding filing from ACAS for Service Experts, we believe that this is clear evidence of an internal control failure. Functional internal controls would have meant an audit of the subsidiary, and any reasonable auditor may have required the filing of a franchise tax form. As well, any investment with such a substantial revaluation should receive heightened scrutiny from both auditors and directors, neither of which appears to have occurred here. When viewed alongside other issues we will talk about, we believe this should draw serious questions about the integrity of ACAS's disclosures.

We spoke to the Texas State Comptroller's office and inquired as to what the nature of Lennox filing this form in 2014 may be. It informed us that in the case of a merger, buyout, or acquisition during the tax year, only one company is required to file this form and it is the company that is the new owner by the end of the year - and as the date of the filing.

This leads us to ask several questions:

- Is it appropriate for American Capital to list Service Experts at a fair value of seven to ten times more than what it paid for it just three years after the deal took place?

- Why are officers and directors of Lennox Corporation still listed as officers of "Service Experts, LLC" in 2014 and "Service Experts Heating and Air Conditioning, LLC" in 2015?

- Why does it appear that the Texas State Franchise tax filing for "Service Experts, LLC" was prepared in late 2014 by Lennox Corporation and Lennox's VP of Tax?

- Why is Lennox Corporation listed as the parent company of "Service Experts, LLC" on a form signed by David Dorsett (Lennox VP of Tax) in November 2014?

- What is the nature of the two-year equipment supply agreement between the two companies, and what is the current status of Service Experts, Lennox Corporation and American Capital?

Are we being asked to take a massive leap of faith in believing all of this falls under the course of "normal" business for a company that's turning around a losing business?

This is the problem with fair value accounting in public companies - and especially companies with Board members who all know one another - they basically have carte blanche to do whatever they want.

No matter what the makeup of the preferred stock, we simply do not trust management or that this newly acquired company, held under SEHAC Holding alongside a new 2014 acquisition and possible others without any additional cost, could be worth ten times cost this quickly. This management team has a credibility problem, and we'd love to be privy to SEHAC Holding's corporate structure and financials, should ACAS want to disclose them.

ACAM lines a mystery employee's pockets with $140 million

American Capital Asset Management, LLC ("ACAM") is a wholly-owned portfolio company of American Capital ("ACAS"), as the company writes in its 10-K:

Our asset management business is conducted through our wholly-owned portfolio company, American Capital Asset Management, LLC ("ACAM"), a registered investment advisor under the Investment Advisors Act of 1940.

In this section, we want to look at what appears to be extremely robust compensation for an unnamed employee that took place at ACAM from 2011 to 2014. An unnamed employee was granted "membership units" that were entitled to a pro-rata share of any distributions from the company paid to its members. These units were priced at about $14 million when they were granted to the unnamed employee, and then at about $140 million when the company bought them back in two installments over the course of three years.

Who makes this kind of money in just three years? Aaron Rodgers? Kobe Bryant? And now an employee with no name at a subsidiary of ACAM? Who is receiving this compensation?

Here is an exact quote from American Capital Asset Management, LLC's (ACAM) 2014 annual financial statements (all numbers in 000s):

Note 14. REDEEMABLE NON-CONTROLLING INTEREST

In 2011, a subsidiary of the Company (the "Subsidiary Grantor") granted restricted units (the "Employee Membership Units") of the Subsidiary Grantor (the "Employee Grant") to one of its employees (the "Employee Member"). Under the terms of the Amended and Restated Limited Liability Company Operating Agreement of the Subsidiary Grantor (the "Subsidiary Grantor LLC Agreement"), holders of the Employee Membership Units are entitled to a pro-rata share of any distributions paid by the Subsidiary Grantor to its members, including during the vesting period. Additionally, the Subsidiary Grantor LLC Agreement allows the Employee Member to require the Company to redeem vested Employee Membership Units at a value defined in the Subsidiary Grantor LLC Agreement in certain circumstances that are under the control of the Employee Member. The Company also has the option to call the Employee Membership Units upon termination of the Employee Member. The grant was originally scheduled to vest ratably over 5 years. After fully vesting, the Employee Membership Units would have represented an 18% equity interest in the Subsidiary Grantor. The grant was initially valued at $13,709. There have been no other Employee Grants. In accordance with ASC 718, the Employee Grant is accounted for as a liability award. As such, the value of the Employee Grant is measured at fair value at the end of each reporting period. After the Employee Member bears the risks and rewards normally associated with equity share ownership for a reasonable period of time from the date the requisite service is rendered, which is estimated to be six months after the vesting date, the fair value of the vested portion of the Employee Grant, as measured six months after the date of vest, is reclassified to Redeemable Non-controlling Interests (the "Maturation").

In 2012, the Employee Grant was modified (the "2012 Modification") to accelerate vesting on a portion of the original grant that had not yet vested prior to the 2012 Modification. An expense of $36,929 was recognized in 2012 as a result of the 2012 Modification. At the date of the 2012 Modification, ACAM purchased Employee Membership Units representing an 8% membership interest in the Subsidiary Grantor from the employee for $55,898.

In 2014, the Employee Grant was further modified (the "2014 Modification") to accelerate vesting on a portion of the original grant that had not yet vested prior to the 2014 Modification. An expense of $19,657 was recognized in 2014 as a result of the 2014 Modification. At the date of the 2014 Modification, ACAM purchased Employee Membership Units representing the remaining 10% membership interest in the Subsidiary Grantor from the employee for $85,000.

During the year ended December 31, 2014, we recorded compensation expense of $30,742 attributable to the Employee Grant, including the expense associated with the 2014 Modification. During the year ended December 31, 2013, we recorded compensation expense of $15,377 (unaudited) attributable to the Employee Grant. During the year ended December 31, 2012, we recorded compensation expense of $63,225 attributable to the Employee Grant, including the expense associated with the 2012 Modification. We calculated the compensation expense recognized during the years ended December 31, 2014, 2013 (unaudited) and 2012 assuming there would be no forfeitures. Included in compensation expense were distributions of earnings to the Employee Member attributable to Employee Membership Units which had not yet matured on the date of the distribution of $1,781, $6,433 (unaudited) and $7,172 during the years ended December 31, 2014, 2013 and 2012, respectively.

Here is our interpretation of these events:

- We believe that we are looking at a transaction that has the purpose of compensating an unnamed employee to the tune of $140 million, but that the transaction may be comprised in a way so that it doesn't appear as compensation; but rather as a financing. Additionally, ACAM was not consolidated through ACAS at the time, so the company's shareholders may have had little to no idea what the impact of such a financial arrangement would be.

- In 2011, an unnamed subsidiary of ACAM granted one of its unnamed employee restricted units ("Employee Membership Units"), pursuant to which the employee was entitled to a pro-rata share of any distributions paid by the Subsidiary Grantor to its members - the employee also had the right to require ACAM to redeem (i.e. buy back/repurchase) these vested Employee Membership Units at a value defined in the Subsidiary Grantor in certain circumstances that are under the control of the Employee Member. If the Employee Membership Units were fully vested, they would represent 18% of the total equity interest in the Subsidiary Grantor. This grant was initially valued at $13.7 million.

- In 2012, the Employee Grant was modified and the vesting of the Employee Membership Units was accelerated. At the date of the 2012 Modification, ACAM purchased these Employee Membership Units that represented an 8% membership interest in the Subsidiary Grantor from the employee for $55.8 million.

- In 2014, the Employee Grant was further modified and the vesting was accelerated. At the date of 2014 Modification, ACAM purchased the remaining 10% membership interest in the Subsidiary Grantor from the employee for $85 million. There was no redeemable purchase made from ACAM in 2013.

- Thus, it appears one subsidiary of ACAM granted one employee of American Capital Asset Management 18% membership interest of that subsidiary in 2011, valued at $13.7 million back then (it seems like the holder of Employee Membership Units had costs of nil for this interest), and during the time period between 2012 and 2014, ACAM purchased back a total of $140.89 million in Membership Units from that employee holder.

- In other words, it appears the unnamed employee made $140.9 million from this non-controlling interest redeemable arrangement in three years and, again, that this transaction was not consolidated into ACAS's financials.

We are curious not only as to who this unnamed ACAM subsidiary's employee is, but which subsidiary of ACAM this is; the information doesn't appear to be disclosed in the company's 10-K. If we compare the two payments of $55.8 million and $85.0 million made by ACAM in 2012 and 2014 with the public company ACAS's net operating income for these two years ($397 million and $117 million, respectively), we see this purchase amount is 14.1% of the entire American Capital's net operating income in 2012 and 72.6% of it in 2014.

Let's face it; we are comparing this excessive compensation to ACAS because ACAM is a wholly-owned subsidiary of the company. ACAM can obscure the payments in its non-consolidated financials, but when we pull them out and compare them to the entire company's net operating income, we can see how big of an impact they'd be if found in an ACAS filing.

Had this been consolidated into ACAS, we may have seen in the company's last 10-Q that this sum of $140 million would represent the fifth largest investment for ACAS as a whole.

In the interim, we have found that ACAM has disclosed its Redeemable Non-Controlling Interests in its annual financials. For example, in the 2013 Annual Financial Results, it stated the "Redemption of Employee Membership Units" was $12.57 million, which is different from the $55.89 million stated in the "Note 13. REDEEMABLE NON-CONTROLLING INTEREST" in its own annual financials.

However, in its 2014 Annual Financials, it stated the "Redemption of Employee Membership Units" was $85 million, which is the same amount of $85 million stated in the 2014 annual financials' "Note 14. REDEEMABLE NON-CONTROLLING INTEREST".

The 2014 numbers appear to reconcile with the disclosed "Redemption of Employee Membership Units" line item while the 2012 numbers do not appear to match. It's unclear to us why the "Redemption of Employee Membership Units" number of $12.57 million recorded in the summary for FY 2012 was different from the purchase amount of $55.89 million in FY 2012 stated under the financial notes in the annual report, yet those two numbers match with each other for FY 2014.

Regardless, the amounts paid for redemption of the non-controlling interests in 2012 and 2014 are substantial when compared to ACAS's reported net operating income. Further, ACAM is the biggest investment in terms of fair value (based on ACAS's 10-K), so the company has a nice deal in being able to compensate via ACAM while not having to show these payments in its financials. Since ACAM is a wholly-owned subsidiary of ACAS, this non-controlling interest likely drew cash from the company's shareholders who appear to have paid this one employee upwards of $140 million over a three-year period.

Our questions are:

- Who is this superstar employee that ACAM delivered a risk free $140 million profit to over three years - the same three years that ACAS's net operating income went from $397 million to $117 million?

- What did this unnamed employee do over the course of three years to earn about $140 million? Would the performance of the company been worse without this employee; net operating income was already down about 75%.

- What subsidiary is involved in the issuance of these redemption units?

- Was this $140 million issuance of ACAS's shareholder money approved by the Board of Directors?

Loaning employees risk-free cash to buy ACAS's stock?

Moving on, we have cases of two ACAS subsidiaries apparently lending its employees cash to buy the company's common stock - and in one case indemnifying the employees financially should their investments turn sour.

European Capital Limited is a fund that is managed by European Capital Asset Management Limited. European Capital Asset Management Limited is a wholly-owned subsidiary of ACAM, which is a wholly-owned subsidiary of ACAS.

From our due diligence, it appears that European Capital made loans to unnamed employees for the purpose of them buying ACAS's common stock. Here's some interesting verbiage from European Capital Limited's 2014 Annual Financial Statements:

Note 11. Loans to Investment Manager Employees

European Capital made loans to employees of the Investment Manager in the form of non-recourse notes to purchase the common stock of American Capital from December 2005 to February 2007. The Original loans are denominated in US dollars, bear interest at the Applicable Federal Rate at the date of grant, and were repayable from April 2014 through March 2016. In 2010, the employees waived their right to exercise the written put option following which the shares associated with this arrangement can be sold by European Capital and used to repay the loans.

Following the employees waiving the right to exercise the put option, the fair value of these loans is determined by reducing the principal of the loans to the fair value of the shares of American Capital associated with this arrangement. The amount outstanding on these loans as of 31 December 2014 was €7,088 (2013: €6,006). As of 31 December 2014, the fair value of the shares of American Capital based on the closing market quote was €2,823 (2013: €2,645), which is recorded in other assets on the Consolidated Balance Sheets. The revaluation of the shares at the balance sheet date has resulted in depreciation of €432 (2013: appreciation of €348; 2012: appreciation of €692), which is included in net unrealised appreciation (depreciation) of investments in the Consolidated Statements of Operations.

The interest earned on these loans for the year ended 31 December 2014 was €266 (2013: €264; 2012: €259).

In March 2014, after agreement with the employees the loans expiring in 2014 were extended by four years and the interest rate was reset at 3.5%. Loans with maturity dates in 2015 through to March 2016 will be extended for a period of four years with the agreement of the employees.

Another example is the "French Stock Loan Plan", which is fleshed out in ACAM's 2014 Annual Financial Statements:

In 2005 through 2007, pursuant to a long-term incentive plan (the "FSL Plan"), ECAM made non-recourse loans (the "French Stock Loans") for the purchase of common shares in American Capital (the "American Capital Shares") by employees of its French branch (the "FSL Participants"). The French Stock Loans were collateralized by the American Capital Shares acquired by the employees and have original maturity dates of April 2014 through March 2016, which may be extended with the permission of the FSL participants. Loans that had original maturity dates in 2014 have been extended until 2018. The Company originally accounted for the FSL Plan as if it was a stock option plan. During 2009, the Plan was modified such that participants forfeited their rights to the American Capital Shares and transferred control of them to ECAM in return for the indemnification by ECAM of their future income tax liabilities, if any, arising from the forgiveness of loans made under the FSL Plan. The indemnification was made pursuant to indemnification agreements (the "Indemnification Agreements") entered into with the participants as part of the modification and was capped at a maximum of $15,309 (the "Original Indemnification Cap") in the aggregate. Proceeds on the sale of shares of American Capital Shares controlled by ECAM will be used to offset participant indemnification liabilities. In conjunction with and as a condition of entering into the Indemnification Agreements, an escrow account was established and was funded with $15,309 (the "Indemnification Escrow"), which represents the maximum potential liability as calculated on the date the Indemnification Agreements were executed.

The French plan differs from the European plan in that it actually indemnifies employees from losses in the case where loans are forgiven, creating a tax liability.

In the case of European Capital, the loans were initially repayable from April 2014 through March 2016, but it appears that European Capital has extended the dates of the maturities - perhaps while waiting for ACAS's stock to appreciate?

What type of a company enters into an agreement with its employees wherein it loans them money and indemnifies them financially against losses in purchasing its parent corporation's common stock?

Why not structure this compensation as normal stock options? Could it be because this type of plan creates a significant expense and causes dilution?

Most importantly, we believe investors need to ask: How much loan exposure does ACAS have to its own stock price?

In Elliott's letter to the company, it raises points about the board's integrity and management's ineffectiveness. Here's the five concerns that Elliot Management raises in its letter, with our emphasis in bold:

- Ineffective management drives low valuation. Median analyst price targets for ACAS point to a 10% discount to NAV, compared to a 48% and 7% premium for comparable internally managed BDCs and externally managed BDCs, respectively.

- Poor capital deployment. ACAS has continued to deploy capital into highly illiquid and risky assets instead of generating riskless accretion through share repurchases.

- Directors lack qualifications to oversee management. With an average Board tenure of 15 years and limited professional investment experience, the Board lacks the relevant expertise to govern the behavior of the investment team and hold management accountable.

- Compensation that rewards failure. ACAS has consistently paid excessive compensation for poor performance, as evidenced by the Company receiving "F" grades in Glass Lewis' pay-for-performance model for each of the last four years (and no better than a "D" since 2008).

- Excessive overhead. ACAS's compensation expense ratio is one of the highest compared to publicly-traded alternative asset managers.

The above-mentioned examples of compensation and loans to employees are two perfect examples of what Elliot is talking about.

Strategic review may be at risk

We have some very real concerns about management's integrity and ACAS directors' abilities to be independent. We share the same view as Elliot, who comes right out and says that the company has numerous major problems. The only difference is that we see these major issues as a reason to be even more cautious, as opposed to taking an investment in the company and trying to somehow unlock value. Why do we take the opposite stance as Elliot Management? Because we believe that some of the problems may lie in the underlying portfolio, and in the event ACAS can't continue to raise money or has ACAM called under immense scrutiny, it may cause a disaster that cannot be repaired.

What we have here are a litany of questions that we believe need to be answered in detail before ACAS can move forward with its strategic review.

- Who was the unknown employee that made $140 million over the course of three years?

- Why did a subsidiary of the company issue loans to employees for the purposes of buying ACAS's common stock versus issuing stock options?

- With the company's biggest shareholders admitting management's credibility is shot, how can we trust SEHAC - or any other portfolio company's - fair value?

We have a significant amount of due diligence that we still would like to undertake, but we believe that questions raised in our report need to be examined very closely by potential investors.

We also believe that this new evidence will likely shine a new light on the company's ongoing strategic review process, as we believe potential acquirers of the company (as well as Goldman Sachs (GS), which is working with the company) will need to partake in significantly more due diligence than they already have. Further, we believe this new evidence will delay any type of acquisition or strategic alternatives for the company well into 2016, as all parties will need to be very comfortable with all of the facts before moving forward. We doubt the company will be able to issue a decision on its strategic review by January as it has planned.