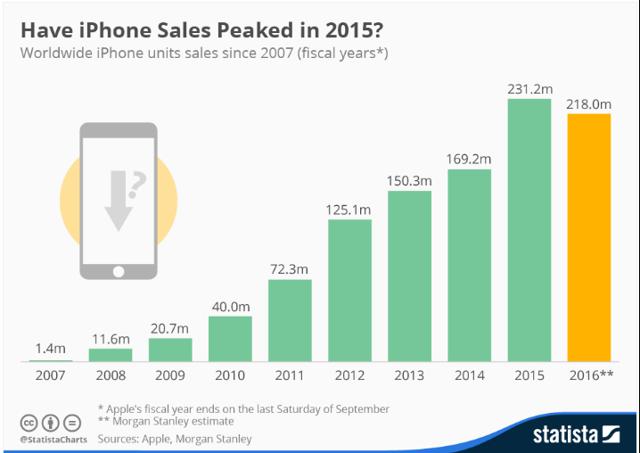

Apple (NASDAQ:AAPL) Q1 sales are sagging and Q2 may well be an outright decline year-over-year. Digitimes reports Apple suppliers cutting production 5%-10% below earlier schedules.

Many Apple watchers have begun to conclude that iPhone sales have peaked.

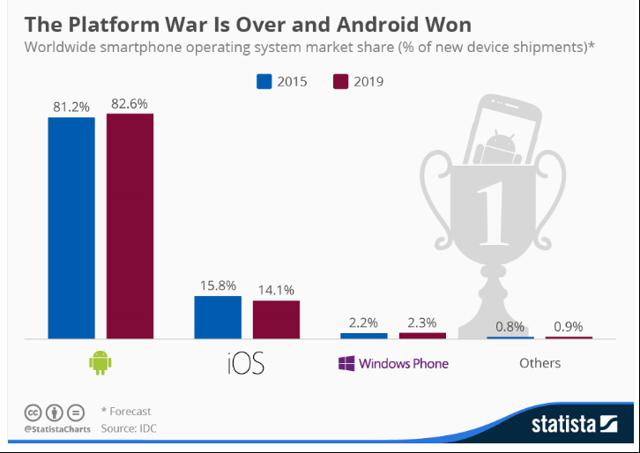

Some go so far to say that the platform war is over and that Google (GOOG) (GOOGL) and its Android OS platform have won.

That seems likely. The strength of a platform can be measured in a number of ways:

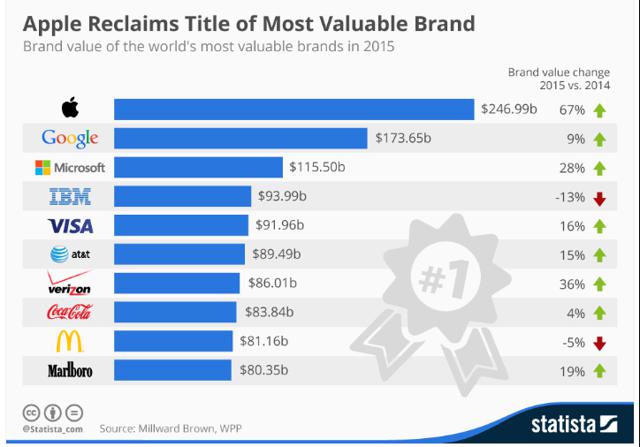

- Strength of brand

- Number of users

- Size of applications library

Apple continues to have the strongest brand with Google and Microsoft (MSFT) in second and third position. That brand strength has been the linchpin of Apple's success, in my opinion, and cannot be ignored as a strong foundation for continued success.

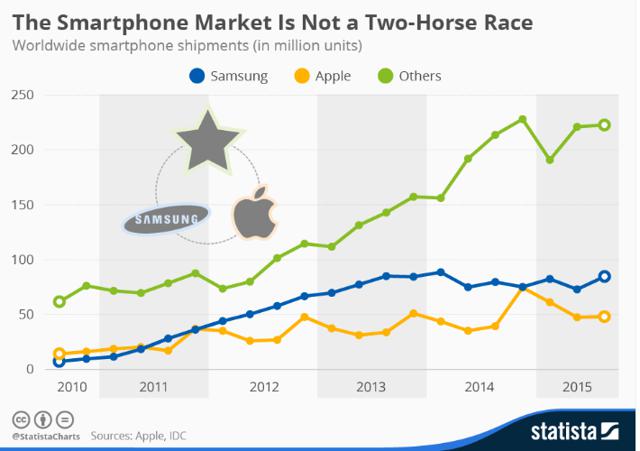

Notwithstanding the strength of the Apple brand, it is clear that Android has become the de facto mobile standard with over 80% of smartphone shipments using Android OS. Of course, Android is like Intel (INTC) was in PC's in that it is not a smartphone brand but rather provides a smartphone component. By allowing any vendor to use its Android OS free of charge, Google has increased competition in the smartphone space and the war is no longer Apple versus Samsung (OTCPK:SSNLF) but more correctly Apple and Samsung versus everyone else. Moreover, "everyone else" is winning.

Does this remind anyone of the PC wars of the 1990's? First it was Apple versus IBM (IBM) and, in no time, it was Apple versus everyone else with "Intel Inside" commanding the lion's share of the PC vendor's offerings primarily running Microsoft's Windows OS. The result was Microsoft and Intel holding a commanding almost 90% of the PC market with Apple stuck in a niche.

Mobile seems to follow the same path, with Qualcomm (QCOM) providing the application processors and Google providing the OS and Apple in danger of finding itself a niche player using its own OS and AP's. The game is now between Apple and Google with Microsoft and Intel largely absent with neither having a meaningful share of the mobile market. The real growth in smartphone competition is a plethora of Android assemblers whose share of market is growing rapidly at the expense of both Samsung and Apple.

The competitive advantage of Apple's brand is today overwhelmed by the sheer number of Android users. In addition to its powerful brand, Apple's early success was based on a rich and fast growing library of applications unmatched by any other smartphone supplier. It was the absence of such a library that spelled the end for BlackBerry (BBRY), and threatens to do the same to Microsoft's Windows phone. BlackBerry has now introduced an Android OS phone as a last-ditch effort to survive while Windows is attempting a bold differentiation based on Windows 10 for all form factors hoping that will appeal to developers.

The future for Android and iOS is to some degree going to be a function of their respective applications libraries. The question is not only which is stronger today but also can either step out ahead and command the support of the worldwide developer community. I think the answer to both questions is Android.

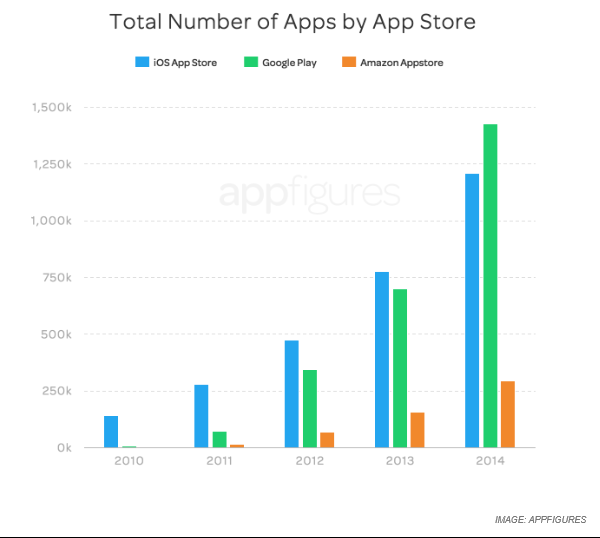

During 2014, Google Play passed Apple's App Store in the sheer number of available apps.

Source: Mashable.com

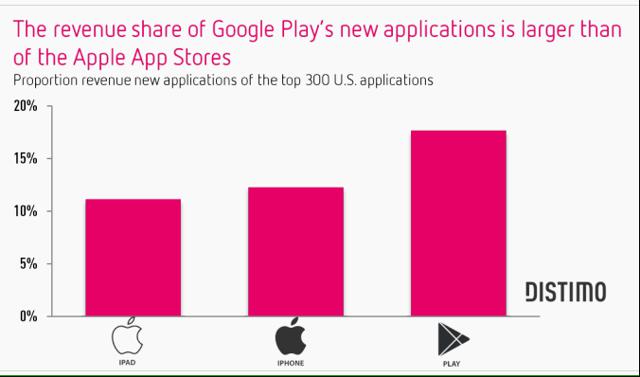

Developers still make more money on the App Store than Google Play. That may be changing. New applications on Google Play represent more revenue than do new applications on the App Store.

Source: Tech Crunch.com

The war will rage on and 2016 should make it an interesting race. Digital Trends gives the edge to Android across a wide range of metrics but calls it close. Interestingly, the Digital Trends survey credits Microsoft Windows mobile OS with high scores on user interface and basic phone functions, limited primarily by its relatively weak applications library.

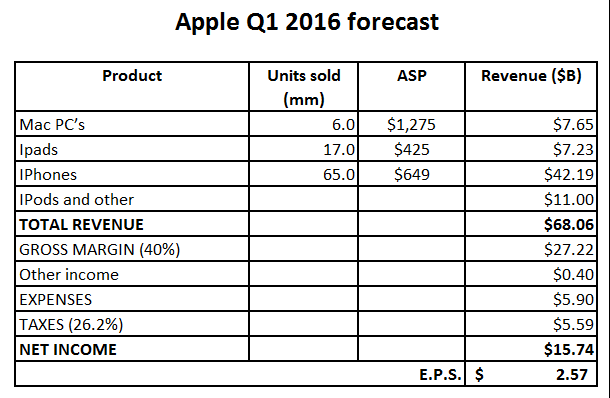

What seems clear in Apple's key Q1 for 2016 is that iPhone sales are lagging and more than likely will surprise to the downside. My estimates for the quarter put iPhone sales at 60-65 million and that may be aggressively high. The super cycle created by the iPhone 6 in 2014 has passed and in my opinion pulled demand from the current year. The risk of such an event was well assessed by Tyler Durden in an excellent article in August 2015.

For Q1 I foresee sales of $68 billion and net income of about $16 billion. For any other company these would be stunningly good results but for Apple, they represent the onset of declining performance, a meaningful decline from sales of $75 billion and net income of $18 billion last year. The stock will surely follow lower.

I am short Apple.