Scott's Investments provides a free "Dual ETF Momentum" spreadsheet which was originally created in February 2013. The strategy was inspired by a paper written by Gary Antonacci and available on Optimal Momentum. Antonacci's book, Dual Momentum Investing: An Innovative Strategy for Higher Returns with Lower Risk, also details Dual Momentum as a total portfolio strategy.

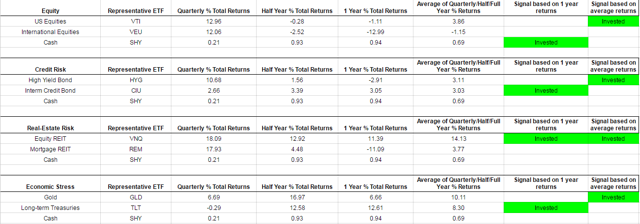

My Dual ETF Momentum spreadsheet is available here and the objective is to track four pairs of ETFs and provide an "Invested" signal for the ETF in each pair with the highest relative momentum. Invested signals also require positive absolute momentum, hence the term "Dual Momentum".

Relative momentum is gauged by the 12 month total returns of each ETF. The 12 month total returns of each ETF is also compared to a short-term Treasury ETF (a "cash" filter) in the form of iShares Barclays 1-3 Treasury Bond ETF (SHY). In order to have an "Invested" signal the ETF with the highest relative strength must also have 12-month total returns greater than the 12-month total returns of SHY. This is the absolute momentum filter which is detailed in depth by Antonacci, and has historically helped increase risk-adjusted returns.

An "average" return signal for each ETF is also available on the spreadsheet. The concept is the same as the 12-month relative momentum. However, the "average" return signal uses the average of the past 3, 6, and 12 ("3/6/12″) month total returns for each ETF. The "invested" signal is based on the ETF with the highest relative momentum for the past 3, 6 and 12 months. The ETF with the highest average relative strength must also have an average 3/6/12 total returns greater than the 3/6/12 total returns of the cash ETF.

Portfolio123 was used to test a similar strategy using the same portfolios and combined momentum score ("3/6/12″). The test results were posted in the 2013 Year in Review and the January 2015 Update.

Below are the four portfolios along with current signals:

Return Data Provided by Finviz

As an added bonus, the spreadsheet also has four additional sheets using a dual momentum strategy with broker specific commission-free ETFs for TD Ameritrade, Charles Schwab, Fidelity, and Vanguard. It is important to note that each broker may have additional trade restrictions and the terms of their commission-free ETFs could change in the future.

Disclosure: None