If you don't listen in to earnings calls or read the transcripts, the Full House Resorts (NASDAQ:FLL) one is a great one to start with. CEO Dan Lee doesn't use much corporate speak and goes into a lot of detail on what the company is doing exactly. He talks about how the company wants to install a swimming pool and the problem it encounters with sand, he talks about customers having to walk around a building due to construction and the number of reindeer they ordered for the Christmas decoration and why they already put it up well in advance of Christmas.

After several quarters where Mr. Lee and his team implemented lots of small and not very costly or time-consuming improvements and Full House Resorts started doing better, they are now moving on the bigger improvements. No more easy money falling to the bottom line, and the quarter disappointed a little bit given how spoiled I was getting.

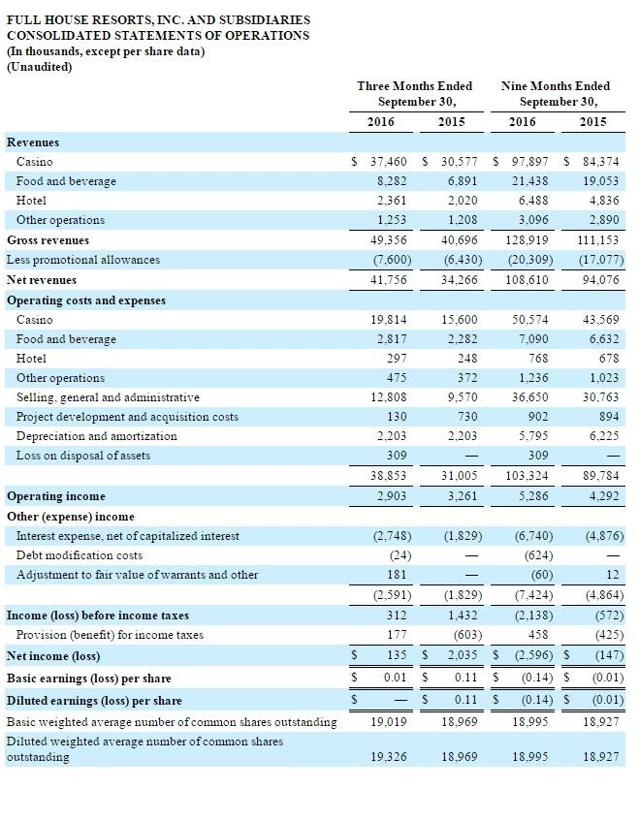

Casino earnings are up quite a bit year over year, but that's including an acquisition. If you back it out, they are slightly down, although there were a few credible explanations like a one-time positive last year and an especially bad month on the Casino floor. With lots of small bettors playing tables and slots that's unusual, but I guess it can happen.

After the recent $5 million rights offering, it is looking to spend $10 million on a number of improvements that should generate very good returns by improving the properties. In the words of the CEO (emphasis mine):

Yes, the returns, each of these obviously we had returns which we shared with our Board, and we'd share them with you too, but our lawyers would have a heart attack, and we like our lawyers, so we don't want to do that. But I think the worst of them was about a 20% per year return cash-on-cash, and the best of them were probably higher than that and some potentially higher, but a lot of it is guesswork. Like the ferry boat, for example, I think has a very high return. But we're going to put a little ferry boat in to carry 10 cars, it goes across the Ohio River to a bunch of people that today takes them almost an hour to drive here, and with the ferry boat takes three minutes. And so it's pretty clearly a plus, but trying to figure out how big a plus you can get numbers all over the place. I mean, that thing could pay for itself in a year, or three years, or five years.

If returns are close to the low end of the range projected by Lee, the company is now well on its way to achieve $25 million in EBITDA. A very interesting prospect given its current Enterprise Value of $130 million. The CEO also reiterated that target:

If you go back to last quarter, Chad, we talked about hitting a $25 million EBITDA figure in the next couple of years, and we haven't really wavered from that thinking. We want to hit four times total leverage. And if you think about net leverage, we're a turn less than that. We'd be at somewhere in the ballpark of three times net leverage if we hit $25 million of EBITDA. And we feel very good about our chances of hitting $25 million.

It still seems credible to me Full House Resorts can achieve $25 million in EBITDA especially given the improvements it is making with bars, entrances, swimming pools, renovations, Christmas decorations, installing RV parks and a ferry.

When it gets there, the company will be able to deal with 50% of its debt that it pays 13.25%+ interest on. This debt is now eating up a large slice of each quarter's cash flow, but that's going to change and the equity will look much better by that time.

Then, there's some optionality with Full House trying to move excess gaming capacity from the Rising Sun (about 2,000 positions) elsewhere in the state. The company figures it can put in another 1,200 slots or tables in another location if it is permitted to do so under its current license but at a different location. We'll see if it happens.

Not every quarter can be a great success, but things are still happening under the new management team, and I keep betting on it.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.