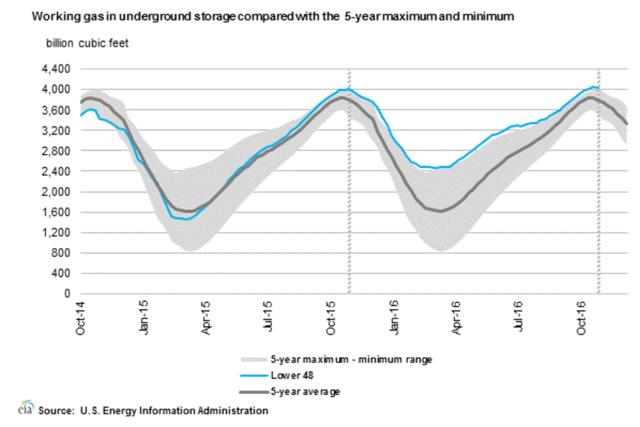

The EIA reported an injection figure of -2 Bcf, bringing the total storage number to 4.045 Tcf. This compares to the +9 Bcf build last year and the -45 Bcf build for the five-year average.

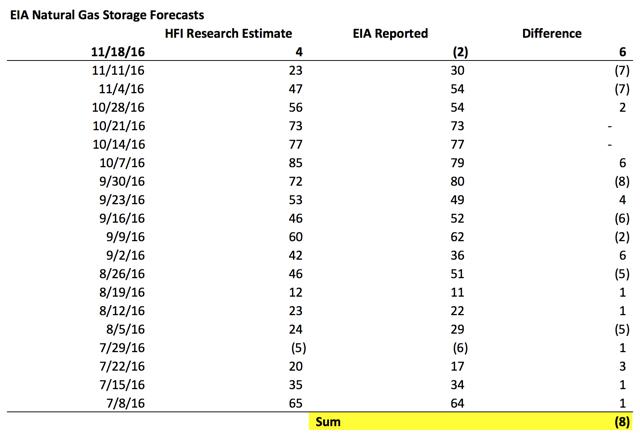

Going into this report, SNL did a survey among traders and analysts that showed a range of 0-11 Bcf with an average of +7 Bcf. We expected a +4 Bcf build and were off by 6 Bcf.

Source: HFI Research Natural Gas Injection Forecast Track Record

Since we started publishing injection forecasts, we have been off by 8 Bcf vs. the EIA estimate. Notice that we were underestimating storage for the last two weeks, and, historically, our estimate has one way or another reverted itself. Could we get another bullish downward surprise next week? It's certainly possible.

Looking at this report, the injection figure came in at our lowest forecast. The deviation from the consensus estimate points out to us that this storage report was more of a catch-up than actual fundamentals, as EIA might've overstated injections in the previous two reports. Nonetheless, this report was supposed to be the last injection report and propel us to an all-time high in storage, but that didn't turn out to be the case.

Next week's storage report is going to be much healthier. The current range is for a draw of -48 to -55 Bcf. This would compare to -53 Bcf last year and -18 Bcf for the five-year average. The five-year minimum is -53 Bcf, so we could see the five-year minimum beat next week. Looking at demand this week, heating demand is finally picking up and overall demand is currently around 87 Bcf/d.

U.S. gas supplies picked up this week as Canadian gas imports surged higher. The AECO basis differential widened again and currently sits around C$0.73/Mcf. U.S. gas production, however, remains pressured below 71 Bcf/d as shut-in wells are slowly being brought back online. We haven't seen any meaningful increases to U.S. gas production.

Overall, this was a positive storage report. Storage draws will now accelerate in the coming weeks as our injection forecasts currently indicate. If you would like to see our forecasts four weeks in advance, please sign up here.