ipopba

Dear Partners & Friends:

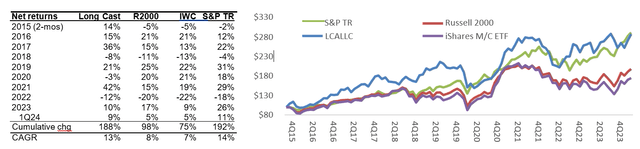

For the 1Q24 quarter (ended March 31, 2024), cumulative net returns improved 9%. Since inception in November 2015 through quarter end 1Q24, LCA returned a cumulative 188% net of fees, or 13% CAGR. As a backdrop to returns, on a cumulative net basis, since inception we comfortably exceed two widely used representative indices for passive small company investing, the iShares MicroCap ETF (IWC) and Russell 2000 Index (RTY), and are roughly in line with the S&P. Past performance is no guarantee of future results. Individual account returns may vary.

Whether returns are up or down, ours is not a quarter-to-quarter approach. Foundational to Longcast Advisers’ strategy is fundamental analysis. We evaluate individual companies’ financial statements, corporate strategies, and industry characteristics to develop a reasonable and competent set of expectations on long term cash earnings. Where we see an attractive multiple relative to expected long-term earnings growth, an opportunity may exist. This “old-fashioned” method of investing has little to do with “the market” as discussed every 15-minutes on the radio and covered 24/7 on the bizfotainment networks, notably but not exclusively because the small companies we invest in are barely included in any indices.

I’m grateful to have clients that appreciate our approach and welcome the continued interest from other knowledgeable and experienced investors who share the view that concentrated investing in well-researched and well-understood companies offers compelling opportunities for high returns.

Portfolio Holdings

MTRX, PESI and QRHC were the biggest contributors to returns in the quarter. The largest detractors in the quarter were CCRD, RELL and ENVX. During the quarter, we added to our two largest holdings, MTRX and CCRD and reduced our positions in DAIO and PESI. Same as last quarter, our top five holdings at quarter end were MTRX, CCRD, QRHC, PESI and RSSS, and same as last quarter, our concentrated ownership of these companies means price changes in these stocks will have an overweight impact on our overall portfolio.

Though it remains a top holding, I’ve lightened our position in PESI, hewing to the investment philosophy that one should buy the page 16 story and sell the cover story. Late February saw a Barron’s cover story on PFA’s i.e. “forever chemicals.” Two weeks later, on PESI’s year-end conference call, the company announced that it had discovered a safe and cost-effective solution for getting rid of them.

It’s the kind of announcement that can really get investors hearts aflutter.

So why did I sell some? With an R&D budget, just $2.5M total over the last four years, it doesn’t seem reasonable that PESI has solved an allegedly $100B issue, or were their solution indeed scalable, how defensible it might be. On the same conference call, the company forecast a paltry 1H24, driven by a gap between the completion of large projects and the beginning of new ones. Anticipating a potentially negative market reaction to this, I wanted to preserve capital to add more shares later.

This short-term investment decision is heavily biased by our recent experience with CCRD which I did not sell ahead of a well telegraphed decline in earnings. Maybe I am “fighting the last battle.” Investing is full of uncertainty and best guesses, and every decision is its own hypothesis. In a few weeks, when PESI reports 1Q24 earnings, we will know the outcome. I generally operate under the assumption that doing nothing is usually the best option and I probably will end up there again, but it made sense at the time. PESI remains a large position commensurate with what, I think, will be a large long-term opportunity beginning in 2025.

I continue to add to CCRD, whose stock may remain pressured for some time due to the cloud of uncertainty around the Apple / Goldman “situation” and the likelihood that it will be “kicked out” of various indices as its market cap has fallen below $100M. Even as near-term financials are pressured by the repriced Goldman contract, I continue to see value in this company, which processes the most successful credit card launch in history. I believe we are at or near the trough in earnings and should see growth once the repriced Goldman contract laps in 2H24.

Furthermore, at ~$11, it is trading 3x non-Goldman revenues, not a terrible price for a small software company with organic growth ahead. Viewed through this lens, you get for free the ~$25M in annual contracted revenues from Goldman through ’25 and ’26 plus an option that Apple (AAPL) doesn’t switch processors even if it switches banks. Importantly, at some point this will be resolved, and the market seems to have already priced in the worst-case outcome (cogent that it can always get worse).

Finally, I’ve reestablished a small position in SNES at about $0.75 after selling it last year for tax loss harvesting in the split adjusted $4 range. This NYT article came across my desk (shared by my 17-year- old son; he’s paying attention!) indicating that the NYC City Council would vote on a 10-block pilot study of rat contraceptives. The Bill is now in Committee (can be read here) and may be brought to a vote as soon as June. The pilot could provide real-world evidence on the market acceptance and product effectiveness of the new “Evolve” soft bait, which is easier and cheaper to deploy than the legacy ContraPest product.

In Conclusion: On Evolving as A Portfolio Manager

In the wake of the 1929 stock market crash, and to improve the fairness and transparency of exchanges and markets, Congress passed a series of laws including three of note for my business: The Securities Act of 1933 (why we have 10K’s and S-1’s), the Securities Act of 1934 (why we have the SEC) and the Investment Adviser Act of 1940 (why as a Registered Investment Adviser, I must file and annually update a Form ADV.)

The Form ADV is a multipart-standardized RIA disclosure of self-reported facts (types of assets managed, regulatory actions taken, legal and or bankruptcy matters, etc). It includes in Part 2, a “plain English” narrative about the institution, also called a “brochure”, which must be provided to prospective new clients, and existing ones annually.

Were you to look at Long Cast Advisers’ Part 2A brochure, which I utilize as a sort of owner’s manual for clients, you would observe a structure similar to the one described in this SEC document, which lays out the requisite order and content of the brochure, almost like a Haggadah describes a seder, if you’ll please tolerate the seasonal reference. And like a long seder, our brochure has a little more elaboration, especially for Item 8 “Methods of Analysis, Investment Strategies and Risk of Loss”.

Recently, a prospective client, who had read the Long Cast Adviser ADV Part 2A “brochure”, asked questions specifically about the part where I described the types of companies I typically invest in. They wanted examples for each bucket - Compounders, Turnarounds, Control Situations, etc. – and the result.

A think it’s a fair question and I appreciated the opportunity to reflect more closely on what actually works for me,` and what doesn’t. It led to some changes to the “owner’s manual,” none material from a regulatory standpoint, but demonstrating some evolution and maturation as a portfolio manager that I wanted to share.

This screenshot from my 2016 FORM ADV, my first full year as an RIA, was essentially the lead paragraph from the “Methods of Analysis …“ section, up to and including last year. I think it aptly described my aspiration on investing for the first eight years of my firm:

It’s a perfectly fine comment, but not a great heuristic. Whatever returns I’ve generated to date weren’t because we owned “great companies.” They were because I’d properly anticipated a change in a company’s operations before these changes showed up in the income statement.

For example, I don’t think CCRN is a “great company.” The initial catalyst for buying it was a positive management change (Kevin Clark part deux, 2019-2022) followed by COVID, where it didn’t tax my brain much to anticipate a change in the slope in demand for nurse staffing, (even as it initially dropped off when procedures stopped).

I don’t think MTRX, our current number one holding, is a “great company.” I think it’s a well-run cyclical E&C, going through a robust cycle with tailwinds from post-COVID pent-up demand, profitable traditional energy and government subsidized new energy.

On the flip side, I still think CCRD is a “great company,” and where has that gotten us? And don’t get me started on our two biggest detractors since inception, the definitely not great CTEK and PSSR (insert “vomit emoji”). These failures call to mind the great Cormac McCarthy line (delivered here by Javier Bardem): “If the rule you followed brought you to this, of what use was the rule?”

I have shared in these letters a few important lessons I’ve learned managing our portfolio over the last eight years, including: The importance of IRR, the need to change one’s mind, and the inappropriateness of didacticism. I hope to always be learning, though as a caveat, I must add, this means I’ll always be making mistakes, hopefully not the same ones twice and hopefully, I’ll keep them inexpensive.

The most recent lesson is that I am not looking for “great companies” anymore. I am looking to generate wealth by owning companies with stocks that can double in five years. Quoting from Item 8 of the ADV:

“The purpose of the research that precedes an investment (and continues throughout our ownership of it) is to have a foundation of knowledge and information to support owning a business regardless of what the market tells us about its value, precisely because the right time to invest is when the market insists we are wrong.”

The research provides an opportunity to establish an independent view on three overarching questions:

What is changing that the company isn’t getting credit for, by me or the market? What is the market misinterpreting that I more fully appreciate (and vice versa)? What does success mode look like and does the company have the management, strategy and balance sheet to get there?”

I think this is a better description of what I want to be doing. Coincidentally, because it's more tangible and measurable, I think it may increase our ability to find great companies because great companies consistently exceed reasonable expectations.

I remain committed to building a durable and sustainable business based on a repeatable investment process and intelligent capital allocation. My entire investible net worth is invested alongside yours, which according to this article from Barron’s, is quite rare in institutional finance. I remain grateful to have clients (by design) aligned with my long term, small company centric and research-intensive focus, and I welcome the continued interest from individuals and institutions as I patiently grow the business.

Sincerely,

Avi Brooklyn

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.