In a previous article related to American Electric Power (NASDAQ:AEP) posted on February 27, 2012, a bull-put credit spread was considered for American Electric Power following a sharp drop in the price of the company's stock as a result of the Public Utilities Commission of Ohio rejecting the company's rate settlement agreement.

In the intervening time, the company's stock price has traded sideways for the most part as shown below:

In response to the rejection by the Public Utilities Commission of Ohio, American Electric Power is filing a modified Electric Security Plan with the Ohio regulator. The results of the revised filing are unknown at this point.

The bull-put credit spread considered in the previous article was a 2012 April 32/35 which had a potential return of 6% (38.4% annualized). The bull-put credit spread position realized the full 6% return as of April options expiration, as the $38.33 stock price was above the short put strike price of $35 at expiration.

With American Electric Power's upcoming ex-dividend date on May 8, 2012, entry of a protected covered call will be considered for the company, as a protected covered call enables receipt of dividend payments and also protects from a significant drop in stock price. A protected covered call may be entered by selling a call option against a stock and using some of the proceeds to purchase a protective put option.

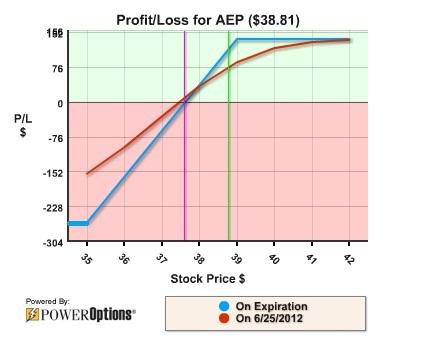

Using PowerOptions tools, a protected covered call position was found with a 3.3% return (6% annualized) and a maximum potential loss of 7%. The potential return and the maximum potential loss assume receipt of $0.94 worth of dividends during the holding time. American Electric Power's current dividend yield is around 4.9%. The specific call option to sell is the 2012 August 39 at $0.75 and the put option to purchase is the 2012 August 34 at $0.30. A profit/loss graph for one contract of the protected covered call is shown below:

For a stock price below $35, the value of the protected covered call remains unchanged (at expiration). Additionally, if the price of the stock increases to around $45, the position can most likely be rolled in order to realize additional potential return.

The protected covered call for American Electric Power looks like a wise choice at this point, as the company may have some serious capital expenses to make in the future in order to convert from coal to other means of electric power generation. The Review of World Energy, published by BP (BP), shows that the US had the world's largest increase in natural gas consumption in 2011, growing by 5.6% to a new record high. Yet coal's share of monthly power generation dropped below 40% in November and December 2011, for the first time since March 1978, according to the US Energy Information Administration. This is a worrying sign, says Nick Atkins, president and CEO of American Electric Power , as reported in a Columbus Dispatch newspaper article. Addressing the US Chamber of Commerce on April 26 2012, Mr Atkins said that the federal government should ease up the speed with which it is transitioning out of coal. Worried by the significantly increased demand for natural gas, combined with its greater availability and volatile price history, he added 'Betting on just one fuel to power our energy future isn't smart'. EPA requirements to further reduce emissions by 2015 could put a strain on the economy, increase energy prices and put the reliability of the electricity grid at risk, he said.

Coal-reliant AEP makes no secret of the fact that it is lobbying for an extension of the EPA's compliance deadlines to avoid risky premature closure of some coal-burning plants and expensive retrofits in others. The Center for Responsive Politics says that AEP spent over $10 million on lobbying the federal government in 2011. However, as CEO of one of the nation's largest electricity generators and largest transmission system owner, Nick Atkins is a man whose viewpoint cannot be ignored. AEP has over 37,000 megawatts of generating capacity, almost 39,000 miles of transmission network, and 5 million customers in eleven states. Its main operating companies, in descending order of contribution to earnings, include Ohio Power (by far the largest with a 36% contribution), Appalachian Power (Virginia and West Virginia), Southwestern Electric Power Company (Arkansas, Louisiana and east Texas), AEP Texas, Indiana Michigan Power, Public Service company of Oklahoma, and Kentucky Power.

While its subsidiaries are still mainly regulated utilities, American Electric Power's real competitors are few. They include large, diversified power generators that may have traveled further along the path towards cleaner and renewable energy, companies like First Energy(FE), Duke Energy (DUK), Entergy (ETR), Exelon (EXC) and Pacific Gas & Electric (PCG). In de-regulated Texa,s AEP faces challenges from NRG Energy (NRG), and it will shortly have new competitors in Ohio.

In 2011 AEP had revenues of over $15 billion, net income of $1.94 billion ($4.02 per share) and over $52 billion in assets. Energy sales in 2011 were 29% residential, 28% industrial, 24% commercial and 19% wholesale. Since 2006 it has achieved a 5% reduction in CO emissions and a 51% reduction in both sulfur dioxide and nitrogen oxide emissions. (Fast Facts) First quarter earnings for 2012 were released on April 20. Record mild weather throughout the regions served by AEP had reduced demand, producing a slight fall in revenue ($3.6 billion compared with $3.7 billion in comparable 2011) although GAAP earnings grew to $389 million ($353 million in 2011). Continuing growth in industrial demand offset the weather-induced low commercial and residential demand. During the quarter AEP completed the acquisition of Chicago-based electricity retailer BlueStar Energy and announced a competitive transmission project joint venture with Great Plains Energy (GXP). Given the continuing uncertainty surrounding the transition to competitive electricity distribution in its largest profit contributing state, Ohio, AEP's management has put 2012 earnings guidance on hold, retracting its previous indication of $3.05 to $3.25 per share. (Q1 2012 earnings release)

Nick Atkins made it clear, during the Q1 2012 earnings call, that AEP is still committed to moving into a competitive environment in Ohio, while looking to its continuing regulated businesses to provide the backbone for its target of 4-6% long-term earnings growth. Security bonds to the value of $800 million were issued in March 2012, with proceeds to be used in funding the current transition to competition in Texas, including the capital program at AEP Texas. Meanwhile, the new clean coal power plant in Arkansas is about 90% complete. CFO Brian Tierney commented on a number of positive factors, including the impact of the company's strict spending discipline and the fact that GDP growth in AEP service territories in Q1 2012 is estimated at 4.4%, compared to estimated total U.S. growth of 2.2%. Employment growth in AEP's areas was also higher, and there are hopes that the improved local economic outlook will translate into increased electricity sales in the near future. The company's coal needs for 2012 are fully hedged while requirements for 2013 are about 80% covered, and net liquidity at the end of the quarter was about $3 billion, he said.

Despite the problems in Ohio, AEP's earnings are partly safeguarded by its geographic diversity and its mix of regulated and competitive markets. Increasing pressure from the federal government for faster emission reduction will require the company to make heavy capital expenditure outlays over the next few years, given its current heavy commitment to older, coal-fired plants, but its basic platform is strong. Investors can watch the way in which it manages the competitive transition in Ohio as an indication of its likely resilience. Until the company's future earnings potential is more clear, an investor can take advantage of a protected covered call in order to take advantage of the company's dividends, yet remain protected from downside movements in the company's stock price. With the protected covered call, an investor can receive dividend type income, yet remain protected.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.