You have to be bullish on the long-term prospects of CenturyLink Inc (CTL) before you even consider implementing this strategy as there is a chance that the shares could be assigned to your account. If you are not bullish on this stock, you would be best served by looking for alternative plays.

Selling naked puts is a great way to purchase shares in companies you like at a predetermined price. In essence, you are getting paid to put in a "limit order."

Benefits associated with selling puts

- In essence, you get paid for entering a "limit order" for a stock or stocks you would not mind owning.

- It allows one to generate income in a neutral or rising market.

- Acquiring stocks via short puts is a widely used strategy by many retail traders and is considered to be one of the most conservative option strategies. This strategy is very similar to the covered call strategy.

- The safest option is to make sure the put is "cash secured." This simply means that you have enough cash in the account to purchase that specific stock if it trades below the strike price. Your final price would be a tad bit lower when you add the premium you were paid up front into the equation. For example, if you sold a put at a strike of 20 with two months of time left on it for $2.50; $250 per contract would be deposited in your account.

- Time is on your side. Every day you profit via time decay as long as the stock price does not drop significantly. In the event it does drop below the strike you sold the put at, you get to buy a stock you like at the price you wanted. Time decay is the greatest in the front month.

Suggested Put Strategy for Century link Inc

The stock is overbought right now, so we would wait for it to test the 39.00-40.00 ranges before jumping in. Additionally if you sell the puts, and the stock trades to the 46-47 ranges, consider closing the position out. The stock market could mount a stronger correction after the summer is over.

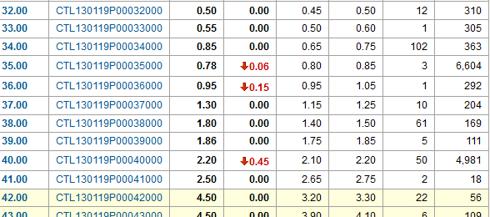

The Jan 2013, 39 puts are trading in the $1.75-1.85 ranges. If the stock pulls back to the suggested ranges the puts should trade in the $2.10-$2.40 ranges. For this example we will assume that the puts can be sold at $2.20. For each put sold, $220 will be deposited into your account.

Benefits of this strategy

If the stock trades below the strike price, you have the chance to get in at a much lower price. If the shares are put to your account, your final price when the premium is factored in will work out to $36.80. If the shares are not assigned to your account, you will walk away with a gain of 5.6% in roughly six months.

Your potential risk

- The stock has to trade to the suggested price before you can put this strategy into play. Thus if it does not trade in the stated ranges, then this strategy cannot be put to use, which means you eliminate your chances of getting into this play or earning some money while attempting to get in.

- Even if you put this strategy into play, there is no guarantee that the shares will be assigned to your account. Though generally if the put is well in the money, the odds are high that the shares will be put to your account.

- The stock could trade significantly below the strike price. Thus when the shares are put to you, any advantage you had when you implemented this strategy could vanish. One way to deal with this is to roll the put. Buy the old put back and sell new puts. The shares would have to trade below 36.80 before you start to lose money. So even if the stock closes at 38.00 and the shares are assigned to your account, you are still up by $1.20 when the premium is factored in.

A suggestion to boost your potential gains

You could take some of the premium you received from the puts you sold to purchase some out of the money calls. For example, you could purchase the Jan 13, 45 calls which are currently trading in the $0.35-$0.40 ranges. If the stock pulls back to the stated ranges, the calls should drop down to the 20-25 cent ranges. If the stock takes off, you could walk away with some handsome gains. Technically, the calls are free as you are using the money obtained from selling the puts to leverage your position.

Company: CenturyLink Inc

Basic overview

- Sales vs 1 year ago = 118%

- Levered Free Cash Flow = $2.82 billion

- Beta = 0.71

- 52 week change = 8.32%

- Sales vs 1 quarter ago = 171%

- Quarterly revenue growth rate = 172%

- Quarterly earnings growth rate = - 5.2%

- 5 year sales growth rate = 46%

- EPS 5 year growth rate = -16%

- 5 year capital spending rate = 49.5%

- Long term debt to equity = 1.00

- EPS vs 1 quarter ago = -5.3%

Growth

- Net Income ($mil) 12/2011 = 573

- Net Income ($mil) 12/2010 = 948

- Net Income ($mil) 12/2009 = 647

- EBITDA ($mil) 12/2011 = 6046

- EBITDA ($mil) 12/2010 = 3509

- EBITDA ($mil) 12/2009 = 2155

- Cash Flow ($/share) 12/2011 = 8.43

- Cash Flow ($/share) 12/2010 = 8.12

- Cash Flow ($/share) 12/2009 = 5.7

- Sales ($mil) 12/2011 = 15351

- Sales ($mil) 12/2010 = 7042

- Sales ($mil) 12/2009 = 4974

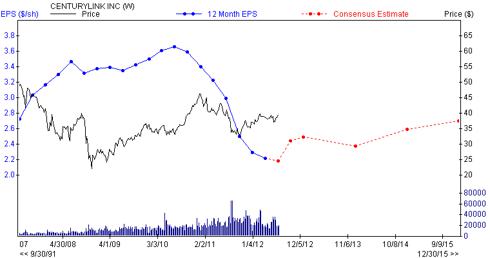

- Annual EPS before NRI 12/2007 = 3.16

- Annual EPS before NRI 12/2008 = 3.37

- Annual EPS before NRI 12/2009 = 3.6

- Annual EPS before NRI 12/2010 = 3.39

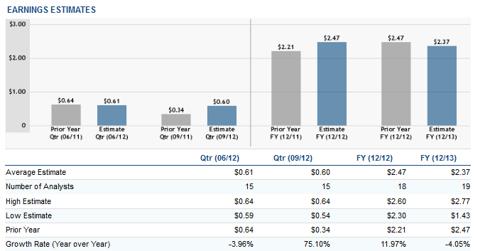

- Annual EPS before NRI 12/2011 = 2.21

Dividend history

- Dividend Yield = 7.00

- Dividend Yield 5 Year Average = 6.50

- Dividend 5 year Growth = 66%

Dividend sustainability

- Payout Ratio = 3.33

- Payout Ratio 5 Year Average = 0.68

Performance

- Next 3-5 Year Estimate EPS Growth rate = 4.09

- ROE 5 Year Average = 10.29

- Return on Investment = 3.26

- Debt/Total Cap 5 Year Average = 46.13

- Current Ratio = 0.90

- Current Ratio 5 Year Average = 0.76

- Quick Ratio = 0.60

- Cash Ratio = 0.38

- Interest Coverage = 1.70

Conclusion

Only put this strategy to use if you would not mind owning these shares at a lower price. Now if you have a change of heart after selling the puts because you now feel that the stock could trade significantly below the strike price, then you can roll the puts. Buy back the old puts and sell new slightly out of the money puts with more time on them. Your breakeven point in this trade is $36.80. If after selling the puts, the stock makes it to the 46-47 ranges, consider closing the position out. Then wait for the stock to pull back and sell a new set of puts.

Disclaimer

It is imperative that you do your due diligence and then determine if the above strategy meets with your risk tolerance levels. The Latin maxim caveat emptor applies - let the buyer beware.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Additional disclosure: EPS and Price vs industry charts obtained from zacks.com. A major portion of the historical/research data used in this article was obtained from zacks.com. Options tables sourced from yahoofinance.com. Earnings and growth rates obtained from dailyfinance.com.