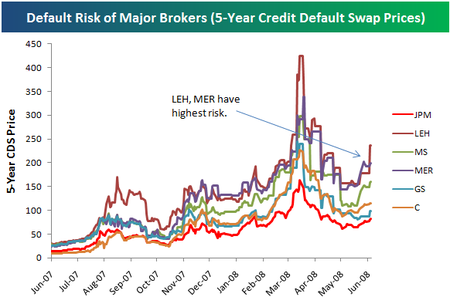

Below we highlight historical default risk for JPMorgan (JPM), Lehman (LEH), Morgan Stanley (MS), Merrill (MER), Goldman (GS) and Citigroup (C) as measured by their 5-year credit default swap prices.

After peaking in March during the Bear Stearns (BSC) blowup, default risk for banks and brokers declined sharply but still remained elevated when compared to normal historical levels. As questions about Lehman and other firms have returned in recent weeks, default risk has begun to rise again, with Lehman and Merrill seeing the biggest increases. While the price of Lehman's stock is now very close to its closing lows of March, default risk still remains below its March peak.

However, the spike is still disconcerting. The rankings of default risk from lowest to highest are JP Morgan, Goldman Sachs, Citigroup, Morgan Stanley, Merrill Lynch and Lehman.