The current rally has been questioned on its validity for weeks now, but the internal indicators have been telling a different story. The gradual decline of the VIX (VXX) has done the opposite of diminish fear in the market. At its current levels, many traders have begun to speculate that a potential deep cliff is possible in equities. This trade is improbable due to the existence of ready central banks. September looks to be the month that reveals the true nature of foreshadowed stimulus. A major drop is likely to stimulate immediate action, most likely in China. They have been quick to the trigger on easing policy lately, and with a low CPI, they look to be up for more stimulus soon. The indicators that are presented in this article correlate nicely with the VIX, and show potential for a strong market rally in the future.

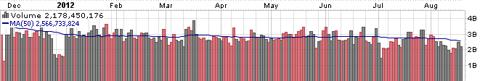

The first indicator above is that of the volume for the S&P 500 (SPY) over the past nine months, along with a 50 day moving average. The low volumes are evident, and with such strong moves on low volumes, the markets remain skeptical. This is expected, but the path of least resistance looks to be up for now. As long as there aren't any negative catalysts in the near future, the markets should continue a melt up.

The markets (RSP) have outperformed 20+ year treasuries (TLT) recently, which is a bullish indicator. The outbreak came in early August and has confirmed equities move as of late. The problem is that we are gradually approaching September, and no hard news has been presented yet. The upward resistance looks to be a suppressor over the next few trading weeks, which could limit equity gains till decision day.

The next chart is that of Junk Corporate Debt (JNK) versus Corporate Investment Grade (CORP) . Although both should outperform treasuries in a bull market, junk should outperform all in a truly strong economy. The high positive correlation between this ratio and the move of equities is a testament to its validity. Like earlier indicators, this ratio has been appreciating over the past few months. There looks to be some upside until the point of resistance, but expect for a drastic move, either higher or lower, to come in September.

The two charts above represent Utility (XLU) and Consumer Staples (XLP) stocks versus the broader market. Both of these indicators should show weakness in a strong rally. The fact that both indicators have, and are still on the cusp of a downward breakout is positive for risk assets. With more definitive news, look for both to show convicted breakouts lower.

Angela Merkel reaffirmed Germany's commitment to the Euro on Thursday, which led to further equity rallying. European equity (VGK) has outperformed our market recently which correlates to a move higher in risk assets. With so much tied into the situation with the Euro, any form of strength out of the European Union looks strong for global assets as a whole. This indicator is fast approaching resistance, and further strength in this ratio should correlate with action from European officials.

A more obscure variable, but nonetheless important ratio is that of Emerging Market Debt (EMB) versus US 20+ year Treasuries . As is expected, this ratio has outperformed with other risk assets. Emerging market debt requires the perception of a strong global environment, due to their many exports. With emerging markets recently hitting a wall, look for this indicator to move along with the global picture of further easing, or lack thereof.

As a whole, financial markets do show some semblance of strength. Speculators may be calling for depreciation from the current levels, but the market internals signal that higher moves are capable. All moves are tied to decisions to be made in the future, but a drift higher is likely, especially on the limited volumes seen as of late.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.