After the Reserve Bank of Australia (RBA) released its monetary policy statement on September 4th, I noted how the loudest part of the statement was left unsaid. The RBA raised no significant alarms - a distinct contrast to the loud alarms bells ringing from numerous analysts due to China's slowing growth rate. The minutes from that meeting filled in most of the holes and certainly confirmed the RBA's overall sense of calm about the Australian economy. In the world of forex, those minutes are already old news, but I find it worthwhile to review given the additional clarity it brings to likely near-term monetary policy and currency trends.

The RBA is well aware that the markets project near certainty for a total 50 basis points rate cut by year-end: "the cash rate was expected to be reduced to around 3 per cent by the end of 2012." However, the RBA did not tip its hand on its assessment of that projection. Instead, the RBA noted that "the current assessment of the inflation outlook continued to provide scope to adjust policy in response to any significant deterioration in the outlook for growth." If we are to believe the RBA's rather hopeful review of the Australian economy, I think it is extremely unlikely that Australia faces down a "significant deterioration" in outlook by year-end.

With the Federal Reserve promising to buy assets until U.S. employment improves sufficiently, I think the RBA will feel ever more pressure to rejoin major central banks in the global easing campaign. Otherwise, the RBA will risk having a currency that gets even more over-valued than current levels. In the meantime, the RBA claims that the impacts of earlier rate cuts are still working their way through the Australian economy.

While the RBA feels the Australian dollar (NYSEARCA:FXA) is higher than it should be, the current historic terms of trade suggest that the overall strength in the currency is not extreme as some analysts have suggested (see for example the analyst commentary in sensationalistic BloombergBusinessWeek article "Aussie Debacle Flags China Hard Landing as Iron Market Melts"):

While the Australian dollar depreciated slightly over the past month, it remained near its recent highs, despite significant falls in some commodity prices and a weaker outlook for the global economy. Members noted that most model-based estimates of the currency generally placed a large weight on the terms of trade. With the terms of trade still high by historical standards, these models suggested that the Australian dollar may have been somewhat overvalued, but not substantially so, although members also noted the significant uncertainty that surrounded this assessment.

The RBA apparently discussed whether the currency's high valuation is "…weighing more heavily on the economy than might be expected." The RBA provides no clues on their conclusions.

To me these musings on the currency suggest two things: 1) The RBA is not inclined to believe that a strong currency is overly burdensome to the economy; 2) monetary policy will not likely directly target reductions in the Australian dollar. Once again, it seems the near-term bar remains high for rate cuts.

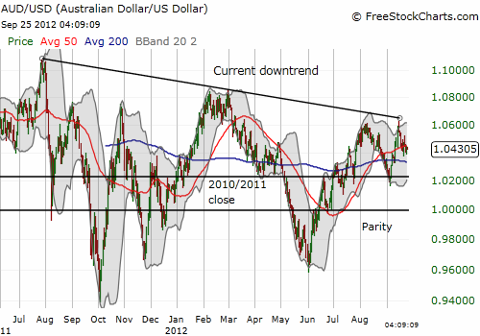

The chart below shows that the downtrend from last year's historic highs remains intact with AUD/USD fading right below this line of resistance on September 14th…the same day the S&P 500 (SPY) mark its high (so far) for the year before also fading a bit. The close relationship between the Australian dollar and the S&P 500 remains an important tell on the stock market, even a leading indicator at times. In "How To Estimate Intraday Moves For The S&P 500 Using The Australian Dollar" I finally provide some additional, quantified evidence of the close relationship. I will use the methods in that analysis to demonstrate longer-term relationships.

image

The Australian dollar remains resilient - caught between a cooling China and QE3 in the U.S.

Source: FreeStockCharts.com

Commodities are a large part of the Australian economy - iron ore constituted 20% of exports last year - so the RBA is compelled to discuss current economic/financial conditions in commodity markets. The commentary from the minutes further underscored the RBA's lack of alarm over the drop in iron ore and coal prices.

Even after large Australian miners hit record levels of iron ore production in the first half of 2012, the RBA expects production to continue increasing in the next year and that "recent announcements curtailing projects were likely to have only a small effect on the expected profile for mining investment in the near term. However, members observed that concerns about current high costs and a softening in commodity prices may have implications for resource projects still under consideration." The RBA projects that resource investments will "…peak some time in 2013/14, at around 9 per cent of GDP." Interestingly, the RBA believes that current LNG (liquefied natural gas) and other mining projects will help keep resource investment growing even "…if the fall in the iron ore and coking coal prices were to be sustained…this decline would imply a larger fall in the terms of trade than the staff had earlier forecast, though the terms of trade would still remain high by historical standards."

Taken together all these projections imply that the RBA believes slowing growth rates in China are not going to undermine the Australian economy anytime soon.

The RBA acknowledges that economic conditions outside the mining industry are "subdued" and likely to remain so through 2012. Interestingly, business credit is now "growing at its fastest pace in over three years." Australian business remain "solidly" profitable, and their business balance sheets remain strong. There are also "tentative signs" that the housing sector is improving.

Perhaps most importantly, the RBA tries to allay concerns that its banks are vulnerable to external turmoil (primarily from Europe):

Australian banks "…continued to have ready access to wholesale markets, including offshore wholesale markets…the Australian banking system remained well placed to service the needs of the Australian economy…. the large banks had further reduced their use of offshore wholesale funding as growth in deposits continued to outpace growth in credit. While the Australian banks remained exposed to swings in global financial market sentiment associated with the problems in Europe, the changes in their funding, liquidity and capital positions over recent years suggested their resilience to these swings had improved."

Overall, "aggregate measures of financial stress were relatively low."

Unless the RBA is completely off base, I think traders and investors may be surprised through the end of this year by a resilient Australian dollar and monetary policy that is not quite as accommodative as most analysts expect. The above chart of AUD/USD suggests that the Australian dollar will not likely get much stronger from current levels, so I remain marginally bearish. The closer AUD/USD gets to parity, the less bearish I will get. If AUD/USD manages to break through its downtrend, I will have to reassess my outlook. Regardless, I think it makes sense to keep trading positions on the Australian dollar small until new trends emerge or something significant changes in macro-economic conditions.

Be careful out there!

Disclosure: In forex, I am short AUD/USD. I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.