Terex Corporation (TEX) is the 3rd largest manufacturer of construction equipment in the world. The company manufactures equipment for construction, infrastructure, quarrying, mining, shipping, transportation, refining, and utility industries worldwide (Yahoo! Finance, 2008). It operates five primary segments, namely Aerial Work Platforms [AWP], Construction, Cranes, Materials Processing & Mining [MP&M], and Road-building, Utility Products, and Other [RBUO] segments. Sales are geographically diverse with almost 70% of 2007 sales being derived from outside the US. TEX has achieved 12-year compound annual sales growth rate of 27% (Terex, 2008 [PDF]).

Intro

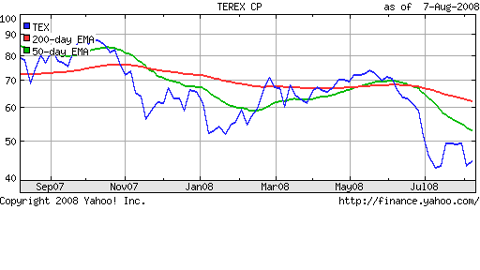

Call it a collapse of the colossal kind. As the 1-year price chart (Courtesy Yahoo! Finance) below attests, TEX is substantially down from it 52-week high of $90, and has just bounced of lows in the $40s. This comes at a time when TEX posted outstanding quarterly and six month results for FY 2008, and reaffirmed all time revenue and earnings guidance of $10.5 billion to $10.9 billion, and $6.85 to $7.15 per share for the year, respectively.

click to enlarge

TEX now trades at a pitiful forward PE multiple of 6. So, in this beaten down market where value stocks abound by the dozen, do you really need another story touting a value play? Yes, this one is different! Since the market seems convinced otherwise with expectations of an impending slowdown and earnings "top" for the construction and heavy machinery companies implied in their valuations, I thought I would take a few moments to convince you that the concerns are pre-mature with growth drivers essentially in tact for near-term visibility.

Management Business Outlook

In the 2Q 08 earnings conference call held on July 23, 2008, TEX management presented their business outlook for the rest of year while shying away from making any predictions on visibility into 2009. I inferred the management business outlook to be cautiously optimistic. Comments of particular interest presented by Chairman and CEO Ronald DeFeo that sum up management's business outlook during the conference call are presented below:

"We do realize that our end markets are varied and choppy, but the fact is that we are rapidly growing in developing countries and that our crane and mining businesses are also growing nicely with excellent margins."

Chairman DeFeo reiterated that TEX can achieve $12 billion in revenues with 12% operating margin by 2010. Competitor Caterpillar (CAT) earlier reported that for the full year, it now expects revenue of about $50 billion and profit of about $6 per share (AP, 2008). Did you also know that the CAT revenue target of $50 billion was a goal Chairman and CEO Jim Owens set for 2010 which is now expected to be achieved by the end of 2008? However, there is some cause for concern as both CAT and TEX mentioned rising raw material costs and inflationary steel pricing environments that are compressing operating margins in some segments. While CAT announced in a regulatory filing it plans to raise prices by 5 - 7 percent worldwide starting in January due to "current industry factors as well as general economic conditions", TEX expects to raise prices 7.7% on average for some future orders. Interestingly, TEX COO Riordan remarked during the earnings conference call that "we have a larger than we'd like inventory hedge on steel".

A segment by segment analysis is presented by management in the earnings conference call transcripts (https://seekingalpha.com/article/86814-terex-corp-q2-2008-earnings-call-transcript?page=1">Seeking Alpha, 2008). There are some TEX businesses such as AWP and North American markets experiencing a slow down. It is also true that margins in some other business segments are also being squeezed. But expectations of an immediate downturn (as implied in the collapse of TEX market capitalization) as well as anyone's concern of an "earnings top" are premature, unfounded, and largely myopic views that the market seems to be holding. I believe that many of the growth drivers that have propelled TEX to its current market position are intact, and can reasonably be expected to work for the company in the future. Specifically, I would like TEX skeptics to consider the growth drivers discussed below.

Growth Drivers for Construction Equipment Firms

New Product Life Cycle Driven By Environmental Standards

The front pages of major daily periodicals have been recently awash with articles on China's efforts to institute pollution curbs on the eve of the 2008 Olympics (WSJ/ WSJ2 / LAT, 2008). The air pollution problems in Beijing being bought to attention on the onset of the Olympics will not end when the event is but a cherished memory and guest visitors and athletes return to their home countries. The temporary curbs instituted to curtail air pollution to respectable levels is not a panacea for the residents of Beijing or the people of China. Once the dust kicked by the Olympian athletes settles and anti-pollution curbs lifted, winds will return with suburban industrial pollution to compound urban environments already saturated with high levels of auto exhaust and smog. In that respect, countries like China (and BRIC nations alike) will need to make a quantum leap to the strictest of the environmental performance standards in order to do make their economies and businesses sustainable. With this in mind, I believe investment in cleaner diesel equipment will definitely be a growth driver for companies such as TEX, CAT, and CMI. While concerns of an impending slowdown in some construction sectors abound, I see an emerging product life cycle that could sustain demand for the foreseeable future.

One need only look to US EPA Tier III and IV environmental performance standards for off-road diesel-fueled equipment to see what is possible in air pollution control. I also see that the rest of world following the US lead in setting higher environmental performance standards, and waking up to the fact that the present economic prosperity of double digit GDP growth is not sustainable and could have catastrophic consequences in years to come by neglect of environmental pollution and associated adverse health effects on their people. Neither is a slowdown in the construction economies for many a developing nation an option as this may put additional inflationary pressures on an already resource constrained (for example, housing) society with a dire need for modern public facilities and services (for example, wider roads, highways, bridges, and airports, etc.).

Infrastructure Build-out in Developing Nations

With the developing and emerging nations are now doing business with the west, comes the need to upgrade their own civic facilities such as airports, roadways, and bridges to modern standards. In addition, with the economic prosperity comes the need to provide housing and develop communities and marketplaces for a rising and increasingly populous middle class. The auto sector is still growing double digit in many eastern and asian markets, and countries such as India will have to address the need to accommodate the larger driving population with newer and wider roads, and links that facilitate transportation of goods to the far reaches of the country.

Worldwide Adoption of Modern Construction Practices

The construction industry in economies such as India are labor intensive, and my personal observation is that project turnaround times from cornerstone to completion far exceed US norms or westernized pace. Drive up to a construction site in an Indian city and you are likely to see a petite lady transporting a pail of mixed cement balanced on her head. Another common sight you are likely to witness is a dozen or so pipes of 20 foot length mounted on a bicycle and being transported to a construction site. My belief is that such conditions exists in all developing nations with emerging economies. Therefore, I see a need for continued investment in construction equipment such as mobile cranes and concrete pumping trucks. This investment can have a far greater positive impact in improving human conditions and alleviating a labor work force with advanced skills than the few construction laborers it would displace.

Concluding Remarks

I strongly believe that companies such as TEX and CAT are about to witness new product life-cycles, spearheaded by the next generation of cleaner burning off-road diesel engines. Recent engine sales reported by CAT (AP, 2008) and CMI (Seeking Alpha, 2008) sans the North American market have been exceptionally strong, leading me to believe construction and heavy equipment manufacturers are gearing up cater to the new demand. Lastly, an analysis of TEX inventory turns is not indicative or conclusive of an unusually slowing overall business condition that warrants a "dump" of the company shares, other than what management confessed were impacts to some business segments.

With TEX valuation driven to dirt amidst the Street rubble, we are thankful that TEX management has committed $1.2 billion to the repurchase program. That's 25 percent of TEX market capitalization, and their valuation call.

Disclosure: I am long TEX.