Yesterday's losses have almost entirely been recouped across the major equity indices, as all are trading well in the green during the afternoon session. Oil prices continue to trend lower today, currently they are just under $68 per barrel. Lower oil prices are expected to be extremely detrimental to the Russian economy, as Russia's Economy Ministry announced this morning that it has downgraded its forecast for 2015 gross domestic product (GDP) growth to -0.8% from +1.2%. However, oil isn't the only culprit as the value of the ruble continues to slide, punishing economic sanctions continue to exist from western trading partners, and the government recently abandoned plans for a $40 billion gas pipeline. Lower oil prices may actually help Europe as producer prices have dropped sharply, and may prevent the European Central Bank (ECB) from inevitably enacting a stimulus package. Online sales were good for Cyber Monday, jumping by 8.7% year-over-year, but fell well short of analyst expectations for a 13%-15% jump year-over-year, while mobile purchases actually surged by 29.3% over last year. However, there were a few more industrial data points lifting the market today.

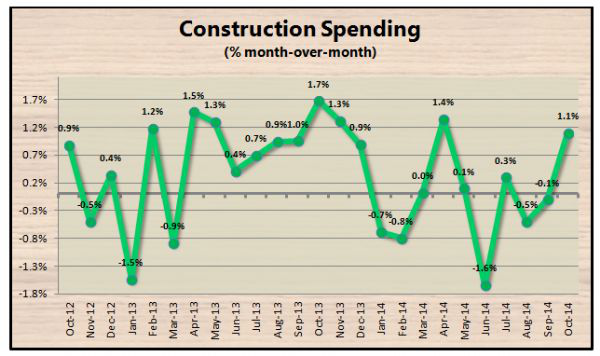

Firstly, construction spending rebounded in a major way, with particular strength in the public outlays and the private resident component. During the month of October, construction spending jumped by 1.1% following a 0.1% decline in September and handily beat economists' estimates which called for a 0.6% boost. The increase in October was led by public outlays which rebounded 2.3% after a 1.6% drop in the month before. In addition, private-residential spending increased by 1.3% in October, after an increase of just 0.8% in September. However, private nonresidential construction spending declined by 0.1%, following an increase of 0.2% in the month before. On a year-ago basis, total outlays were up 3.3% in October compared to 3.9% in September. Odds are that the boost in construction spending will translate to higher Q4-2014 US GDP. Below is a two-year chart of month-over-month US construction spending.

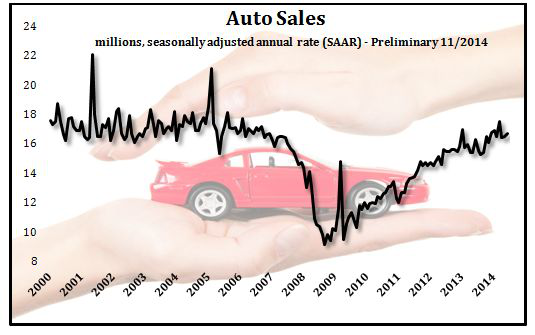

Throughout the day, US November auto sales have been trickling in from various automakers both foreign and domestic. By noon, about 75% of the domestic totals were in, and November unit sales of North American-made cars and light trucks are actually tracking slightly higher than consensus expectations at seasonally-adjusted average rate (SAAR) of 13.5 million cars. This is slightly higher than the consensus estimate at 13.4 million SAAR and October's pace of 13.3 million. However, when foreign automakers are included, some analysts suspect that the number will jump to 13.7 million SAAR, which noted in the chart below. Five of the top six automakers sold more vehicles than expected thanks to a surging economy, heavy discounting and falling fuel prices, which all lured consumers into showrooms. Black Friday's sales last week gave November sales the final surge they needed to beat last month's rate, expectedly increasing by 2.3% for the month. Early indications were that the industry's annualized sales rate in November was more than 17 million vehicles, which is the best pace for November since 2003. The two major US automakers, Ford (F) and General Motors (GM), reported month-over-month changes of -1.8% and +6.5% respectively. The biggest winner so far is Chrysler, which reported growth of 20.1% over last month and 15.7% over the same month last year.