The Market as measured by the Value Line Index is down a bit. I trimmed a few stocks from the Barchart Van Meerten New High portfolio not because I wanted to raise some cash but because of sell signals triggered by each stock individually. My initial warning is when I lose 10% or the stock begins to trade below its 50 day moving average. The stocks trimmed were

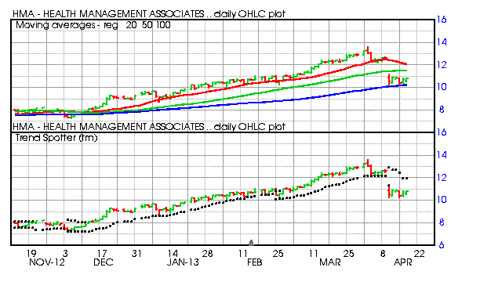

Health Management Associates (HMA), Community Health Systems (CYH), First Commonwealth Financial (FCF), Oriental Financial (OFG) and Chevron (CVX). Please review the Barchart technical indicators and charts and see if you agree: Health Management Associates (HMA)Barchart technical indicators:

- 40% Barchart short term technical sell signals

- Trend Spotter sell signal

- Below its 20 and 50 day moving averages

- 11.91% off this month

- 20.76% off its recent high

- Relative strength Index 38.39%

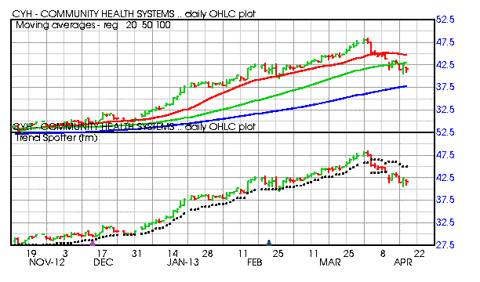

Barchart technical indicators:

- 40% Barchart short term technical sell signals

- Trend Spotter sell signal

- Below its 20 and 50 day moving averages

- 6.21% off this month

- 14.24% off its recent high

- Relative Strength Index 40.11%

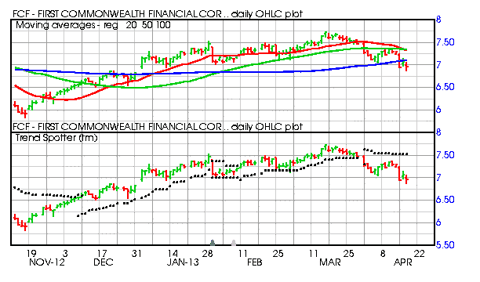

Barchart technical indicators:

- 80% Barchart short term technical sell signals

- Trend Spotter sell signal

- Below its 20, 50 and 100 day moving averages

- 9.83% off this month

- 9.95% off its recent high

- Relative Strength Index 35.80%

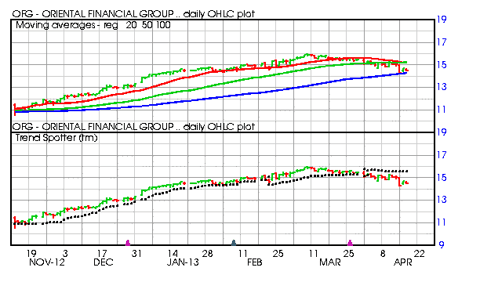

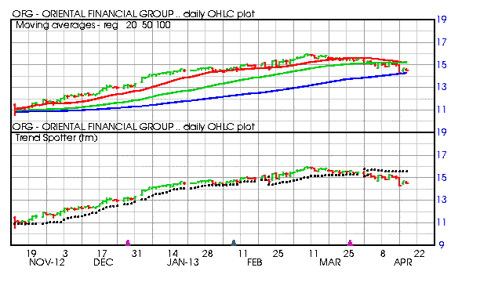

Barchart technical indicators:

Barchart technical indicators:

- 100% Barchart short term technical sell signals

- Trend Spotter sell signal

- Below its 20 and 50 day moving averages

- 8.39% off for the month

- 9.54% off its recent high

- Relative Strength Index 39.34%

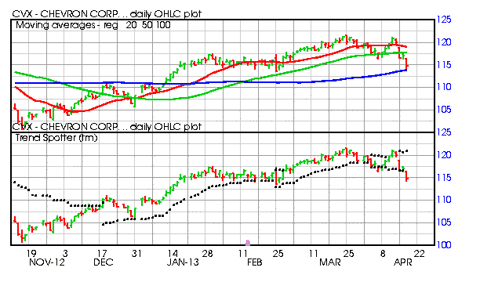

Barchart technical indicators:

- 60% Barchart short term technical sell signals

- Trend Spotter sell signal

- Below its 20 and 50 day moving averages

- 4.07% off for the month

- 5.55% off its recent high

- Relative Strength Index 36.95%

I'll begin adding back positions when the Market starts to come back. My gauges will be the Barchart Market Momentum and the Value Line Index.