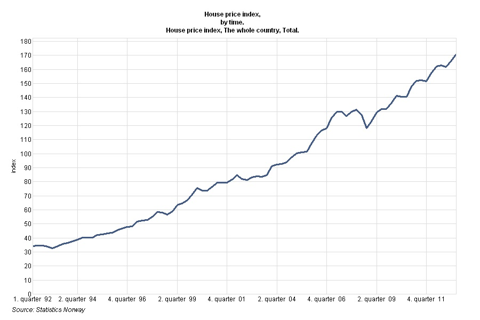

House prices in Norway continued to climb in Q2 2013 data released today by Statistics Norway show.

The house price index in Q2 increased 5.4% on Q2 2012 and 2.6% on Q1 2013...

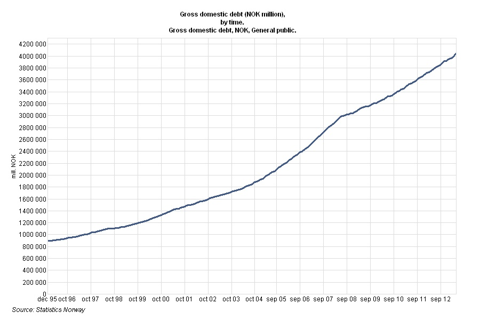

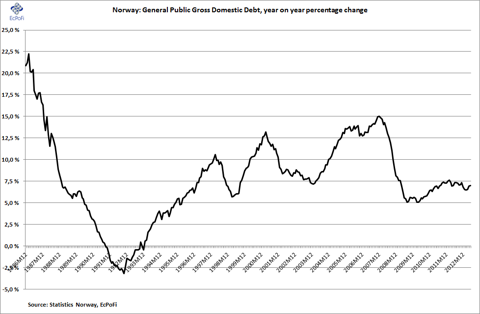

...supported by significant growth in general public's gross domestic debt in Norway...

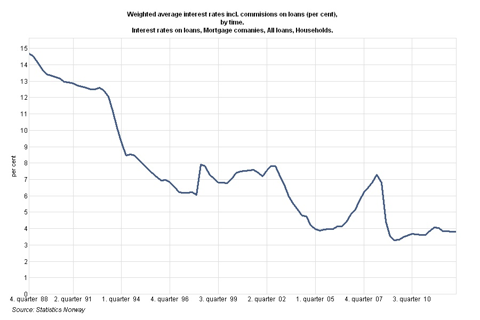

...and low interest rates.

There can be little doubt that the housing price boom in Norway has some of the main features of a classic credit fueled bubble. To sustain it, interest rates need to continue to remain low and the growth in credit and broader measures of money supply need to continue. If not, it is a near certainty that prices will have to go down. The question is by how much and at what speed.

A prediction: the central government election is coming up in Norway this fall. After eight years in charge, it looks likely the Labour Party led coalition will be ousted by a coalition formed by the Conservative Party. When the housing bubble bursts (not likely to happen before the election as interest rates are still low and current credit growth is still substantial) the conservatives will get the blame for the housing bubble created by the the Labour Party. And the Labour Party will be the one making the allegations. And the majority of the electorate will believe it to be true.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.