In his latest weekly commentary, fund manager John Hussman analyzes several mainstream arguments that suggest the stock market is inexpensive at current valuations, including the most common "methodology" that focuses on corporate earnings forecasts. As he correctly observes, the forward earnings model has a very poor performance history, and it is especially dangerous near highs in the long-term corporate profit cycle.

One of the aspects of the market that is most likely to confuse investors here is the wide range of opinions about valuation, with some analysts arguing that stocks are cheap or fairly valued, and others - including Jeremy Grantham, Albert Edwards, and of course us - arguing that valuations are very rich.

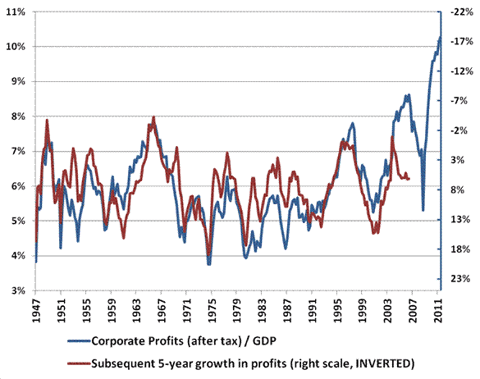

The following chart may help to bridge that gulf. Essentially, analysts who view stocks as "cheap" here are invariably basing that conclusion on current and year-ahead forecasts for earnings. In contrast, analysts who view stocks as richly valued are typically those who view stocks as a claim not on this years' or next years' earnings, but instead are a claim on a long-term stream of deliverable cash flows. Simply put, there is presently a massive difference between short-horizon earnings measures and longer-term, normalized earnings measures.

What's going on here is that profit margins have never been wider in history. But profit margins are also highly cyclical over time. The wide margins at present are partly the result of deficit spending amounting to more than 8% of GDP - where government transfer payments are still holding up nearly 20% of total consumer spending, and partly the result of foreign labor outsourcing (directly, and also indirectly through imported intermediate goods) which has held down wage and salary payouts. Indeed, the ratio of corporate profits to GDP is now close to 70% above its long-term norm.

Now, if you look at the red line (right scale, inverted), you'll notice that unusually high profit shares are invariably correlated with unusually low growth in corporate profits over the following 5-year period. Thanks to continuing deficits and extraordinary monetary interventions, this effect has been largely postponed in recent years, allowing profits to expand to present extremes. We are not arguing that profit margins necessarily have to decline over the near-term, and our concerns don't rest on the assumption that they will. It is sufficient to recognize that the bulk of the value of any stock is not in the early years of earnings, but in the long tail of future cash flows - especially if payouts are low. Stocks are essentially 50-year instruments here in terms of the cash flows that are relevant to their valuation. There are a lot of factors and quiet math that affect the P/E multiple that can be appropriately applied to earnings. Slapping an arbitrary multiple onto elevated earnings reflecting extraordinarily inflated profit margins ignores all of it.

The upshot is that if investors are willing to believe (without the use of off-label hallucinogens) that current profit margins are the new normal, and will be sustained indefinitely, then Wall Street's valuations based on current and forward earnings estimates can be taken at face value. This assumption of a permanently high plateau in profit margins is quietly embedded into every discussion of "forward earnings" here.

As we often note, many mainstream analysts base their projections and recommendations on faulty assumptions because they fail to see the big picture. Anyone who contends that stocks are currently "cheap" as investment vehicles is either ignorant of the cyclical nature of corporate earnings or subscribes to the infamous "this time is different" philosophy. In either case, the forward earnings model is once again poised to perform very poorly as we approach the most extreme cyclical high in corporate profits in more than half a century. Based on 80 years of market data, our analysis indicates that the current risk/reward profile of the stock market is in the worst 1 percent of all historical observations, so we remain fully defensive and recommend that you do the same.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.