My previous articles have primarily focused on Medical Marijuana, Inc (OTCPK:MJNA) because of its strong leadership, products & services diversification and strategic growth opportunities. But GrowLife, Inc (OTC:PHOT) has also been on my radar scope, and in light of its recent press release regarding its letter of intent (LOI) to acquire Rocky Mountain Hydroponics, LLC, Evergreen Garden Center, LLC and 58Hydro.com (Collectively known as "ECG"), it deserves a more detailed review.

GrowLife, Inc.

I had already deemed GrowLife a company that is worthy of investment. The company has one of the primary risk reduction properties that I look for in issues in this space which is diversification. For the record, my exception is Cannabis Science, Inc (CBIS.OB) which I value because of its re-channeled focus on cannabinoid pharmacology. But, GrowLife is a fully reporting holding company with multiple operating businesses that manufactures and markets high-end horticultural equipment.

The horticultural distinction from agriculture is important because while horticulture is focused on the science and technology of plant cultivation for human consumption, agriculture also includes the cultivation of animals and on a broader definition, farming. Okay, this is not a science lesson, so what's important is that there is a degree of specialization that creates a niche market.

After I mentioned GrowLife in a previous article, I was contacted by its Investor Relations firm Integrity Medias President, Kurt Divich and asked if I would be interested in speaking with the CEO, Sterling Scott about the recent press release regarding the company's intent to purchase ECG.

I took him up on the offer and in a brief phone conversation; I found Mr. Scott to be very focused on the evolution of the business. My initial growth thesis for the company was based on my expectation of increased sales by individuals for personal cultivation. I saw the market much the same as that for home brewers of beer with the potential for expansion as medicinal use gained acceptance across the US.

Mr. Scott pointed out that retail consumers are only a portion of the market that the company serves. He explained that GrowLife is also marketing to large scale hydroponics growers. He offered that the measure in the industry is lights per operation and that the company was targeting 3000 to 5000 light operations. He also emphasized that the company had highly recognizable brands in the industry.

I realized that my initial perspective needed to be broadened as I began to see the company as being more in line with models such as John Deere (DE), who is a diversified equipment manufacturer with a strong brand. Now that I understood the company a little better, I wanted to look a little deeper at the growth potential of company.

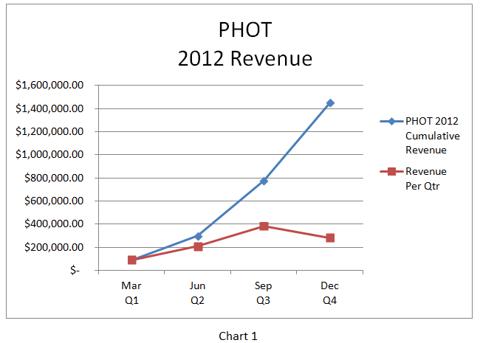

The company distributes over 3000 products which produced $1,450,745 in revenue for 2012 as reported in the company's 2012 10K Annual Report. This was punctuated with a 300% + Q4 revenue increase over the same period in 2012 as shown in its April 2nd, 2013press release GrowLife Report Record 300% + Increase in Q4 Revenues and Audited FY 2012 Financial Results.

This press release was followed just two days later on April 4th, 2012 by the company's press release GrowLife Signs LOI to Acquire Hydroponics Store Chain Rocky Mountain Hydro, Evergreen Garden Centers and 58Hydro.com.

I've outlined GrowLife's 2012 revenue in Chart 1 below. Revenue per quarter increased in the first three quarters with a slight decline for Q4, but as shown, still higher than Q3 and Q4.

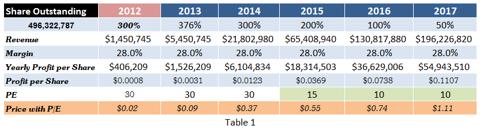

To illustrate where I see revenue going in 2013 and beyond, I also put together the 5 year projection shown in Table 1 below:

The press release stated the deal with ECG would add over $4 million to the company's revenue. So I added the additional revenue to the 2012 revenue (with no other growth) to reach the $5.5M revenue number for 2013. I didn't add any additional growth to account for growing pains. I then took the 28% margin from the annual report and used it for the entire projection. Then to be very conservative, I put a declining growth percentage for each year out to 2017. I also reduced the conservative growth PE of 30 starting in 2015 to 15, ultimately putting it at 10 for 2016 and 2017.

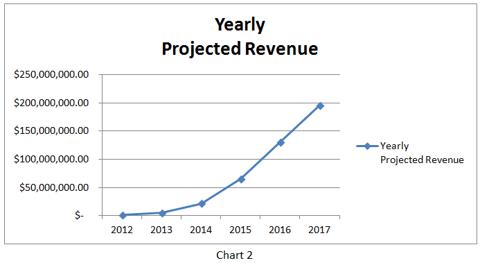

Now, just to put this into perspective, the 2014 price of $0.37 represents a 7 bagger and a 640% increase over the Apr 12th closing price of $0.05. The revenue numbers are also shown in Chart 2 below.

Conclusion

As you can see, GrowLife's acquisition could add some nice zeros to the bottom line moving forward. The company's market includes both retail and industrial growers. With legalization on the horizon, both markets could see significant growth. Of course, the purchase has not been completed as the company is still doing due diligence. Also, micro caps in general come with a lot more risk than more established issues. But remember, GrowLife is a fully reporting company, and a small investment now, could yield some significant returns in the future. And if the new legislation House Bill 1123 Respect State Marijuana Laws Act of 2013 gains traction and is ultimately adopted, demand for the company's products will skyrocket.

Disclosure: I am long OTC:PHOT, OTCPK:MJNA, CBIS.OB. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.