AutoChina (AUTC) - The Most Preposterous Chinese Reverse Merger Yet

The recent onslaught of media coverage focused on Chinese reverse mergers has finally started to illuminate one of Wall Street's darkest, and most dangerous, corners. The fallout from the accusations (and confessions) of accounting irregularities and potential fraud has been single-digit "earnings" multiples, increased regulatory scrutiny, painful investor losses, and high levels of disdain towards most Chinese reverse mergers.

One company that has somehow managed to avoid scrutiny until now is AutoChina (NASDAQ: AUTC). However, after a deep dive into AutoChina, The Forensic Factor ("TFF") has concluded that AutoChina is potentially the most dangerous Chinese reverse merger that we have examined. As the AutoChina story gets exposed, we would expect a significant share decline of at least 50% and a material increase in the short interest (incredibly, less than 1% of the shares are short - a true rarity among the Chinese reverse mergers). TFF believes investors would be prudent to avoid AutoChina at all costs. At the same time, we implore regulators to protect the investing public and launch an investigation into AutoChina. This report, Part I of II that we will publish on AutoChina, will highlight the following issues:

- An extensive use of the same gain-on-sale accounting that led to the entire sub-prime industry blowing up. As we will discuss, AutoChina's accounting methods were dubbed "Crack Cocaine Accounting" by Bloomberg in a story on the sub-prime lenders

- A mockery of U.S. GAAP accounting, resulting in massively overstated revenue and earnings that should not be relied upon by investors

- A harrowing $450 million discrepancy between operating cash flow and net income over the past six quarters

- A labyrinthine org structure and a reliance on related party debt that has become the primary funding source for the core business

- The largest funding source for the company's auto loans appears to be a related party operator of grocery stores called Beiguo Commercial Building Limited

- The most dilutive, and shareholder unfriendly, earnout that we have ever seen. The perverse earnout has potentially incentivized management to use logic-defying accounting to drive specious revenues and earnings

- A misunderstood market capitalization based upon future earnout shares that do NOT appear to be included in sellside models

- Massive expense understatement and large related party payables

- A CFO that was previously the Director of Research at a firm that turned out to be one of the largest ponzi schemes in U.S. History

- A new auditor that will need to address the issues and questions raised by TFF in this report - a process that could be the impetus for a large accounting restatement

Accounting Dramatically Overstates Income, Restatement Likely

Before delving into an accounting schematic that we thought had died with the subprime debacle, it is worth mentioning the unusual birth of AutoChina. The operating company is located in China, but the holding company is incorporated in the Cayman Islands [we will explore the unusual corporate structure later illustrating a similar structure to Rino International (pink sheets: RINO)]. AutoChina came public in April 2009 in a reverse merger with Spring Creek Acquisition Corp. At the time of the merger, the company's primary operations were new and used car lots in China. Just a few quarters after the reverse merger was consummated, the core business was disposed of (12/09) so that the company could focus on leasing commercial vehicles. This unusual change in corporate strategy was quite a gamble at the time, given the leasing business had a history of less than one year, "ACG's commercial vehicle sales, servicing and leasing segment has only been operating since 2008, and after the sale of our automotive dealership business is the only business we operate" (http://google.brand.edgar-online.com/DisplayFiling.aspx?TabIndex=2&FilingID=7139746&companyid=762060&ppu=%252fdefault.aspx%253fsym%253dAUTC).

The leasing business is relatively easy to understand: they find a truck buyer, order and buy the truck, provide the financing, and then lease the truck at a marked-up value. The high level leasing concept is where the straightforward ends and where the mysterious begins. Simple arithmetic suggests the numbers that AutoChina provides in its financial statements are nonsensical. The company's 2010 guidance is $600 million to $650 million of revenue on 12,000 to 13,000 "leased" vehicles. This equates to exactly $50,000 of revenue per vehicle. Reported revenue per transaction of $50,000 per vehicle would seem to represent a sale rather than a "lease." On page 28 of their investor presentation (http://edg1.vcall.com/irwebsites/autochinaintl/Autochina_December2010.pdf), AutoChina outlines the economics of a typical lease, which includes $48,000 of total collections over the life of a lease (26 months) and $38,000 for the cost of the truck. The difference is shown as the $10,000 of gross profit potential (before SG&A and interest expense) over 26 months.

Table 1

Total collections over life of the lease | $48,000 |

Cost of Goods Sold | $38,000 |

Potential profit over life of the lease | $10,000 |

Average lease | 26 months |

Source: Company presentation and company filings

However, TFF believes AUTC is actually recognizing almost all of the potential profits upfront. For example, in the third quarter 2010 AUTC recognized over $8,000 of gross profit for each new vehicle it leased (sec.gov/Archives/edgar/data/1417370/0001...).

Table 2

AUTC's Actual 3Q Results |

|

3Q10 Revenue per vehicle leased | $50,382 |

3Q10 COGS per vehicle leased | $42,358 |

3Q10 Profit per vehicle leased | $8,023 |

Source: Company filings

TFF believes this is an extremely aggressive form of accounting. In fact, this accounting treatment is nearly identical to the "non-cash gain on sale" accounting popularized by the subprime mortgage industry before they all went bankrupt. A prominent story by Bloomberg described this accounting method as the financial world's equivalent of "Crack Cocaine" (http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aIOWGBzzWpNo). This form of non-GAAP accounting generates substantial "paper" income but significantly overstates and misrepresents economic income. While AutoChina's sales-type lease accounting generates 60% to 80% upfront profits, it is important to compare this to the actual cash flows of a loan. According to the example below (Table 3), AUTC does not get to breakeven cash flow until month 22 of a 26 month lease!!! Even if the company did not have to finance its leases, it would still take 20 months to breakeven. Keep in mind this analysis does not even include any overhead costs, costs for collections, or potential defaults that would push the average breakeven out even farther.

Table 3

Cash Accounting |

|

| |

Outflow for vehicle |

| ($38,000) | |

Down payment |

| $11,400 | |

Cash out of door |

| ($26,600) | |

|

|

|

|

Lease collections |

| $34,600 | |

Months |

|

| 26 |

Payment per month |

| $1,331 | |

|

|

|

|

Initial monthly cash financing cost - at 9% | ($155) | ||

|

|

|

|

Months to breakeven CF |

| 22 | |

Source: Company presentation and TFF analysis

This unsavory and alarming dynamic of reporting positive "accounting" profits despite enormously negative cash flow is obvious when comparing AutoChina's cash flow from operations to its net income. The company has blown through $384 million of operating cash flow over the past six quarters. This is amazing considering reported net income was $69 million over the same period. The discrepancy between the CFO and the reported earnings is a staggering $450 million over that same timeframe (www.sec.gov/Archives/edgar/data/1417370/...). AutoChina's inexplicable delta between operating cash flow and net income is one of the more alarming statistics that TFF has ever uncovered.

Table 4

| 2Q09 | 3Q09 | 4Q09 |

|

Cash from Operating Activities | -35,027 | -86,600 | -74,548 |

|

Net Income | 5,493 | 6,992 | 23,822 |

|

Difference | -40,520 | -93,592 | -98,370 |

|

|

|

|

|

|

| 1Q10 | 2Q10 | 3Q10 | Total |

Cash from Operating Activities | -50,220 | -142,269 | 4,832 | -383,832 |

Net Income | 6,246 | 17,177 | 9,463 | 69,193 |

Difference | -56,466 | -159,446 | -4,631 | -453,025 |

Source: Company filings

To be absolutely certain that AutoChina was an anomaly with regard to its overly-aggressive accounting, we examined other leasing models. TFF could not find one public U.S. company that utilized the same aggressive accounting treatment for their main business. Every U.S. leasing company that TFF evaluated (including GMT, MGRC and TAL), used straight line accounting methods. If AUTC used straight line accounting that recognized revenue over 26 months, the income statement would be materially lower. Table 5 presents the amortization schedule other leasing companies would use for a typical AUTC lease. As Table 5 illustrates, in the first three months of the lease, the company would recognize just under $1,600 in interest revenue offset by interest expense (~$400 at 6% interest rate). This would equate to $1,200 of net interest margin. Even if the company recognized a $2,000 upfront mark-up gain (which we believe should also be amortized), AUTC would still be overstating the first three months of revenue on a new lease by a whopping 92.5% while overstating gross profit by almost 60%.

Table 5

Amortization Schedule |

|

|

| |

Period | Payment | Principal | Interest | Balance |

1 | $1,331 | $784 | $547 | $25,816 |

2 | $1,331 | $800 | $530 | $25,015 |

3 | $1,331 | $817 | $514 | $24,199 |

4 | $1,331 | $834 | $497 | $23,365 |

5 | $1,331 | $851 | $480 | $22,514 |

6 | $1,331 | $868 | $463 | $21,646 |

7 | $1,331 | $886 | $445 | $20,760 |

8 | $1,331 | $904 | $427 | $19,856 |

9 | $1,331 | $923 | $408 | $18,933 |

10 | $1,331 | $942 | $389 | $17,991 |

11 | $1,331 | $961 | $370 | $17,030 |

12 | $1,331 | $981 | $350 | $16,049 |

13 | $1,331 | $1,001 | $330 | $15,048 |

14 | $1,331 | $1,022 | $309 | $14,026 |

15 | $1,331 | $1,043 | $288 | $12,984 |

16 | $1,331 | $1,064 | $267 | $11,920 |

17 | $1,331 | $1,086 | $245 | $10,834 |

18 | $1,331 | $1,108 | $223 | $9,726 |

19 | $1,331 | $1,131 | $200 | $8,595 |

20 | $1,331 | $1,154 | $177 | $7,441 |

21 | $1,331 | $1,178 | $153 | $6,263 |

22 | $1,331 | $1,202 | $129 | $5,061 |

23 | $1,331 | $1,227 | $104 | $3,834 |

24 | $1,331 | $1,252 | $79 | $2,582 |

25 | $1,331 | $1,278 | $53 | $1,304 |

26 | $1,331 | $1,304 | $27 | $0 |

AutoChina's "non-cash gain on sale" accounting would not be as ridiculous if they also accrued for loan losses. As TFF dug through the disclosures and assumptions behind AutoChina's loans, we were shocked to see zero accruals for losses. By recognizing 60% to 80% of profits upfront, almost all of the potential profit is recognized immediately. A consequence of this policy is future credit losses will provide a huge downside surprise (reversal of recognized gains, costs of repossession, and loss on collateral). TFF believes this concern is quite relevant given the recent jump in delinquent accounts relative to the minuscule provision for loan losses. In fact, TFF believes AutoChina has only reserved $1.1 million against $410 million in loans. According to SEC filings, over 4.25% of AutoChina's loans were delinquent as of September 30, 2010. This deteriorating loan book paints a different picture than the paltry reserve that represents less than 0.27% of the total lease portfolio (see Table 6) (sec.gov/Archives/edgar/data/1417370/0001...). Management has claimed that they have experienced less than 20 defaults (versus 20,000 leases) and cumulative losses of roughly 15 basis points (http://www.investorcalendar.com/IC/CEPage.asp?ID=161965). TFF believes this defies all conventional logic. But then again, TFF is using the same financial logic that would NEVER place delinquent loans into accounts receivable on the balance sheet (during the company's most recent earnings call management confessed to this uncommon treatment of delinquent loans - http://www.investorcalendar.com/IC/CEPage.asp?ID=161965). TFF was almost as shocked to hear this statement, as we were when we heard the unbelievably low loss frequency and severity.

Table 6

| 12/31/09 | 3/31/10 | 6/30/10 | 9/30/10 |

Trade accounts receivable | 2,425 | 2,794 | 4,008 | 17,438 |

Net investment in sales-type leases current | 123,413 | 154,775 | 208,649 | 246,597 |

Net investment in sales-type leases LT | 93,164 | 116,633 | 148,220 | 145,654 |

| 219,002 | 274,202 | 360,877 | 409,689 |

% delinquent | 1.11% | 1.02% | 1.11% | 4.26% |

Reserve for loan losses | (298) | (504) | (543) | (1,126) |

Reserve as % lease portfolio | 0.14% | 0.18% | 0.15% | 0.27% |

|

|

|

|

|

Coverage of reserve to delinquencies | 12.3% | 18.0% | 13.5% | 6.5% |

Source: Company filings

Given the myriad of related party transactions and checkered history of management (see below), TFF is extremely skeptical about AutoChina's claims of pristine credit quality. Compounding our concerns towards credit is the company's initiative to provide financing for fuel, tires, and insurance. The lack of collateral associated with these unsecured loans should justify higher loan loss reserves. Despite an extensive search, TFF has not been able to find another leasing company that provides loans for diesel. TFF wonders why a customer base as healthy as AutoChina's would need loans to buy diesel fuel and tires….. perhaps it's a question, along with many others, that the new auditors will flesh out.

Regional accounting firm Crowe Horwath was the company's auditor for fiscal 2009. TFF finds this odd because Crowe Horwath didn't even form its Chinese business until September 2009 (http://www.chcncpa.com/english.asp). For the fiscal year just completed, Big 4 accounting firm PricewaterhouseCoopers will be performing the year-end audit. While this may appear promising, TFF would use Duoyuan Printing (NYSE: DYP) as a cautionary tale for AUTC investors. In 2010, DYP switched from a regional accounting firm to Deloitte. When Deloitte began the audit, troubling accounting discrepancies were discovered. When these issues came to light, DYP's shares dropped over 62% in just three days (http://goingconcern.com/2010/09/duoyuan-printing-is-all-kinds-of-screwed-up-after-firing-deloitte/). We have prepared a number of questions and concerns for PwC to address as they begin their work in February for their first audit. Given the issues above (and below), TFF would not be surprised if AutoChina restates its financial results.

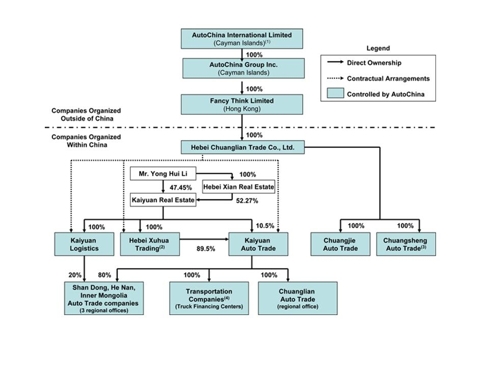

The Organizational Chart - Not that much to say

If Sherlock Holmes was looking for a challenge, we would ask him to decipher the baffling ownership structure that is a hallmark of AutoChina. This convoluted chart illustrates the inherent complexity and risk in the ownership structure of AutoChina (http://www.sec.gov/Archives/edgar/data/1417370/000114420410014943/chart.jpg).

An article in China Economic Review provides a good description of AUTC's corporate structure: "In April 2009, Spring Creek acquired ACG, a Cayman company owned by Honest Best, and changed its name to AutoChina International. ACG was formerly KYF, Inc, a holding company set up in 2007 by the CEO of AutoChina, Li Yong Hui. ACG operates three subsidiaries: Kaiyuan Logistics, Kaiyuan Auto Trade, and Hebei Xuhua Trading. All are owned by Hebei Kaiyuan Real Estate Development, a company founded in 2005 by Li"(www.chinaeconomicreview.com/stock_profile/sinosage/2010_05_12/AutoChina_running_on_empty.html).

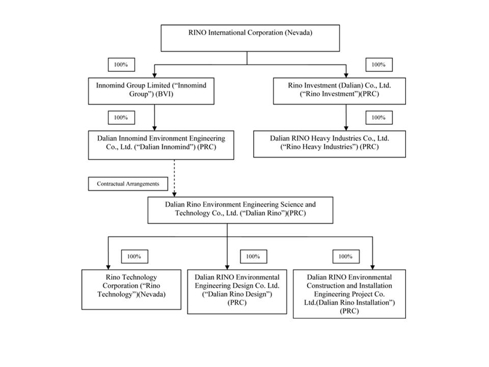

TFF can not overstate the risks that this type of structure presents for investors. We invite investors to compare AutoChina's org chart with the org chart of another well known Chinese reverse r /edgar/data/1394220/000114420410017658/chart1.jpg):

****Sometimes two nearly identical pictures are more powerful than all of the forensic analysis in the world.

3 for 1: A Notorious Earnout, Perverse Incentives, and more accounting issues

The org structure above is complimented by one of the LEAST shareholder friendly earnout agreements that TFF has ever reviewed. This earnout arrangement was initially developed under the reverse-takeover agreement. According to AutoChina's 20-F, the earnout stipulates that the public company will pay the CEO "between 5 and 20%" of the total shares outstanding annually as an "earnout." Literally, shareholders will be diluted by at least 5% every single year, regardless of performance. The earnout is scaled based upon the level of growth achieved in that year (obviously it is not based upon cash flow) (sec.gov/Archives/edgar/data/1417370/0001...). In early 2010, AUTC issued CEO Li over 2.6 million shares, diluting existing shareholders by the maximum amount of twenty percent. Shockingly, this vulpine program is in place until 2013. With the maximum issuance, AUTC could give Mr. Li an additional 19.5 million shares over the next three years, which would dilute shareholders by roughly 50% (only 20.3 million outstanding at 9/30/2010 - www.sec.gov/Archives/edgar/data/1417370/...). This might be one of the most lopsided compensation packages ever offered to an executive.

TFF believes this massive future dilution is not currently reflected in AUTC's stock price. In a perverse twist, should AutoChina actually hit analyst expectations, then the sellside price targets would be off by 50% (double the shares out). On a fully diluted basis, AutoChina's market cap could double to $1.1 billion over the next few years with the stock price remaining flat. For the company to maintain its same valuation, the stock price would need to decline by 50% (forget the fact for a moment that TFF believes the current "E" is extremely unreliable).

What is perhaps most worrisome about the earnout is that the financial metric of choice is "reported" EBITDA growth (not on a per share basis). TFF does not understand why more shareholder friendly metrics like return on equity, free cash flow, or even EBITDA per share were not used instead. This benchmark for the earnout incentivizes Mr. Li to pursue the most aggressive earnings and revenue recognition policies.

Finally, this stock compensation expense appears to be hidden from investors and is not reflected in the company's income statement. After examining FASB guidelines, TFF believes these earnouts should be expensed through the income statement and are not currently treated in accordance with GAAP.

Although there is some ambiguity, FASB has provided a framework for expensing earnouts. According to EITF 95-8, "situations in which employee compensation other than the contingent payments is at a reasonable level in comparison to that of other key employees in the combined enterprise may indicate that the contingent payments are additional purchase price rather than compensation" (72.3.243.42/pdf/abs95-8.pdf). Further, if the "substance of some agreements for contingent consideration is to provide compensation for services…the additional consideration should be accounted for as expenses." According to the proxy statement, Young Hui Li has received only $1.00 in salary and no bonus or other compensation in the last fiscal year. This level of compensation would clearly be defined as well below "other key employees" (www.sec.gov/Archives/edgar/data/1417370/000114420410030941/v186933_ex99-1.htm). As a result, it is clear to TFF that the earnout should be considered "compensation" expense under U.S. GAAP. The value of stock issued to Li in 2010 was over $57 million. If this was expensed appropriately, AUTC would show negative pretax earnings in 2010 (www.sec.gov/Archives/edgar/data/1417370/...). The company could issue over 3.6 million shares in early 2011 to fulfill the earnout, representing almost $100 million of potential expense in 2011. Instead, this massive dilution and expense will never even hit the income statement based upon AutoChina's renegade accounting.

TFF believes a salient question is why exactly are shareholders compensating the CEO with this extremely generous earnout? If China Economic Review is correct and "each truck financing subsidiary is held by a separate legal entity owned by Kaiyuan Auto Trade – which is owned by Li, not by AutoChina" (www.chinaeconomicreview.com/stock_profile/sinosage/2010_05_12/AutoChina_running_on_empty.html), then the earnout compensation would appear to exist so the CEO does not walk away from AUTC? If that is the case, then the earnout is unquestionably an expense. But a more concerning reality for AUTC shareholders is that based on the org structure it appears equity owners in AutoChina do NOT own the operating companies.

Should PwC agree with TFF and force AutoChina to expense the earnouts, shareholders would suffer dramatically based on two recent examples. Shares of CNInsure (NASDAQ: CISG), declined over 25% in a month when a report from OLP Global highlighted the "company's sales incentive program is actually an equity incentive plan that should be, but currently isn't, reflected in the company's expenses" www.fool.com/investing/general/2010/12/02/cninsure-shares-plunged-what-you-need-to-know.aspx. The mistreatment of earnout accounting and subsequent restatement drove Huron Consulting (NASDAQ: HURN) down over 70% (https://seekingalpha.com/article/153334-the-spectacular-blow-up-of-huron-consulting). TFF believes earnout accounting will be ANOTHER issue driving the need for a restatement at AUTC.

Related Party Debt

AutoChina's atrocious cash flow characteristics (see Table 4 above) result in an incessant need for new capital. This need for capital has created an "un"virtuous cycle for management in order to keep the game going. Since the company recognizes most of its profits upfront before they are ever earned, the only way to grow is through additional originations. However, to drive incremental originations, the company needs debt and equity capital. Because raising capital from U.S. investors would require opening the kimono, AutoChina has relied on prodigious levels of related party debt.

Since the company's inception, the largest provider of debt to AutoChina has been an entity called Beiguo Commercial Building Limited. TFF was shocked to discover that this legitimate sounding financial entity is actually a PRC-based operator of grocery stores owned by the CEO of AutoChina (http://www.travelchinaguide.com/cityguides/hebei/shijiazhuang/shopping/) and (google.brand.edgar-online.com/EFX_dll/ED...). But their grocery-store partner is just one of many strange bedfellows. AUTC's complicated web of related party debt financing has fluctuated wildly in recent periods, but represented a whopping $126 million at September 30, 2010. Based on TFF's analysis, we believe the actual number is closer to $865 million of transactions funded by related entities through the first nine months of 2010. (page 27, http://www.sec.gov/Archives/edgar/data/1417370/000114420410063155/v203555_6k.htm).

This reliance on related party transactions and debt can often be associated with unscrupulous activity and/or exchanges which are clearly not arms length in nature. The sheer volume and magnitude of related party activity is very suspicious:

Table 7 |

|

|

|

| Amount (millions) |

|

|

Related Parties | 9M 2010 | Ownership | Comment in Filing |

Hebei Kaiyuan | 67,246 | CEO and wife own / control | Bank loan guarantee provided to the company by the affiliates. |

Hebei Ruihua Real Estate | 11,955 | CEO and wife own / control | Bank loan guarantee provided to the company by the affiliates. |

Kaiyuan Shengrong | 2,989 | CEO and wife own / control | Loan provided to the Company during the period. |

Beiguo | 229,934 | CEO owns 21%; Direct Lau owns 22% | Customer deposits received by the Company from affiliates for the purchase of automobiles |

Beiguo | 31,508 | CEO owns 21%; Direct Lau owns 22% | Deposits for inventories made by the Company to affiliates for the purchase of trading materials. |

Wantong Longxin | 3,719 | CEO's brother owns 40% | Deposits for inventories made by the Company to affiliates for the purchase of trading materials. |

Renbai | 35,261 | CEO owns 20%; Direct Lau owns 20% | Customer deposits received by the Company from affiliates for the purchase of automobiles |

Hebei Kaiyuan | 6,260 | CEO and wife own / control | Purchase of trading materials from the Company during the period. |

Kaiyuan Doors | 1,055 | CEO and wife own / control | Sale of trading material to the Company during the period. |

Kaiyuan Shengrong | 19 | CEO and wife own / control | Interest paid by the Company during the period. |

Wantong Longxin | 4,628 | CEO's brother owns 40% | Sale of trading material to the Company during the period. |

Beiguo | 209,551 | CEO owns 21%; Direct Lau owns 22% | Sale of trading material to the Company during the period. |

Beiguo | 218,686 | CEO owns 21%; Direct Lau owns 22% | Purchase of automobiles from the Company during the period. |

Beiguo | 19,012 | CEO owns 21%; Direct Lau owns 22% | Purchase of trading materials from the Company during the period. |

Beiguo | 3,906 | CEO owns 21%; Direct Lau owns 22% | Interest paid by the Company during the period. |

Renbai | 9,638 | CEO owns 20%; Direct Lau owns 20% | Sale of automobiles to the Company during the period. |

Renbai | 853 | CEO owns 20%; Direct Lau owns 20% | Interest paid by the Company during the period. |

Renbai | 9,178 | CEO owns 20%; Direct Lau owns 20% | Purchase of automobiles from the Company during the period. |

TOTAL Related Party | 865,398 |

|

|

Source: Company filings |

|

| |

Who was the CFO's old boss?

Guilt by association is dangerous and often times unfair. At the same time, if you are the CFO of a Chinese reverse merger, any questions from your past must be properly vetted. TFF wonders how well AutoChina's CFO was scrutinized given a checkered past that revolves around a massive fraud that was perpetrated by his former employer.

According to SPAC Update, AutoChina hired Jason Wang as CFO in July 2009, stating that he was "formerly a senior member of Private Equity Management (PEM) Group"

(http://webcache.googleusercontent.com/search?q=cache:y-QgkKIp1fQJ:spacupdate.com/index.php%3Farticle%3D186+%22a+senior+member+of+Private+Equity+Management%22&cd=1&hl=en&ct=clnk&gl=us). According to his bio, Mr. Wang was the Director of Research at PEMGroup. PEMGroup turned out to be one of the largest ponzi schemes in U.S. history, milking investors for a reported $800 million. New York Magazine christened PEMGroup as the "Most Insane Alleged Fraud of 2009," quite an accomplishment given the competition that year (http://nymag.com/daily/intel/2009/04/and_the_title_for_most_insane.html).

PEMGroup was founded and run by the legendary fraudster and suspected murderer Danny Pang (http://online.wsj.com/article/SB123976601469019957.html). According to an SEC lawsuit, PEMGroup demonstrated "a persistent pattern of abuse" that began in 2007 and "continued through Mr. Pang's stepping down in April 2009" (http://images.ocregister.com/newsimages/2009/05/08/PangReceiver20090506.pdf). While it is probably a mere coincidence, Jason Wang joined PEM Group in 2007 - the year the SEC alleges the abuses began in earnest. According to the SEC, PEMGroup's "spending spree was funded by new monies coming in, giving rise to the claim of a Ponzi scheme." To be clear, regardless of any perceived similarities, TFF is NOT comparing AutoChina's incessant need for new capital to fuel its growth to a ponzi scheme. The SEC complaint provides several anecdotes detailing the culture of PEMGroup, including:

· A time when management "recovered $4 million from a former employee who had been embezzling" from the company's funds. Once recovered, rather than paying this back to the Tranches, Mr. Pang reportedly divided it up amongst senior management."

· "In the troubled year of 2007, the staff was treated to a $1.5 million trip to China"

· "In December 2008 and with many of the loans in the investment portfolio in default…Mr. Pang provided his entire staff with a cruise on a Disney boat at an expense of $1.0 million."

TFF has no reason to suspect Mr. Wang was anything but above board. And for the record, Mr. Wang was not accused of any wrongdoing. But the SEC's observation that "PEMG's senior management appears to have provided little opposition and in many instances facilitated the spending schemes" was disconcerting because Mr. Wang was labeled a "senior member" of PEMG by SPAC Update (http://images.ocregister.com/newsimages/2009/05/08/PangReceiver20090506.pdf). Also, The Wall Street Journal and New York Magazine point out Pang was quite open about the fraudulent activity at the firm. According to one employee, "Pang came into his office and said: 'Nasar, I want you to know we are in a Ponzi scheme" (http://nymag.com/daily/intel/2009/04/and_the_title_for_most_insane.html). While at PEMGroup, Mr. Wang may have been oblivious to the fraud, but his responsibilities did include "analysis of prospective investments, credit and cash flow analysis, and valuations. He was involved in both equity and debt investments." (www.autochinaintl.com/en/InvestorNews/AutoChina_International_Limited_Appoints_New_Chief_Financial_Officer/). According to the SEC's complaint, PEMGroup's employee base was very small, consisting of "approximately 30 individuals" (http://images.ocregister.com/newsimages/2009/05/08/PangReceiver20090506.pdf). Given the small number of employees, the scale of the fraud, Danny Pang's documented openness, and Mr. Wang's considerable responsibilities, TFF believes it would be natural for investors to revisit how the Board vetted Mr. Wang prior to being appointment CFO. [TFF Note - In September 2009, just prior to his trial, PEMGroup founder Danny Pang committed suicide. As a result of his death, the SEC dropped its case against Pang and PEMGroup]

While we have no reason to think Mr. Wang was involved in the Ponzi scheme, TFF believes Mr. Wang's resume has had inconsistencies, a problem his old boss Danny Pang had as well. Mr. Pang alleged he was an investment banker at Morgan Stanley and got his MBA from the University of California at Irvine. Both of these statements were lies (gawker.com/5231292/danny-pangs-last-gamble). Turning to Mr. Wang, AutoChina's financial filings state that Mr. Wang received "Bachelors degrees from both the Wharton School and the School of Engineering and Applied Science at the University of Pennsylvania in May 1994" (http://google.brand.edgar-online.com/EFX_dll/EDGARpro.dll?FetchFilingHtmlSection1?SectionID=6706146-1058-11246&SessionID=XcKRHWLzxztZAl7). However, on AutoChina's webpage, Mr. Wang's date of graduation is different by four years, "Mr. Wang received Bachelors degrees from both the Wharton School and the School of Engineering and Applied Science at the University of Pennsylvania in May 1998" (http://www.autochinaintl.com/en/Investor/Officers/). If would appear from the first set of dates in AutoChina's SEC filings that Mr. Wang graduated from Wharton at the age of 18 - if so, kudos to him. Either way, the inconsistencies are a small drop in an overflowing bucket of questions relating to AutoChina.

So how could so many problems at one company go unnoticed by the sellside analysts that follow it? TFF does not believe that the analysts are in cahoots with the company, but instead have no base of knowledge to cover this type of business model. TFF could only find two analysts that actively cover AutoChina, one from Chardan Capital and one from Rodman & Renshaw (the same reverse merger juggernaut that Barron's has been so critical towards). From what TFF can surmise, the Chardan analyst is a technology analyst who covers a universe of tech companies such as Skyworth, EZChip, and Tower Semi. In fairness to him, it is extremely unlikely he has ever seen lease accounting before. The second analyst from Rodman covers an eclectic basket of Chinese names, ranging from battery manufacturers to recycling companies. TFF believes that AutoChina is the only finance company that either of these analysts follows. So despite being ill-equipped to analyze lease accounting, we fully expect both analysts to support AutoChina all of the way down. Why? Chardan Capital and Rodman were recently selected to underwrite a new SPAC called Prime Acquisition. This new SPAC's CEO and Chairman is none other than AutoChina's CEO, Yong Hui Li (http://247wallst.com/2011/01/21/blast-from-the-past-china-spac-ipo-filing-pacq-autc/).

TFF believes that when the dust settles, AutoChina will be a single digit stock. As of January 24, 2011, the 72 companies in Roth Capital's Chinese Investment Universe Publication traded at 7.7x earnings. If AutoChina simply traded inline with the broad Chinese universe, it would be $14 per share based upon consensus estimates. Taking into consideration the possible 50% dilution, the stock would be closer to $7.00 with an inline multiple to the peer group. However, given the quantity of issues that TFF has discussed, it would seem logical that investors would value AUTC at a discount to its peer group (assuming the earnings do not vanish in a restatement). TFF would point out that should bad debt increase, or funding dry up, there are ample scenarios where AUTC equity could go to zero. We believe the serious issues TFF has raised warrant investor skepticism. It is the opinion of TFF that investors will suffer at least 50% downside from current levels.

As we like to say, "If it looks like a duck, walks like a duck and quacks like a duck, it probably is a duck."

Disclosure:

*** The author of this article is short AutoChina stock. TFF goes to great lengths to ensure that all information is factual and referenced. All facts that we present herein are true to the best of our knowledge. All opinions presented are our own and accurately reflect our opinion on the relevant subject being discussed. We recommend that investors perform their own extensive due diligence before buying or selling any security.