The Japanese cabinet officially recognised this week that Japan's economy has entered its first recession since 2001, following a second quarterly contraction in Q3 2008. Claus Vistesen has already analysed (in this post) the key issues which lie behind the present recession data, and has also, in this post, attempted to place Japan's renewed deflation alert in a somewhat broader context. Thus I will limit myself here to looking at the basic GDP data, and the export developments which accompany it.

The Recession Becomes Official

Japan's gross domestic product shrank by an annualised 0.4 per cent in the three months to the end of September, following a revised decline of an annualised 3.7 per cent in the second quarter, according to data released by the cabinet office on Monday. It is quite possible that we will now see a third consecutive quarter of contraction in the October - December period, especially if October's export performance (see below) is anything to go by.

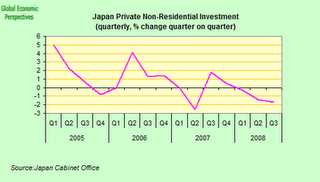

Quarter-on-quarter, Japan's economy shrank 0.1 percent, lead by a 1.7 percent drop in capital spending. In fact, as can be seen in the chart below, Japanese investment has now been dropping back steadily since the third quarter of 2007.

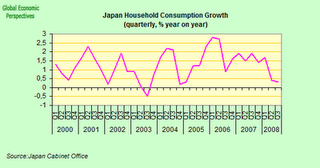

click to enlarge Net exports also weighed on growth - subtracting 0.2 percentage point from growth after imports outweighed an increase in shipments abroad. Exports were up 0.7 percent, while imports climbed 1.9 percent as oil surged to a record in July. Consumer spending, on the other hand, increased by 0.3 percent, a much better showing than the one achieved in the second quarter, when consumption declined a quarterly 0.6%. Year on year, household consumption dropped back from 1.7% growth in the first quarter to 0.4% in the second quarter and 0.3% in the third one.

Net exports also weighed on growth - subtracting 0.2 percentage point from growth after imports outweighed an increase in shipments abroad. Exports were up 0.7 percent, while imports climbed 1.9 percent as oil surged to a record in July. Consumer spending, on the other hand, increased by 0.3 percent, a much better showing than the one achieved in the second quarter, when consumption declined a quarterly 0.6%. Year on year, household consumption dropped back from 1.7% growth in the first quarter to 0.4% in the second quarter and 0.3% in the third one.

The rapid decline in