Global Markets

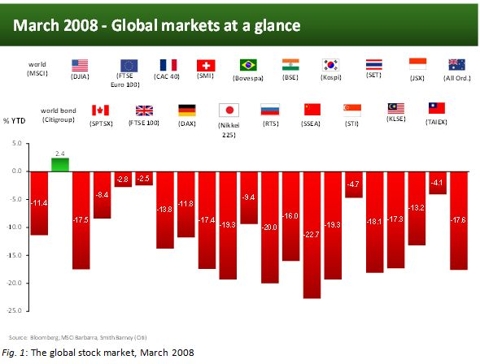

I traditionally start our semi-annual economic review with a cursory look at global equities market performance. Markets are, in themselves, merely a derivative of underlying economic activity and only of interest to economists because they are one of the few leading indicators, given that economic statistics are always lagging indicators. However in times of severe distress markets can impact real economic activity, not just anticipate and follow it. A major crash can lead to such large losses that both businesses and consumers constrain spending as they rebuild cash-a behaviour called the negative wealth effect. It appears that 2008 will be one of those years the tail wags the dog. One year ago, when we first advised members that ‘things would get far worse before they got better’, I took equities allocation to zero. I don’t believe in the nonsense of overweight and underweight. As it turned out, October 2007 was the final peak for equities. By March 2008, my last economic review, the markets were already down around 20% for the Dow and emerging markets, with less than 10% losses for the euro zone (see Fig. 1).

click to enlarge images

At the time this was a necessary and healthy correction: the sub-prime crisis, which had started way back in early 2007, continued to exact its toll on financial stocks. Analysts and the US government, however, continued to believe that this would pass, and that the effects on the real economy would merely result in a slow-down and a short period of low growth. Recession remained off the table officially, and data continued to show positive if weaker growth.

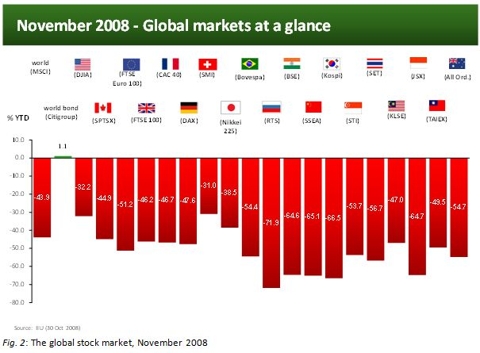

Markets since have made up for lost time. Equities have paid dearly for the long state of denial and avoidance by both analysts and the US government, which only finally dared