Shares of Apple (NASDAQ:AAPL) may be a decent long-term investment for those willing to ride out recent problems but investors need to look through their loyalty to the company and rationally analyze near-term risks. The upside potential over the next few months does not compensate for some serious downside risks to a disappointing product launch. Investors may want to avoid the shares until better guidance is available for future revenue and growth.

Investor loyalty and looking at the shares rationally

An article I wrote in April calling Apple too risky unless investors hedged with a short position in a basket of suppliers was called everything from ignorant to just plain silly. I argued for good valuation but with continued risks to sentiment and the lack of revenue support from new products. The strategy has borne out with a gain of 12% in shares of the Cupertino-based behemoth against gains of just 3% in the basket of shorted names.

Despite the fact that this article will again be widely panned, I truly believe that downside risks outweigh the upside potential over the next two quarters. Investors in the company have been blindly loyal and need to analyze the shares from a rational and objective standpoint.

Analysts have been just as wrong on the shares and provide little help on guidance. At its 2012 highs, calls were for the company to be the first to reach a market cap of $1 trillion. Still one of the biggest in the world, the company trades for just $443 billion now. Analysts have been quick to adjust their forecasts as well with an average target of $735 earlier this year falling to just $520 recently.

What's the real potential?

David Ludlow at Expert Reviews provides some interesting points on the latest rumors around the next iPhone iteration. David talks through the rumors that the new phone may have several screen sizes as well as the potential for a brighter display. He does some pretty apt reading between the lines on a quote by CEO Tim Cook that implies that the next phone will be an iteration of the iPhone5 instead of a new iPhone6 design.

The fact that the most likely release this year will be a revamp of the iPhone5 leaves me worried that the ultimate launch will be a blah-moment. The market is used to being wowed by Apple launches and new features. Simply rehashing the same design and hardware to get a new product on the shelves risks leaving the market cold and represents a downside to the shares.

While Apple loyalists love the phone, it has been almost a year since the release of the iPhone5 and competitors have been stepping up their game. Heavy competition from rivals like the Samsung Galaxy S4 and the HTC One present another problem for Apple. I think the company has been late to the game for a lot of cool technologies like the smart screen features on the Galaxy and might have lost some of its brand cache.

The company is also rumored to be releasing new versions of the iPad around the same time as the iPhone release. While these products could be accretive, the iPhone accounts for 51% of sales and will be the key driver of sentiment in the shares.

Gross margins have declined for more than four years from 47% to just under 37% in the most recent quarter. From here we have rumors of a lower-cost iPhone for the emerging markets. While the company and analysts have been hopeful that the lower-cost product would not drive margins lower, I doubt that it will help. Even on higher quantity sales, a further erosion of the company's margin could send the shares lower as it loses its premium price investors are willing to pay for higher profitability.

What is downside for disappointment?

iPhone sales jumped to 47.8 million units in the company's first quarter of 2013, the first full quarter after the release of the iPhone5. This represented a 77% increase in units sold and the $30.2 billion in total phone revenues represented an increase of 83% on the previous quarter's revenue. An increase of this magnitude would be a huge success for the company but may be wishful thinking. Worse is that the next iPhone will not show through results until the 4th quarter of this year, at best.

Analysts are now expecting full year earnings of $39.10 per share with fourth quarter earnings to see a huge boost of 76% over the September quarter to $13.40 per share. The street is expecting the new iPhone to be a success with earnings in the December quarter just 3% lower than a year before while earnings for the September quarter are 13% lower than the previous year's comparable.

Current quarter revenue is sure to be held back by people waiting on the new phone and I doubt that fourth quarter revenue will be as rosy as the market expects.

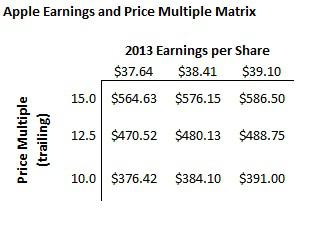

The shares traded just under 10 times trailing earnings in 2012 so we will use that as our downside scenario though further downside exists if the upcoming product launches are a disappointment. The current multiple has been rangebound around 12.5 times, which will be our base scenario. There is always the potential that the shares could regain some of their price premium but I doubt that the price-earnings will reach above 15.0 times without a significantly successful launch.

As for modeling the full-year earnings, I think the consensus estimate of $39.10 is a best-case scenario. A weaker macro-environment and uncertainty in Washington has the very real potential to weigh on consumer spending. The recent launches by competitors have drawn long-time loyalists away from the company and the upcoming launch could ultimately be a disappointment. My own estimate is for full year earnings of $38.41 with downside risks to $37.64 per share.

Shares are up almost a third from lows of $385 earlier this year and it does not look like there's much room for short-term appreciation without strong fourth quarter earnings and a higher multiple. Conversely, shares could end lower than their recent price on the consensus estimate for earnings if the price multiple does not increase. A disappointing launch or slightly lower earnings could take the shares back down to test new lows.

Love the products but be able to hate the stock

I am not a perma-bear on the company. I have done well this year buying into bull spread option strategies when the stock made several runs to $400 per share. The price multiple is not terribly high and I think long-term investors will see higher prices eventually on the share buyback and future earnings. I just don't think that the stock is worth the risk right now for the return potential.

Worse than the risk-return tradeoff is the blind loyalty that many have for the stock and that makes it one of the worst investments you can ever make. The twenty-fold increase in the share price over the seven years to the 2012 high is still fresh in investors' perception of the company. Besides the promise of meteoric returns, the brand invokes fierce loyalty in many and they make the mistake thinking that a good company must also be a good stock.

Successful investing means being dispassionate about your stocks and being able to sell them when fundamentals and the risk-return tradeoff turn negative. Never rush into an investment when all the upside rests on market hopes for upcoming news. Shares may bounce on a successful launch but you will have other opportunities to buy in when sales data justify the optimism. Worry more about getting caught in the herd mentality than missing an initial bump in the price.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I have a long-term (January 2015) bull spread on the shares established earlier this year. Long calls at $450 and short calls at $460 which I will hold until later next year.