The headlines ring of "booming" American oil production and "gluts" of oil (USO). I'm here to tell you that while the boom is real, there is no glut of oil and we need to be aware that the huge production growth of the past eighteen months is going to slow.

It already is slowing.

I've been watching what is going on in the Bakken pretty closely because I think it is going to be an excellent proxy for what will happen across the country.

Let's take a look at what happened to production in North Dakota during the first six months of last year (2012). Here is the raw data detailing barrels of oil production per day:

December 2011 - 535,000 boe/day

January 2012 - 547,000 boe/day

February 2012 - 559,000 boe/day

March 2012 - 580,000 boe/day

April 2012 - 611,000 boe/day

May 2012 - 644,000 boe/day

June 2012 - 664,000 boe/day

Daily production in North Dakota increased by 129,000 barrels per day from December 2011 to June 2012.

Now let's look at the same period for this year (2013):

December 2012 - 768,000 boe/day

January 2013 - 739,000 boe/day

February 2013 - 780,000 boe/day

March 2013 - 785,000 boe/day

April 2013 - 793,000 boe/day

May 2013 - 811,000 boe/day

June 2013 - 821,000 boe/day

Where last year production increased by 129,000 barrels per day in the first six months of the year, this year production is up by only 53,000 barrels per day.

Yes, the rate of growth in the Bakken has slowed considerably in 2013.

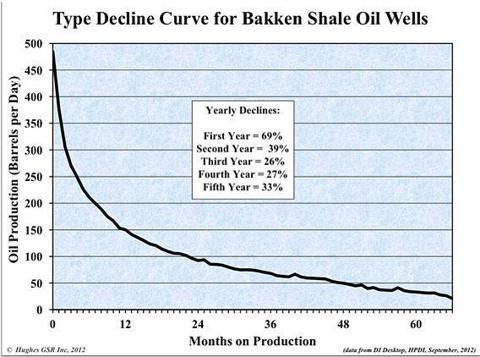

To understand why, a person needs to look at the production profile for these horizontal oil wells.

By the end of the first year of production, a new well is producing at a rate that is 30% of where it was the year before. That means