With just three weeks left in the quarter, and the SP 500 up 27% year-to-date, Ford (NYSE:F) has been a noticeable laggard since early July '13, when the stock traded back over $17, and then has churned in a range between $16 - $18 for the last 6 months.

There are 4 trends which are unmistakable at the company:

1.) Monthly auto sales have accelerated and the Ford F-150 Truck is setting near record sales, dating back to the late 1990's. The truck is a higher-margin product for F, thus margins and profitability are being helped by F-Series sales;

------------

Graphs and commentary compliments of Bespoke:

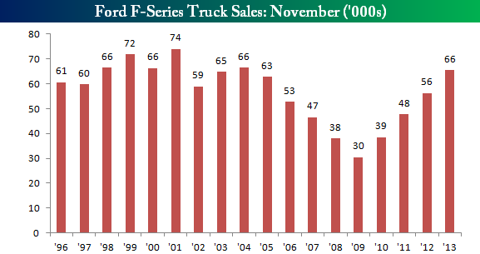

Sales of pickup trucks are often a sign of strength or weakness in the small business and construction sector as these types of businesses are the most common users of these vehicles. With that in mind, today's November numbers from Ford regarding F-Series sales are another strong positive signal. During the month of November, sales of the F-Series totaled just under 65,501, which represented a 16% increase over November of last year and was the highest November reading since 2004. Additionally, there have only been five months since 1996 where November sales were as strong.

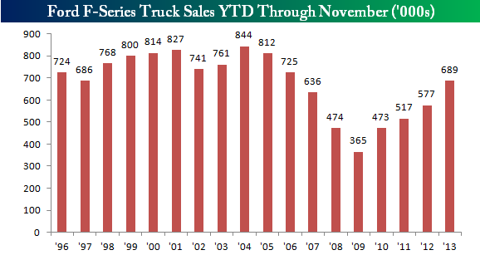

Following November's sales totals, sales of F-Series trucks totaled 689K YTD through November. This represents the highest year to date total through November since 2006's level of 725K. Friday morning's news from Ford implies that the US economy, and more specifically small business and construction, is continuing to improve.

--------------------

2.) Cash-flow is robust and has grown with the improvement in auto sales, but Ford has also become a more efficient manufacturer. Here is F's historical cash-flow data

| Combined 4q trailing CFO | $13,792 | $12,817 | $4,961 | $10,223 | $9,532 | $10,402 | $10,591 | $11,773 | $12,518 | $11,732 | $10,946 | $10,160 | $9,789 | $9,418 | |

| yoy growth |