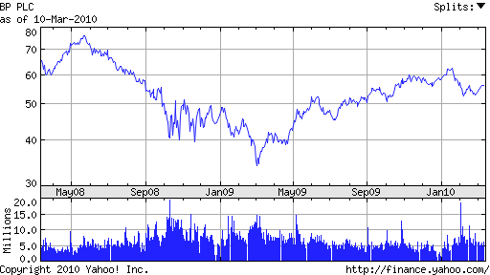

BP (BP) climbed $0.41 to $56.60 after news of its deal to acquire $7 billion in assets from Devon Energy (DVN).

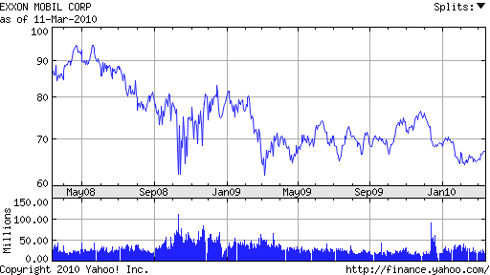

This all-cash deal is quite a contrast to Exxon Mobil’s (XOM) pending $40 billion all-stock acquisition of XTO Energy (XTO). Also, BP is acquiring oil assets and XOM is acquiring natural gas assets.

The market obviously liked BP’s deal better. And what’s not to like? BP will get interests in 10 blocks in Brazil and 240 leases in the Gulf of Mexico. And the company is paying cash for these properties.

On the other hand, Exxon Mobil’s stock has dropped the equivalent of $40 billion since its all-stock acquisition of XTO was announced, So in addition to penalizing its shareholders with the worst dividend in its peer group, Exxon Mobil decided to additionally dilute the value of shareholder’s stock with this deal.

Of course, it’s clear that the street, as well as U.S. Energy Secretary Chu, is still “agnostic” about natural gas transportation and power generation. In other words, Exxon Mobil gets penalized for its purchase of natural gas assets while BP is rewarded for buying oil properties.

So which of these stocks should you buy now? BP pays a hefty dividend in excess of 6% and has been streamlining operations and growing production. Meanwhile, Exxon Mobil's dividend yield is less than half of BP’s, a paltry 2.5%. That said, Exxon Mobil is the best operating oil company in the world and has the best balance sheet. It also was the worst performing stock on the Dow last year and has underperformed the market year-to-date.

I like both these stocks! Exxon's deal should close in the second quarter. At that time, I think you will see the stock begin to support natural gas power generation and natural gas transportation like never before. When