Throughout the 1990s, mutual funds were marketed to individual investors with stellar ten and fifteen year track records made possible by the record bull market of the 1980s and 1990s. While there were a few notable interruptions, with the 1987 crash being the most obvious, most individual investors learned to “buy the dips” throughout this period. Most large capitalization companies made significant advances in earnings during these years but the expansion in earnings multiples had the effect of turbo charging returns to investors. Of course, this all culminated in the bubble of the late 1990s, but small investors remained relatively optimistic for much of the past decade, having been trained to buy the dips for so long. However, optimism may now be turning to pessimism as small investors abandon stocks in disgust.

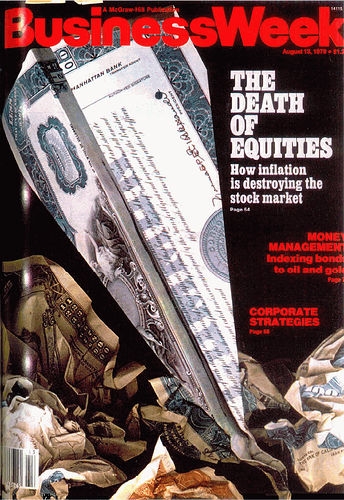

With the Dow Jones Industrial Average and S&P 500 both at levels first breached over a decade ago, the “buy the dips” mentality has been dramatically reduced. A recent article in The Wall Street Journal is somewhat reminiscent of the famous 1979 Business Week cover story entitled “The Death of Equities”. In the late 1970s, investors had endured well over a decade of stagnation in equity prices. The Dow Jones Industrial Average first breached the 1,000 level in 1966 but failed to permanently ascend beyond that level until 1982. The similarities between 1966-1982 and the period we are currently in are obvious and the pattern of investor sentiment turning against stocks may be repeating as well.

With the Dow Jones Industrial Average and S&P 500 both at levels first breached over a decade ago, the “buy the dips” mentality has been dramatically reduced. A recent article in The Wall Street Journal is somewhat reminiscent of the famous 1979 Business Week cover story entitled “The Death of Equities”. In the late 1970s, investors had endured well over a decade of stagnation in equity prices. The Dow Jones Industrial Average first breached the 1,000 level in 1966 but failed to permanently ascend beyond that level until 1982. The similarities between 1966-1982 and the period we are currently in are obvious and the pattern of investor sentiment turning against stocks may be repeating as well.

Safety in Cash and Bonds?

One major difference between the options available to investors in 1979 versus 2010 is that one could actually obtain decent returns from bonds and cash investments in the late 1970s and early 1980s. The primary reason for the high level of nominal interest rates during the period was