Peregrine Diamonds (PGDIF) is a Canadian diamond company, with exploration activities in Nunavut, Canada. Peregrine is advancing its flagship Chidliak diamond project that holds high-grade diamondiferous kimberlites. At least eight kimberlites at Chidliak carry potential economic value, and three of which are ramping up for 2015 bulk sampling. Peregrine plans to update the current mineral resource early next year, and form a 2016 preliminary economic assessment ("PEA") based on the 2015 bulk sample program.

Beating the competition

Peregrine is advancing the Chidliak diamond project to diamond production in separate development phases, the company highlighted in the most recent press release. Phase One Kimberlites include the CH-6, CH-7, and CH-44 kimberlites, three of eight kimberlites that the company has primarily focused on developing.

Additional phases will include the development of CH-1, CH-28, CH-31, CH-45, and CH-46 kimberlites, all of which hold economic potential.

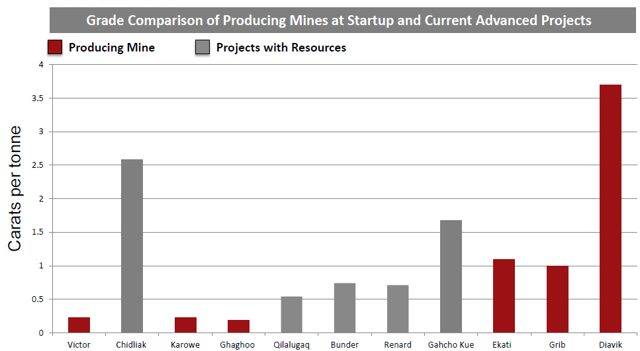

The CH-6 is the flagship kimberlite at Chidliak. Peregrine underwent a bulk sample program in April of last year that returned a 1,042 carat diamond parcel. The parcel carried a diamond grade of 2.58 carats per tonne ("cpt"), making it one of the highest-grade kimberlites globally.

By comparison, only Diavik mine, operated by Rio Tinto and Dominion Diamonds, recovers higher diamond grades than Chidliak (see Figure 1).

Figure 1: Chidliak's high-grade resource tops competing projects with resources. Source: North Arrow

Updating mineral resource estimates

The CH-6 kimberlite has a mineral source of 7.47 million carats at a grade of 2.58 cpt in the inferred category. With an average diamond valuation of $213 per carat based on the 1,042-carat parcel, that gives the mineral resource an in-situ value of $1.6 billion.

Peregrine expects to revise tonnage estimates for the CH-6, CH-7, and CH-44 kimberlites by January 2015 based on drill results from the 2014 summer drill program.

If the