Since 2010, I've been using LendingClub (NYSE:LC) as a platform to increase my passive income. My wife and I were fortunate enough to participate in the directed share program LC set up for retail investors. With the IPO success on December 11th, everyone is wondering what the future of the company is, as well as the future of the banking industry. With a 56% increase from its IPO pricing, investors might be salivating at the chance to own the leader in Peer-to-Peer lending. LC is up about 70% from its IPO price of $15.

Obviously, I'm optimistic about the future of LC, but there are some serious concerns that investors, in both the DSP and potential investors, should be aware of. Before I get into the cons of LC, I'll explain some of the benefits of the IPO, for LC and its investors.

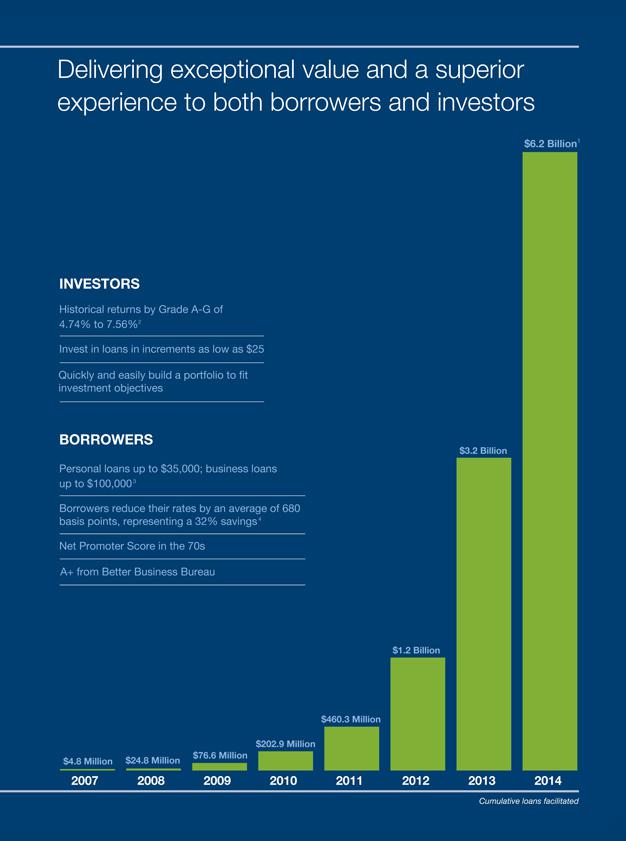

First, LC has been expanding its loan offerings, which is its revenue stream. In 2007, LC opened its platform on Facebook (FB) only offered unsecured personal loans to those with a credit score of 640 and above, with a maximum of $25,000. Now, LC offers personal loans of up to $35,000 to borrowers with a credit score of 660 or more, business loans of up to $300,000, and after acquiring Springstone Financial LLC. they now offer healthcare and education loans of up to $40,000. Higher loan amounts allow LC to collect more in origination fees, currently 1-5% of loan amounts and is based on the borrower's credit risk. Varied loan products also attracts new borrowers, as LC has the potential to become the "go-to" platform for those looking to borrow money.

LC has also been diversifying its revenue. In addition to charging loan origination fees, LC has now started charging investors a 1% fee for collecting payments from borrowers. This allows