This week we're covering a micro-cap dividend stock, which we've listed in our High Dividend Stocks By Sectors Tables for quite some time, (in the tech section).

Most of our articles cover much larger dividend paying stocks, but this company caught our eye due to having a compelling combo of strong growth, a high dividend yield, insider ownership and an upcoming ex-dividend date.

Profile: MIND CTI Ltd., (NASDAQ:MNDO) is a provider of convergent end-to-end billing and customer care product-based solutions for service providers as well as unified communications analytics and call accounting solutions for enterprises.

MIND provides a complete range of billing applications for any business model (license, managed service or complete outsourced billing service) for Wireless, Wireline, Cable, IP Services and Quad-play carriers in more than 40 countries around the world. A global company, with over 13 years of experience in providing solutions to carriers and enterprises, MIND operates from offices in the US, Romania and Israel. (Source: MNDO website)

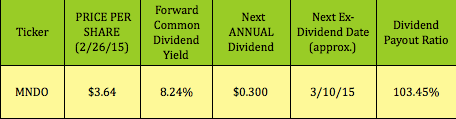

Dividends: MNDO pays just once a year, and its 2015 ex-dividend date is March 10th. After paying $.32 in 2010, MNDO dropped its annual dividends down to $.24 from 2012 through 2015. This year's 25% rise to $.30 is its first dividend hike since 2010.

MNDO's dividend policy is to pay a dividend distribution in the amount being equal to its EBITDA plus financial income (expenses) minus taxes on income.

Options: So far, we haven't been able to add any MNDO options to our Covered Calls Table or Cash Secured Puts Table, as there are no US options available yet. (We maintain options income coverage on over 30 other stocks in these tables).

Big Growth in 2014: MNDO has had very strong growth over the past four quarters, hitting triple-digit growth in Operating Income, Net Income and EPS for its trailing 12 months. Revenue also had strong growth, rising over 35%:

Here are the dollar figures for the past four quarters, and also on an annual basis, for 2014 vs. 2013. These may not be large amounts of dollars, but MNDO's growth was huge for 2014, something more akin to a biotech firm, for example, which normally don't even pay dividends:

Where did this growth come from? Clearly, the company's Customer Care and Billing Software:

Segment-wise, its Maintenance and Additional Services posted 41% growth, while its Licensing had 17% growth:

Regions: The company's revenue shifted higher in Europe in 2014 and it won new business there in Q4 with a leading European global financial services company.

Future Growth?: Here's the rub - there aren't any analysts following MNDO listed on the various financial websites, so there's no consensus for future earnings estimates.

However, we found this interesting tidbit on MNDO's 6-K earnings report for Q4 and full-year 2014 filed with the SEC. MNDO CEO Monica Iancu made this statement -

"We are pleased that in 2014 we succeeded to translate the large deals we signed in 2013 into revenues through successful execution of the implementation of our projects milestones.

While in 2014 we reached exceptional revenues and operating margins, some new deals that we expected to close in 2014 were delayed, thus our booking is lower than a year ago." (Source: MNDO website)

Imagine that revenue grew over 35%, but would have grown even more if these other new deals hadn't been delayed.

So, it looks like we can infer that MNDO will close these delayed new deals in 2015, which will help its 2015 earnings. Granted, this isn't very finite, but there are two other developments, which would indicate more earnings growth:

1. MNDO just opened a second location, in Romania, on February 2015, "in order to enlarge and diversify our teams, mainly in the Professional Services department." These days, companies normally don't enlarge staff and open new offices unless they have the business to support them.

2. MNDO made significant investments in its infrastructure in 2014 - "In 2014, along with supporting the additional needs defined by our customers, we invested significantly in a massive upgrade of the MINDBill infrastructure that includes technology updates of the entire spectrum, including application infrastructure, application server and database upgrades and improved monitoring." (Source: MNDO website)

Valuations: MNDO's trailing P/E of 12.55 is above its 5-year mean of 9.14, but not at the high end of its 5-year P/E range. It also is below industry averages, as are its Price/Tangible Book and Price/Sales.

Performance: MNDO has trounced the market over the past year, but has lagged in the past quarter and year-to-date. However, it rose over 11% on 2/26/15 after reporting its very impressive Q4 and 2014 full-year earnings.

Financials: Although its Management Efficiency ratios lag industry averages, MNDO is debt-free and has a higher Operating Margin.

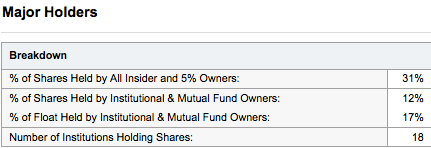

Insiders and Institutional Holders: After subtracting the 12% of shares held by Institutional and Mutual Fund Owners, it appears that Insider Owners hold a significant stake in the company - the remaining 19% of the 31% held shares. Renaissance Technologies is the biggest institutional holder, with over 7.25% of the shares, and there also are some well-known heavy hitters who own shares, such as BlackRock and Morgan Stanley:

(Source: YahooFinance)

All tables furnished by DoubleDividendStocks.com, unless otherwise noted.

Disclaimer: This article was written for informational purposes only.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.