For a look at the retail industry, consider what institutional investors like hedge fund managers are buying.

We created a universe of about 130 stocks from the retail industry and screened for those that have seen the most net purchases from institutional investors over the current quarter.

Interactive Chart: Press Play to compare changes in analyst ratings over the last two years for the top six stocks mentioned below. Analyst ratings sourced from Zacks Investment Research.

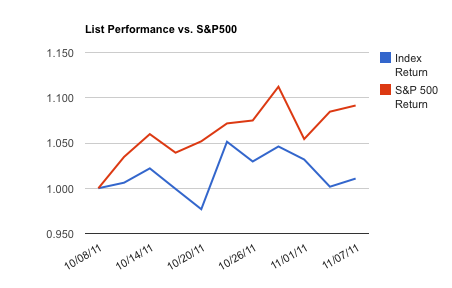

We also created a price-weighted index of the stocks mentioned below and monitored the performance of the list relative to the S&P 500 index over the last month. To access a complete analysis of this list's recent performance, click here.

Click to enlarge

Institutional investors clearly believe in these names – do you? Use this list as a starting point for your own analysis.

List sorted by net institutional purchases as a percent of share float.

1. Titan Machinery, Inc. (TITN): Operates a network of full service agricultural and construction equipment stores in the United States. Market cap of $496.13M. Net institutional shares purchased over the current quarter at 2.9M, which is 18.3% of the company's 15.85M share float. The stock has had a good month, gaining 28.96%.

2. Perry Ellis International Inc. (PERY): Engages in designing, sourcing, marketing and licensing apparel products for men and women in the United States and internationally. Market cap of $402.29M. Net institutional shares purchased over the current quarter at 1.8M, which is 15.83% of the company's 11.37M share float. This is a risky stock that is significantly more volatile than the overall market (beta = 2.14). The stock is a short squeeze candidate, with a short float at 13.48% (equivalent to 10.21 days of average volume). The stock has had a good month, gaining 17.88%.