After weighty deliberations and dramatic preparation, the time has finally come for the ensuing Federal Reserve rate hike. However, the fascinating aspects of this rate hike lay in the methods by which this hike will occur. Never before has the Fed publicly articulated a rejection of solely relying on Open Market Operations to manipulate the Fed Funds rate. Now, a whole new set of tools, such as the Interest on Excess Reserves (IOER) and the Overnight Reverse Repurchase Program (ORRP), will be used to expedite the rate hike process. Clearly, the mechanics of the hike must be thoroughly discussed before its implications on Treasuries, equities, and bonds can be examined.

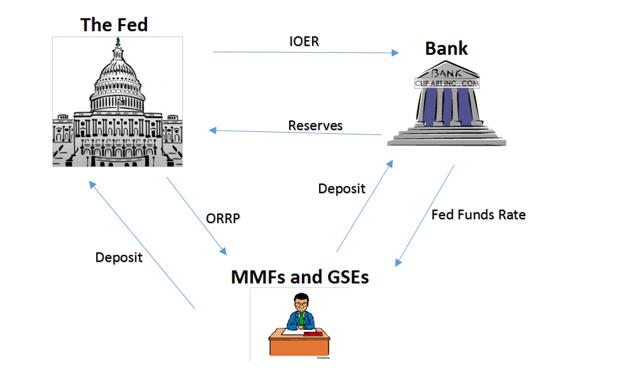

To begin with, the above diagram involves quite a lot of different components, and all are fundamentally important to the Fed's new policy guidelines. In a simplified explanation, banks keep reserves at the Fed, and any reserves over the required amount earn the Interest on Excess Reserves (IOER) rate. Banks, moreover, receive deposits from Money Market Funds (MMFs) and Government-Sponsored Enterprises (GSEs), and pay out the Fed Funds rate to these entities. Thereby, banks receive payments in the form of the IOER, and pay out interest in the form of the Fed Funds rate; this is known as Fed Arbitrage, where banks earn the spread between the IOER and the Fed Funds rate.

Historically, the Federal Reserve would simply perform Open Market Operations to influence the Fed Funds rate. Yet, during the recession of 2008, the Fed pumped so much money into the economy that the balance sheets of all banks rose meteorically. Hence, it offered the Interest on Excess Reserves rate to be able to retain control over the liquidity (excess money) in the system. Furthermore, when the Fed performs Open Market Operations today, i.e., the buying and selling of government securities, it would have to trade massive amounts of such