Goldcorp Agrees to Buy Kaminak Gold for $520 Million

(Credit: Yahoo Finance)

Merger and acquisition activity in the gold mining sector is starting to pick up some steam. Tahoe Resources (TAHO) bought out Canadian gold miner Lake Shore Gold (LSG) earlier this year for $540 million, a move which came just after Goldcorp sold its entire 25.6% stake in Tahoe for C$998.5 million.

Now, Goldcorp (GG) is following suit with a $520 million acquisition of junior gold developer called Kaminak Gold (KMKGF).

Readers of mine may remember that I covered Kaminak last on October 15, 2015, just days after the company announced a $22.5 million investment from its existing shareholders; this private placement was done at a share price of C$.82, which was a premium to the current share price at the time.

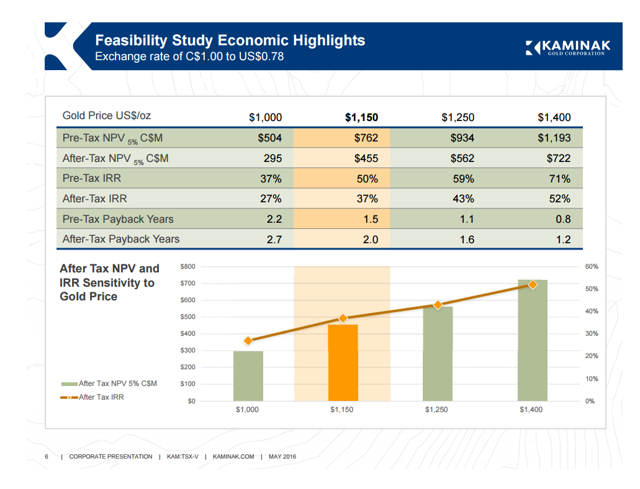

I felt that was a great time to buy the stock, as Kaminak was then in possession of the required funds to advance its high-potential, multi-million ounce gold deposit called Coffee in the Yukon, Canada. This gave the company ample funds to complete exploration work and release a new feasibility study at Coffee (at a cost of $21 million).

(Credit: Kaminak Corporate Presentation)

I'll just go over the investment case for Kaminak quick for readers that aren't familiar. Kaminak's Coffee project is a high-grade gold deposit in the Yukon, located in the heart of a mining district with several other advanced-staged and currently producing mines (Keno Hill, Wolverine, Pogo and Fort Knox mines, to name a few).

The deposit contains a massive resource base of 2.96 million indicated gold ounces (1.45 g/t gold), and 2.21 million inferred ounces (1.31 g/t). 2014 infill drilling at Coffee was highly successful, with a new oxide gold discovery at the "Dolce" deposit. Kaminak has completed a total of 280,000 meters of drilling across 1,682