By The Valuentum Team

Image Source: Comcast 2015 10-K

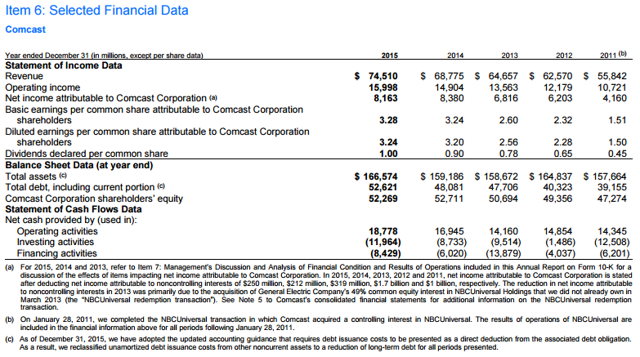

Comcast (NASDAQ:CMCSA) is a global media giant with two key business lines - Comcast Cable and NBCUniversal. The company boasts a very strong free-cash-flow generating profile, even if it is saddled with a rather high debt load. Operating cash flow generation in 2015, for example, totaled ~$19 billion, increasing 30%+ since the mark in 2011, a simply fantastic pace of expansion. The measure continued to advance in the first quarter of 2016, too, with a 6.9% rise on a year-over-year basis. Free cash flow may have dropped from the year-ago period in the quarter, but Comcast still generated $2.8 billion in free cash flow during the period. It's just hard not to like this free-cash-flow rich enterprise.

Many analysts continue to believe that the age of cord cutting will weigh on Comcast's performance, but the company's video subscriber base grew 53,000 during the first quarter of 2016 (versus a loss of 8,000 in the year-ago quarter), and the period was even the best first quarter net-add result in nine years. The major drawback to an investment thesis in Comcast, in our view, is its massive net debt position of $50.7 billion, which could limit financial flexibility, and by extension, hinder potential dividend growth in the future (its pace of dividend growth has been on the decline since 2009). Debt-averse investors should take note, but we note that on a full-year basis, free cash flow has averaged ~$9.1 billion (several times that of its ~$2.5 billion annual cash dividend obligations). We'll also be monitoring the impact of the AT&T (T) deal with DirecTV--AT&T is Comcast's largest phone company competitor.

Comcast's strong free cash flow generating abilities allow it to continue to invest in the growth of its operations. In 2016, the firm spent $3.8 billion