By Jason Booth, 10/12/16

Last week, I wrote about Mitie Group, (OTCPK:MITFY) a UK management services company, whose shares I felt were oversold due to overblown Brexit fears, and worthy of a strong recovery. So far, it looks like a good call, with Mitie up around 8% since publication.

So I was flattered when a reader asked if I had views on another, much larger British management services company, Capita PLC, (OTCPK:CTAGY). Bloomberg News had just run a story highlighting both companies as close competitors being hurt by Brexit. Following the same logic, was Capita's current share price collapse also overblown, giving investors a chance to buy a much bigger company at bargain prices? The simplest answer is: no.

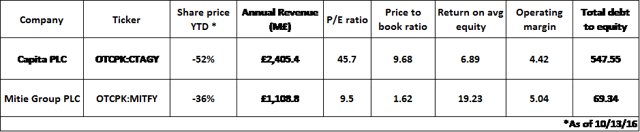

Both Capita and Mitie shares have fallen sharply:

Deal-Driven Growth Strategy

Despite being put in the same basket by the media and most investors, the two companies are fundamentally different in their trade, expansion strategy and valuation. Mitie has grown organically as a conservatively managed company with limited exposure to the EU in terms of revenue. Capita, on the other hand, appears at first review as a deal-driven, well-leveraged company with a major interest and ambitions in the EU, while still boasting unjustifiably high multiples.

But Capita looks overvalues vs. Mitie:

Capita's Went Long on Europe

In 2015, Capita made its largest ever acquisition with the purchase of customer management business, avocis, headquartered in Switzerland. Today, Capita Europe (established in 2015) has 16 offices in Switzerland, Germany, Poland, Austria and the Czech Republic. Capita Europe now accounts for 10% of employees and revenue of Capita PLC.

It marked the high point of a multi-year buying spree by Capita. Based on a review of the company's own announcements, Capita has spent over half a billion pounds on acquisitions since 2013. The uncertainty over Brexit is