Most Americans have heard of Bed Bath & Beyond (BBBY) that sells a wide collection of domestic merchandise and home furnishings through over 1,000 of its namesake stores. What people may not know is that BBBY products are cheaper than Amazon (AMZN) before applying any coupons. With 20% coupons or its new membership program, it's not even close!

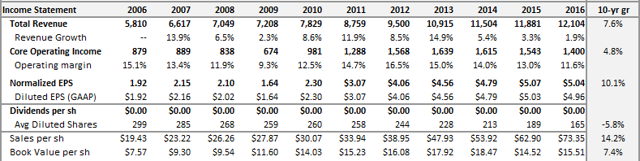

Before we go into the research I did on product prices, let's look at some company fundamentals, comparables and valuation. Over the last 10 years, BBBY has grown revenues, operating profits and EPS by 8%, 5% and 10% respectively.

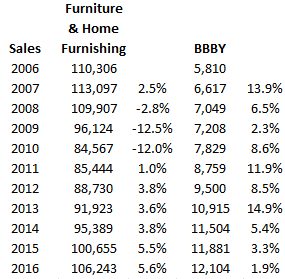

If we look at U.S. Retail Sales and specifically "Furniture and Home Furnishing stores," we see that BBBY has exhibited better growth than the category for every year except the last two.

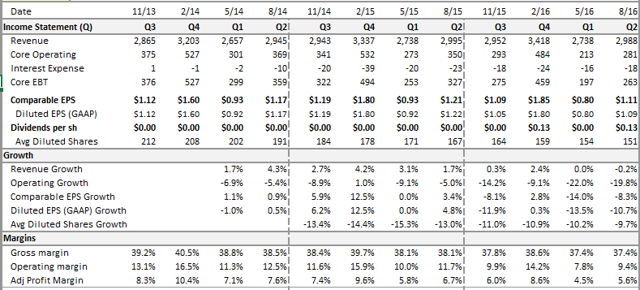

The company has grown year after year, despite the competition, which has had its effect on margins (11.6% in FY16 vs. 16.5% in FY12). Street expectations are for another year of small growth but margins are expected to get even tighter. This trickles down to cash flow and while the company generated $0.8-1.1bn in free cash flow in FY12-15, this came in at $684m in FY16 with expectations of $600-700m for the next 2 years.

Over the last four quarters, sales have been stable but operating profits have suffered with LTM operating margin 200 bps lower!

As a result, the stock price has declined and is at a new yearly low. The last time BBBY was at such prices it was 2010! Since 2010, operating profit and EPS are 43% and 119% higher respectively.

Looking at the 5-year market multiples range the stock has traded at, we see it is below the low end (which would value it at $55). If the stock price were to return to its average or industry valuation, it