Most investors in Citigroup (NYSE:C) are attracted to its perceived cheap valuation (discount on book) and capital return narrative. It is widely seen as the "cheapest" large U.S. bank on the street - at times, punished by Mr. Market for its EM exposure (certainly EM is not currently the flavor of the month!).

I happen to think there is another HUGE reason to hold the stock, namely; Citi's Institutional Client Group (ICG).

A 50,000 foot view

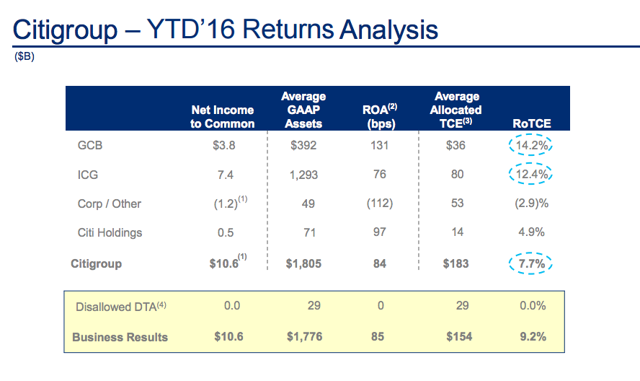

Consider the below slide describing Citi's allocation of capital and returns:

As can be seen from above, ICG is allocated $80 billion of capital which is more than double the allocation to the consumer businesses ($36 billion). So clearly, the performance of ICG, in terms of RoTCE, will move the dial significantly.

Why do I like ICG?

There are multiple reasons & I will mention just a few:

- It is a CCAR-efficient business. In fact, it subsidizes the consumer bank from a binding capital constraint perspective. In other words, returns, while at times volatile due to trading income components, are very good on a (CCAR) risk-adjusted basis.

- The barriers of entry (capital, know-how, regulatory, people, systems etc) are extremely high for new entrants and smaller scale incumbents and the competitive dynamics are highly favourable to the large U.S. universal banks

- The positive operating leverage is huge and the marginal returns on the business are very high. It is to a large extent, a fixed cost-base business.

- Interest rates sensitivity to higher rates due to large operating corporate deposits and expected uptick in trading income (e.g. hedging by corporates and portfolio repositioning by institutional investors)

So for me, there is much to like about Citi's ICG and its prospects and intend to cover it fully in subsequent articles.

But in the mean time, I would